Thursday's report from the Bureau of Labor Statistics showed that its producer price index (PPI) — which tracks the price changes companies see — rose 3% from the year prior, up from the 2.4% in October and above the 2.6% increase economists had projected. This marked the highest year-over-year increase since February 2023. On a monthly basis, prices increased 0.4%, compared to the 0.2% seen in October. Excluding food and energy, "core" prices increased 3.4% year-over-year, above October's 3.1% increase. Economists had expected an increase of 3.2%. Meanwhile, month-over-month core prices increased 0.2%, in line with last month's rise and economist projections.And the bigger problem is that several food-related costs went up in that PPI report, leading to an overall increase in the food index of 3.1%. Within the food index, there were some particularly huge spikes in producer prices. Change in producer prices, Nov 2024

Eggs +55.6%

Fresh vegetables +33.2%

Fresh fruits +21.8%

Grains +5.0%

Beef and veal +2.8%

Pork +2.8%

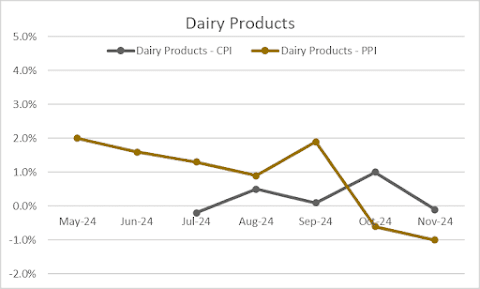

Processed chickens +2.4% That's quite a big 1-month change, and I wanted to see how long it might take before we see those huge jumps in producer prices show up at the grocery store. It looks like that it won't happen immediately or all at once, because the increases and decreases tend to be smoothed out at the consumer level. But if the track of the recent months is an indication, the increases will likely be spread out over the coming months. Oh, and for those voters who thought Donald Trump had some kind of plan to bring down food prices back to 2021 levels? It ain't happening, kids.

The picture at the New York Stock Exchange just takes this to another level. So much like with toys or computers, if you have a chance to stock up on food and use your freezer (or your cold porch) to store it, you may want to do so. Because it seems like food inflation is coming back after leveling off in the last year-plus, and with the Republicans in charge, they won't be doing anything to make the markets more competitive or keep the profits from retailers and middlemen in check. And yes, I still believe that inflation levels of 3-4% aren't that big of a deal. But we may be fortunate if it's only that much this time next year (if we're not in recession), and I can't think the Federal Reserve would be cutting rates much after their meeting next week. Which might put a lot of brakes on the silly rally we've been seeing on Wall Street in the month since the US election, and turn things the other way as reality sets in.Congratulations everyone willing to sacrifice American excellence, pride and freedom (just to start) for better egg prices that you were never going to get in the first place. I’ll remember your ignorance and apathy with every family ripped apart.

— 💙❤️💙Mia💙❤️💙 (@mommamia.bsky.social) December 12, 2024 at 2:05 PM

[image or embed]

No comments:

Post a Comment