The resolution is pretty straightforward.Lawmakers would gain a say in how to spend federal aid under GOP plan https://t.co/bNQFOK88lT

— Patrick Marley (@patrickdmarley) January 11, 2022

No executive branch officer or department may make an initial allocation of federal moneys made available to this state without the approval of a joint committee of the legislature designated by legislative rule.So this would mean that if DC passes down federal money for anything, that the Governor's office and associated agencies wouldn't be able to push the money out the door until the Joint Finance Committee or a some special "federal money" committee would sign off on it. And given the gerrymandered Legislature, they could well decide that they don't want money to go toward certain groups or to help achieve certain goals.. or could even keep it from going out at all. Federal funds are a big part of every biennial state budget ($25.6 billion for 2021-23), and I suppose that would include the Joint Finance Committee approving the budget as part of the regular process. But does that also mean that the state wouldn't be allowed to use any Federal money for a (Federal) fiscal year until it a budget goes through? Seems like a detail that should be cleared up. The other item is well-explained by Patrick Marley is his article.

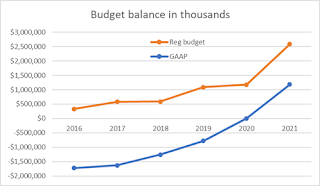

The state constitution requires the state budget to be balanced, but officials have used accounting definitions that differ from those used by businesses. For years, the state maintained a budget that included deficits as defined by generally accepted accounting principles {GAAP}. The condition of the budget has improved over the last decade or so as Republicans who controlled the Legislature sought to eliminate budget tricks such as delaying bill payments and transferring money between unrelated funds. Republican state Sen. Howard Marklein of Spring Green said now is the time to change the state constitution regarding accounting practices because the state is in good financial shape. "What I hope ... this GAAP constitutional amendment will do is will remove the temptation for future legislatures and future governors from using accounting gimmicks to balance a state budget," Marklein said.In isolation, this isn't necessarily a bad idea, although how many of us don't use credit cards or pay for every expense in full as they happen? But take a look at the gaps between the "normal" budget balance and GAAP, and you can see where this would cause a major change in availability. That's a GAAP gap that ranges between $1.2 billion and $2.2 billion in each of the last 6 years, and you could imagine how abilities to take care of needs might change if that amount of money was yanked away to....pass muster on a CPA exam? To maybe raise our state's credit rating from AA/AAA to....AAA? Which is the enitre point of these plans. WisGOPs want to put even more fiscal handcuffs in place to prevent certain options from dealing with social problems, and force even more austerity on a state (and country) that already has had more than enough over the last 20 years. And they certainly don't want a statewide-elected Governor to succeed in making others recognize that there is much more government can do in Wisconsin, if we choose to. While both of these amendments would bypass any chance of a veto by Governor Evers or anyone else, they still have to pass both houses in 2 straight sessions, and then get approved by the voters. Which means the earliest any of this could happen is 2024, but that doesn't mean we shouldn't pay attention now, because WisGOPs will try to sneak this thing through and claim it's some kind of "fiscal responsibility" thing. It is anything but.

No comments:

Post a Comment