Wanted to riff on

a recent report from the Wisconsin Policy Forum on the state's strong fiscal situation.

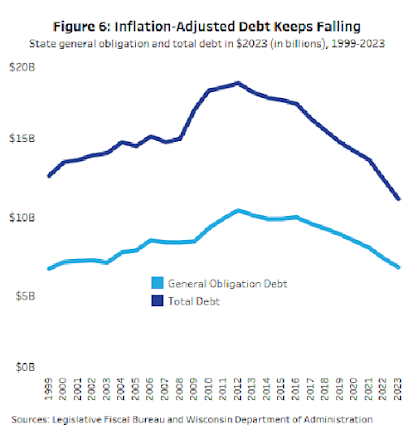

One positive side-effect of the state’s ongoing budget surplus is that there’s less of a need to take on debt. The Policy Forum notes that Wisconsin’s debt has plummeted over the last decade, and especially since 2017.

But some of that is due to paying bills that were put off by the Doyle and Walker Administrations as the state dealt with and recovered from the Great Recession. This meant that the state’s expenses going to pay off debt jumped in the rest of the 2010s, and only recently has declined to give the budget more breathing space.

In times of economic stress, however, the state is most immediately affected not by its total outstanding debt but by its annual debt payments, which can reduce the funds available for other spending priorities or put upward pressure on state taxes. The state has long sought to keep annual debt payments made with its main tax revenues, or General Purpose Revenue, to less than 4% of total spending to avoid crowding out other state priorities. (These figures are calculated using reports aligned with the state budget, not with the state’s comprehensive financial reports).

The state exceeded this target after it delayed making GPR debt payments during and immediately after the Great Recession from 2008 to 2012 to make it through those hard times (see Figure 7). That meant higher payments in later years. During the decade since, the state has been paying down GPR-funded debt and since 2017, it has largely avoided delaying these debt payments. Even during the chaotic pandemic, the state only delayed a relatively small part of its 2020 payment.

The result has been impressive. The share of GPR spending going to debt payments fell below 2.7% in both 2021 and 2022. With the exception of years in which the state skipped making debt payments because of budget challenges, that is the smallest share since 1984, according to the Legislative Fiscal Bureau (LFB) and Forum records.

One area that still has a sizable amount of expenses going to debt is in the state's Transportation Fund. Some of this has been mitigated in recent years with some of the General Fund surplus being used to pay for items in the Transportation Fund, and due to the borrowing spree of the Walker years ending in the last 6 years.

And with added infrastructure spending from the Feds starting to fade out in the next couple of years, it may be a good chance to see if there needs to be more funds sent over on the state level to further lower those debt payments in the Transportation Fund. And if so, will the General Fund surplus continue to be tapped to keep paying for that.

The Policy Forum notes that while the record bank balance is being reduced in this current budget, it is being done in a way that lessens the chances of future budget problems.

During the current 2024 fiscal year that closes on June 30, the state’s general fund is projected to spend nearly $3.3 billion more than it takes in from taxes and fees, according to LFB. As a result, the general fund balance (according to the cash-based accounting used for state budgeting) will fall from nearly $7.1 billion on June 30, 2023 to a projected $3.8 billion at the end of June 2024.

To some degree, spending down at least part of this sizable surplus can be seen as appropriate. Despite the drop in the general fund balance, the state’s rainy day fund will still retain an additional $1.8 billion to bolster state reserves. In addition, much of this new spending in 2024 is temporary or one-time in nature rather than permanent (such as expenditures for constructing and repairing state buildings). Also, the projected drop in the fund balance for 2025 is smaller at $551 million.

It also helps explain why it makes sense for Governor Evers to

veto the $2 billion-a-year in permanent tax cuts that the GOP Legislature tried to get through. Because that would have taken away any ability to respond to an economic downturn, and would have put the state back into a deficit after we had finally gotten back to a solid fiscal situation.

We will find out in the coming weeks what tax season did for the state's revenue and overall budget for what is left in the 2024 Fiscal Year. So far the numbers have beem tepid, which is why the Legislative Fiscal Bureau had already reduced its revenue outlook back in January. But let's see if the big stock market gains of 2023 lead to a need for Wisconsinites to send in large amounts of tax payments in April 2024, which may help the state's bottom line, give expanded breathing room and perhaps allow us to continue on the right path going into the 2025-27 state budget.

No comments:

Post a Comment