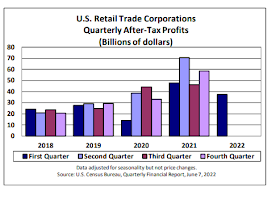

Profits from current production (corporate profits with inventory valuation and capital consumption adjustments) decreased $66.4 billion in the first quarter, in contrast to an increase of $20.4 billion in the fourth quarter (table 10). Profits of domestic financial corporations decreased $28.6 billion in the first quarter, compared with a decrease of $1.3 billion in the fourth quarter. Profits of domestic nonfinancial corporations decreased $21.1 billion, in contrast to an increase of $5.0 billion. Rest-of-the-world profits decreased $16.7 billion, in contrast to an increase of $16.8 billion. In the first quarter, receipts increased $21.3 billion, and payments increased $38.0 billion.But don’t shed too many tears for corporate America, as pre-tax profits for Q1 2022 were up 12.5% compared to Q1 2021, and 19.3% compared to the end of 2019, before COVID was a thing. Note the giant leap at the end there, which accounts for major profit boosts in Q1 and Q2 of 2021. Wanna guess when consumer inflation started to take off in this country? While the Biden stimulus certainly increased demand for products, the profit increases can’t be ignored for this time period. Then, as these companies the economy fully reopened by the second half of 2021 and more products were needed, these companies had to pay more to American workers and suppliers to keep the products moving along. Combine it with global complications in 2022 such as Russia’s invasion of Ukraine and slowing supply chains from overseas, and now these companies can’t take advantage of cheap inputs like they could this time last year. Census Bureau reports on Q1 profits for manufacturers and retailers backed this up. Again, note how those profits are quite a bit higher than they were in the pre-COVID era. In order to maintain and advance on the Bubbly profitability of 2021, there seems to be a serious game of musical chairs going on – one where suppliers, employers, and workers are all trying to get more money for their products in order to maintain the improved position they got to in 2020 (if they were able to survive intact). As of now, all seem to be getting more money, although wages in some industries aren’t keeping up with the price increases of everyday products. But the easy money on the trading markets needs somewhere to go as well, and with profitability down and prices going up, they need to put those funds to use somewhere. Which seems to explain a big part of $120 oil and $5 gasoline to me, because that level seems to be based on little more than speculation that supplies will become tight in the future (it's not due to supply-and-demand conditions of today, which are little different than 3-4 years ago). Which leads me to wonder who makes the first drastic move to JUST SAY NO to what we have going on. Is it consumers who stop accepting higher prices? Is it companies who stop buying things and hiring/paying employees? Is it traders who have to pull money out to actually pay for an actual tangible item? Or will some allegedly scarce resource become plentiful and competition start to undercut the high prices that some rentiers have been able to pull off? That’s the question that is likely to be answered in the coming months. And how that sorts out will be another COVID-era adjustment that is leaving us in a different economic world than we had before 2020. Some of these adjustments have been good (higher incomes and home values, less unemployment), but it’s been coming at a higher price for almost a year now. Something’s going to come down – it’s a matter of what it is, and how hard it falls.

Ventings from a guy with an unhealthy interest in budgets, policy, the dismal science, life in the Upper Midwest, and brilliant beverages.

Wednesday, June 8, 2022

After record profits helped cause inflation in 2021, higher costs are blunting profits in 2022

In 2021, we saw a significant runup in profits among American companies, often as a result of “pricing power” to grab more revenues (there’s a lot of your 2021 “inflation”). In early 2022, the higher prices are continuing, but there is evidence that profits have leveled off.

We got an indication of this in the latest update to the GDP report, which gave us the first look at US profits for the 1st Quarter of 2022. According to the Bureau of Economic Analysis, corporate profits turned down in the first 3 months of this year.

No comments:

Post a Comment