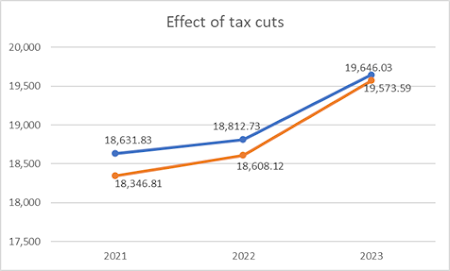

The bulk of the bill was an agreement lawmakers and the Evers administration struck last session to change the tax code to match federal provisions. A similar bill was in the works last session, but failed to pass amid the pandemic. The net impact of the more than two dozen proposed changes in the bill is a $540 million reduction in tax revenues through mid-2023. Because some of the cuts would take effect in the current fiscal year, the impact also would reduce the expected ending balance for the general fund. That in turn would reduce the expected transfer to the rainy day fund by $126.9 million. The amended bill would have to pass both houses and be signed by Evers to take effect.This was done by amending a small tax measure, and the largest move involves giving Wisconsin businesses that received PPP loans and related assistance to write off hundreds of millions of dollars of expenses - even if PPP paid for those expenses in the first place. The Legislative Fiscal Bureau says that most of these write-offs will hit in the next 2 fiscal years, then most of it fades out in 2023. If these tax cuts do become law, that'll limit the amount of money that will be available for Governor Evers to use in the upcoming 2021-23 budget. Also remember that Republicans have introduced an income tax cut that has a price tag of around $653 million between now and the end of that 2-year budget. So you start adding that up, and you can see where the available funds start to run low quickly, especially given that Evers is looking to have his own tax break for caregivers, along with initiatives in mental health, help to farmers and several other items that will be revealed in the coming weeks. My guess is that the full Assembly will quickly try to pass these tax cuts when they next meet on Tuesday, which happens to occur right before Evers will release his budget details. And then the debate goes on full-force. Let's just be aware of how much might be truly achievable (or not), based on the taxing and spending decisions that are already starting.

Ventings from a guy with an unhealthy interest in budgets, policy, the dismal science, life in the Upper Midwest, and brilliant beverages.

Wednesday, February 10, 2021

And there's the inevitable GOP bailout to businesses. And other tax cuts

I kind of saw this coming, and sure enough, 11 of 12 Republicans (and Dem Sen. Jon Erpenbach) on the Joint Finance Committee signed off on extending federal tax breaks from COVID stimulus bills down to the state level.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment