Later this week, the Joint Finance Committee is going to take up the Wisconsin DOT's budget, and all of its related parts. And

the Legislative Fiscal Bureau gave some bad news about how many state funds might be available to fix the roads and pay for the many services that WisDOT is a part of.

Based on the Committee's action to date, as well as this reestimate of current law revenues and transportation revenue bond debt service, net transportation fund SEG revenues after revenue bond debt service would be lower by $126,613,900 in 2023-24 and $258,193,300 in 2024-25. Compared to AB 43/SB 70 [the state budget bill], transportation fund SEG appropriations, including reserves and lapses, under the Committee's actions to date would be: (a) lower by $144,262,800 in 2023-24 and by $213,011,100 in 2024-25 for DOT; and (b) lower by $154,700 in 2023-24 and higher by $228,000 in 2024-25 for other state agencies with appropriations funded from the transportation fund.

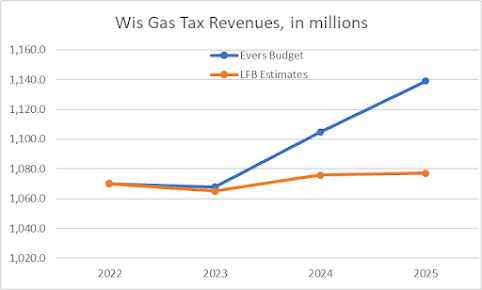

Here's a visual version of those numbers.

Two of the reasons behind this sizable shortfall is because LFB says less gas is expected to be consumed in Wisconsin than the Evers Administration projected, and that there will be less money coming in from vehicle registrations.

But the other big reason is that the GOP-run Finance Committee removed an Evers initiative that would have paid down nearly $380 million of the Transportation Fund's debt, and now it means there are less funds to spend on other DOT needs and services.

Transportation revenue bond debt service is an offset to revenues from vehicle registration and titles fees. Annual revenue bond debt service amounts are estimated to be lower by $5.1 million in 2023-24 and higher by $68.4 million in 2024-25, compared to the amounts included in AB 43/SB 70, which results in an increase in net revenues to the fund in 2023-24 by the same amount and a decrease in net revenues in 2024-25 by that same amount. Of these amounts debt service reductions of $5.1 million in 2023-24 and $7.8 million in 2024-25 are associated with the estimate of current law of transportation revenue bond debt service. The remaining difference in 2024-25 is associated with the Committee's earlier action to delete the proposed general fund transfer related to the defeasement of transportation revenue bond debt service, which would have reduced debt service on these bonds by $76.3 million in 2024-25. These estimated debt service amounts do not include debt service on any additional transportation revenue bonds for the major highway development program and for DOT administrative facilities, which would be authorized at $149.2 million and $18.5 million respectively under AB 43/SB 70. The Committee has yet to address those items.

So because we are still paying off the debt that Evers wanted to use the Gen Fund surplus to pay down, that's more than $76 million in DOT revenues that we have to use up to pay that debt during this budget (as well as more down the road).

The last item that is leading to the shortfall is another offshoot of the WisGOPs on Finance removing Evers' initaitives last monmth. Evers planned to increase the amount of General Fund dollars that is sent over to WisDOT, by diverting some of the sales taxes from auto-related products.

As a result, the recommended revenue increases under AB 43/SB 70 associated with the proposed transfers from the general fund to the transportation fund would not yet be included in the 2023-25 budget bill. These transfers equaled: (a) $43,625,700 in 2023-24 and $52,895,500 in 2024-25 associated with the estimated annual sales tax revenue from the sale of automotive parts, accessories, repair and maintenance services, and tires (APART); (b) $39,300,000 in 2023-24 and $55,100,000 in 2024-25 associated with estimated annual sales tax revenue from the sale of electric vehicles; and (c) $9,000,000 in 2024-25 to offset the loss in railroad property tax revenues to the fund associated with the repeal of personal property tax under AB 43/SB 70.

The upshot of this is that LFB says there is only $28 million available in the state's Transportation Fund to pay for any increased state funding for any DOT services - just more than 1.3% of projected expenses. And the costs of road construction and other needs are likely to go up a lot more than 1.3% over the next 2 years.

That being said, the infrastructure bills should give some more cushion over the next couple of years, and the Finance Committee could/should use some of those extra Federal funds to pay for projects and save state funds in the process. But those funds will go away in the next budget, and the flat gas tax and vehicle registration revenues for the next 3 years indicates that we will need to find new and better ways to pay for our many DOT needs for the rest of the 2020s.

Even in a time of major General Fund surpluses, these updated figures in the Transportation Fund shows that things are still very tight in this key area of the budget. And if WisGOPs choose tax cuts over using the surplus to add more General funds to fix the roads in this budget, they're making a big mistake.

And now we won't find out what JFC wants to do with WisDOT, because they're delaying any action on Transportation until the Republicans can figure out the shared revenue bill.

ReplyDeleteI get the delay, because the shared revenue bill affects so many other items in the budget, and that needs to be cleared up before the other big-ticket items get figured out. But with 3 weeks until the new budget is supposed to start, it sure seems like it's going to be hard to get everything in.

Pathetic. But not surprising.