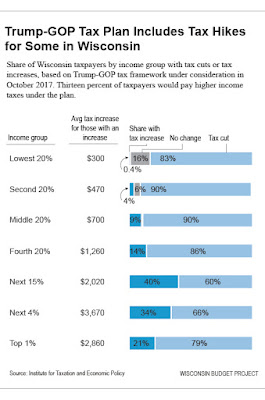

The Budget Project summarizes the findings from the Institute for Taxation and Policy, who performed analyses for all 50 states, using the “tax plan framework” that was released by Donald Trump and the GOP Congress 2 weeks ago. In Wisconsin’s case, quite a few people would end up paying higher taxes under the (admittedly vague) plan, while the rich and corporate would get by far the biggest benefits.

If the framework was in effect in 2018, 13.2 percent of Wisconsin households would face a tax hike. Whether a family would pay higher or lower taxes would depend on their circumstances. There are two provisions that reduce the amount of income that is subject to taxes for most families, and the framework increases one of them (the standard deduction) while repealing the other (the personal exemption). Families who itemize their deductions (rather than claiming the standard deduction) may pay higher taxes because the framework repeals most itemized deductions, including the deduction for state and local taxes [SALT].In particular, ITEP says it’s the upper-middle class in Wisconsin who is most susceptible to getting a tax increase from this plan, due to their group being reliant on SALT and other itemized deductions, but not making enough for the top tax rate reduction.

The framework would be particularly generous to the wealthy in large part because it would reduce the corporate income tax rate. The bulk of the benefits would go to the owners of corporate stocks and other business assets, a group of overwhelmingly (although not entirely) high-income taxpayers. The framework would also provide a special tax rate of 25 percent for other types of businesses. While it describes this as a tax cut for “small businesses,” most of the benefits would go to the richest one percent of Americans. The wealthiest taxpayers would also benefit greatly from the framework’s reduction in the top personal income tax rate from 39.6 percent to 35 percent and elimination of the estate tax.

The Budget Project also notes that the increased deficits will likely require spending cuts and/or other tax increases in order to keep the federal budget deficit in line. If we assume those extra taxes and reduced benefits are applied equally, then almost all Americans end up losers, with the poorest ones taking the hardest hit.

Here’s the even worst part of this package for Wisconsinites – it’s already on top of numerous regressive tax cuts and wage suppression during the Age of Fitzwalkerstan that have helped to make economy lag the country and made inequality worse. So now we add in this extra “juice” from the Feds that also will have most of the benefits go to the richest and most connected? How does that improve things?

It leads to a simple question that Ted Kennedy asked 10 years ago on the Senate floor, during the last era of GOP tax cuts and deregulation combined with a lack of an increase in the minimum wage. “When does the greed stop?”

No comments:

Post a Comment