It wasn't all great news in the jobs report, as the rise in the unemployment rate from 3.4% to 3.65% with more Americans identifying as unemployed at the same time that more people entered the US work force. But it appears that a sizable amount of those losing jobs were in the "part time for economic reasons" category in April, which is why the U-6 unemployment rate only rose by 0.1%, staying near multi-decade lows. While fewer Americans may have been self-employed in May, more were finding work at businesses they didn't own.JUST IN: The US economy added a strong 339,000 jobs in May -- Another month of beating expectations.

— Heather Long (@byHeatherLong) June 2, 2023

Unemployment rate = 3.7% (up as more people look for work)

Wages grew 4.3% in past year. (Lower than 4.9% inflation)

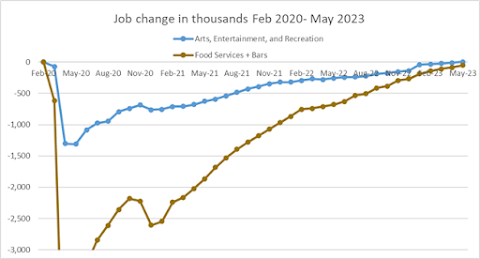

While Americans were claiming they lacked consumer confidence and were buying into the RECESSION FEAR being spread around the news (because "healthy economy with solid job/wage growth" is boring), we still see consumer-driven restaurants, bars and recreation services sectords hiring up. In fact, the arts/entertainment/rec sector has now gained back all of the losses it took on in the COVID era, and bars and restaurants will likely get back to pre-COVID levels by the end of the Summer. The wage growth figures in the jobs report were good-but-not-great, matching a trend of the last several months that goes along with our declining levels of 12-month inflation.Since Feb '23, self-employment unincorporated is down 607k. So we're seeing a lot of return to payrolls from self-employment. Now thats a small sample, so caveat emptor, but if so that is less aggregate labor impact than the payrolls would otherwise suggest.

— Adam Ozimek (@ModeledBehavior) June 2, 2023

Or maybe we're in a balanced economy that is continuing to need workers, which helps everyday Americans. That's what the Fed SHOULD recognize, and use their meeting later this month as the one to pause on their trend of rate hikes, as the Fed Funds target of 5-5.25% is now above the 12-month gains in both inflation and average hourly wages, and quite a bit more when you look over the last 9 months (where the annual rate is 3-4%). Combine the strong jobs market with the threat of debt default going away, and the DOW Jones Industrial Average jumped by more 700 points on Friday. We've also seen US gas prices decline in the last month, and go down more than 25% compared to a year ago, asLet's talk about wages... they are up 4.3% in the past year (lower than 4.9% inflation).

— Heather Long (@byHeatherLong) June 2, 2023

-Wage growth is slowing (see chart)

-Low-wage workers continue to see biggest pay gains

-Fed likely still wants slower pay growth to ensure inflation comes down more pic.twitter.com/6lHlZOZfqI

No comments:

Post a Comment