First of all, here are 3 topline stats-

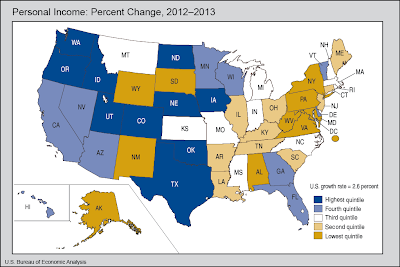

1. The state was 19th in income growth for 2013, and 3rd in the Midwest (behind Minnesota and Iowa). Pretty good, as the 2.73% increase was above the national average of 2.57%, the first time the state beat the country as a whole since 2008-09.

The state also had per capita income growth of 2.44%, which beat the U.S. total of 1.85%, and placed 2nd in the Midwest (behind farm-heavy Iowa). But the flip side of that stat is that Wisconsin's coming from a lower start, as the state is still a mediocre 26th in per capita income at $43,149, which is more than $5,700 less than Minnesota and $3,600 less than Illinois (in fact, Minnesota's per capita income went up by a higher dollar amount than Wisconsin, it just had a lower percentage on its increase). Good luck competing with those places for talent if workers are getting a 10% premium on pay.

Despite the strong year-round figures, the state ended 2013 poorly, as it placed 43rd in income growth for the 4th Quarter, and 5th out of 7 Midwestern states. Even that masks how bad things were in Wisconsin, as the national report mentions "The fourth-quarter personal income decline in Iowa and six other states reflected lower crop prices which reduced the value of farm output and farm earnings." One of those other 6 states was Minnesota, which not surprisingly was the other state behind Wisconsin. Take out farm earnings for the 4th Quarter, and Wisconsin is dead last.

Change in non-farm earnings, Midwest, 4th Quarter 2013

Ind. +0.73%

Mich +0.71%

Ill. +0.69%

U.S. +0.67%

Ohio +0.59%

Iowa +0.51%

Minn +0.38%

Wis. +0.29%

So not a good ending, and that was before the brunt of the polar vortex hit, which already led to a 0 for private sector job growth in Wisconsin for January, and stagnated sales taxes for February.

The other item I want to look at is the income trends over 3 years of the Walker/WisGOP era in Wisconsin. 2010-11 will take into account the increased income that resulted from the 2-year cut in Social Security taxes that started in 2011, but it will also include the higher pension payments that Wisconsin public employees had to make due to Act 10, which reduced incomes. 2011-12 had a lower income growth with Social Security taxes staying the same, and 2012-13 featured declines all over the country as the Social Security tax cut ended. First, we'll go with total personal income.

Now we'll show you personal income per capita, which has a similar story.

In both graphs, Wisconsin started off in 6th place out of the 7 Midwestern states in 2010-11, and you'll note the flatter slope of the trend line for Wisconsin (in red) compared to Minnesota (in orange) and the U.S. as a whole (in blue). This shows that Wisconsin has "caught up and passed" other places not through booming incomes in our state, but because the other places fell back toward us in growth levels. And the larger difference with Minnesota on personal income vs. personal income per capita reflects the Gopher State adding nearly 110,000 people since 2010 while Wisconsin has only added 53,122 (in fact, Wisconsin's population growth has declined in each of the 3 years Scott Walker has been in office). The disparities in income could also lead to an attraction of talent to Minnesota, and brain drain and lower population growth would certainly be something to limit Wisconsin's economic vitality and income levels if it continues.

So in the short-term, Wisconsin came out reasonably well in the BEA's state income report. But the 3-year picture of the Age of Fitzwalkerstan still shows the state staying behind many of its neighbors and the nation as a whole, and with a weak 4th Quarter of 2013 and a cold 1st quarter of 2014, it doesn't look so good for the next reports that might emerge.

Jan/Feb of 2014 was the 8th coldest in Wisconsin history and was on average 10 degrees colder than the same period in 2013. February on its own was the 6th coldest and 9.4 degrees colder than February 2013.

ReplyDeleteHopefully we'll get a vacation-worthy summer for those seasonal jobs.