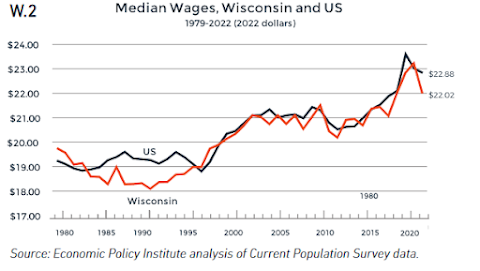

[In Wisconsin], over 2018-2021, wages grew significantly. Wages grew strongly especially across 2020-2021 thanks to sustained job growth and low unemployment. In 2022, inflation spiked and workers faced rapidly rising prices on everything from groceries to housing. Wages rose at the median but not enough to keep up with prices. Both nationally and in Wisconsin, the value of the 2022 median fell below the 2021 level. In terms of purchasing power, Wisconsin’s median wages fell back to 2019 level. The 2022 median wage in Wisconsin was $22.02 per hour, slightly below the national median of $22.88. In a remarkable reversal of patterns of wage growth since 2000, lower wage workers have secured greater wage increases than higher wage workers. Unlike higher wage workers, low wage workers more often secured wage increases that kept them ahead of inflation in 2022. For this reason, Wisconsin’s considerable racial, ethnic, and educational gaps in wages have continued to recede slightly over 2019-2022. Though wage inequalities remain substantial, low unemployment rates appear to have allowed lower wage workers to improve their pay.And here are some of the numbers COWS uses to show how the state's large disparities in wages have shrunken in the COVID-era and post-COVID Wisconsin. Interestingly, the only group not to have wages keep up with inflation since 2019 is white men - even though white guys still make the most money out of any group in the state.

This past year has seen workers at the bottom increase their wages, and this is reflected in the stronger wage growth of Wisconsin’s Black and brown workers, who disproportionately work in low-wage jobs. Workers have taken advantage of the tight labor market to demand more from their jobs. The floor under wages in the state has come up, and this reduces wage disparity.In 2023, the rate of inflation has gone down, but the rate of wage increases hasn't dropped as much, which means we are seeing a restoration of real wage gains. And it means that the median worker is better off than he/she was before COVID was a thing, with a couple of years of stimulus payments added in on top of this.

This year, we are also continuing to see this pattern of higher wage increases for lower-wage and line-level workers. Take a look at the last US jobs report, where the wage growth for non-supervisory and production employees continues to outpace the overall increase in average hourly wages over the last year. These numbers are not adjusted to change in CPI over this time. Change in average hourly wages, Aug 2022 - Aug 2023Senator, as you requested I compiled the following chart to help add some context to your claim. https://t.co/nGeIaOGZ6G pic.twitter.com/hVDLi1PwuZ

— Justin Wolfers (@JustinWolfers) September 1, 2023

All private sector jobs +4.29%

All non-Supervisory/prod. workers +4.50% And goods-producing workers are seeing especially strong wage growth. Services less so, although many of those sectors are still outpacing inflation and overall wage growth Change in avg hourly wage, Non-Supervisory/Production Workers, Aug 2022 - Aug 2023

Manufacturing +5.72%

Construction +5.68%

Utilities +5.65%

Prof/Business Services 5.20%

Leisure/Hospitality +4.72%

Wholesale trade +4.69%

Private Education/Health Services +2.90% Even that last number that shows smaller wage increases in private education/health services masks good news, because over 1 million more jobs have been added in that part of the jobs market over those 12 months, so this likely reflects newer, lower-wage workers joining that work force over wages being suppressed for those that were alread working. The health care sector has especially boomed since the end of 2021. This makes for a rare celebratory situation for this Labor Day, with strong wage growth to go along with a low unemployment rate of 3.8%. And it helps to drive strong consumer spending, as we saw in July. So I ask again, why does the Fed and other Wall Streeters not want this to continue, and why are they especially trying to crush manufacturing and construction with high interest rates that are well above the rate of inflation?

No comments:

Post a Comment