So the 4 WMC-bought "Justices" claim that they shouldn't do anything about gerrymandering, because voters should. But gerrymandering exists to make it unlikely that the voters hold the politicians accountable. It's disgustingly cynical, and insulting that GOPs think anyone is so stupid not to see what a bunch of self-sustaining garbage this is. So "least change" it is. Even though it's a standard that didn't exist until (like most things in GOP BubbleWorld) Republicans made it up to try to match the needs of Gerrymander 2.0. Well, good thing I made up maps based on "least change", which I discussed in this post. To review, here's what my "least change" Assembly map looked like. And here's the GOP's Gerrymander 2.0. The purple lines are Assembly districts, and the black lines are the Senate districts (which are made up of 3 Assembly districts). You can already see some differences in Northwest Wisconsin as well as in the districts east of Janesville (mine are a lot more like the current borders). But the major changes are in the Milwaukee area. For my map, I kept most of the 2010s base, which spread districts from Milwaukee County across into nearby WOW Counties. By comparison, take a look at WisGOP's Gerrymander 2.0 in the Milwaukee area. It makes a major change in combining districts 14 and 18 into Wauwatosa, while shoving 13 and 15 into Waukesha County to give State Sen Dale (Koo-Koo) Kooyenga a chance at holding onto a seat in an area that gets bluer by the year. There you go Dems/others who want democracy returned to Wisconsin. Use as much as you wish in court. Disgusting stuff, but despair and giving up is not an option. Because the ultimate goal of the bad guys is to make the good guys give up because it's too much effort to overcome, which is how most Banana Republics and crooked 3rd World counties operate, when you think about it. But I'll be damned if I sit back and let those amoral weenies and trailer trash to rule over the Real Wisconsin, and have this state go down the drain for good. But it makes keeping Evers and other Dems in charge statewide all the more crucial in 2022.While it's a 4-3 ruling for the most part, @judgehagedorn writes concurring opinion that takes issue with one component of majority decision. But he also backs the "least-change" approach in his opinion.

— JR Ross (@jrrosswrites) November 30, 2021

Ventings from a guy with an unhealthy interest in budgets, policy, the dismal science, life in the Upper Midwest, and brilliant beverages.

Tuesday, November 30, 2021

WisGOP hacks allow 2010s WisGOP gerrymander to base 2020s WisGOP gerrymander

Monday, November 29, 2021

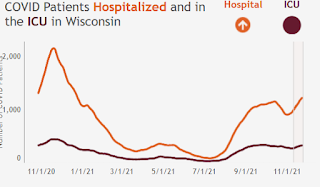

COVID update - cases still high, hosptials full. So get boosted and play it smart

All the more reason you should be getting boosted if you first got vaccinated before May. And why you should be angry at the 2/5 of Wisconsinites that still have yet to be fully vaccinated, because it is their arrogance that is allowing this virus to continue and harm people.⏺ Many #Wisconsin hospitals are at full capacity due to #COVID19.

— WIDeptHealthServices (@DHSWI) November 27, 2021

⏺ This time of year we can expect hospitalizations to increase due to seasonal illness & holiday-related injuries.

➡ Do your part to help health care workers by helping #StopTheSpread: https://t.co/s6NUa4fQQ8 pic.twitter.com/FbT8Yp7brv

Saturday, November 27, 2021

Incomes back to pre-COVID pattern, spending still beating inflation, but virus still an economic problem

I'll take a little short-term inflation over years of chronic unemployment and subpar economic performance like we saw in the past. And after seeing oil prices crash on Friday, it's pretty evident that a lot of that "inflation" was nothing more than profiteering, and that can be corrected by ways that don't involve pulling the rug out from under the typical AmericanTHIS is the key chart to watch (from @calculatedrisk)

— Heather Long (@byHeatherLong) November 5, 2021

This recovery has been incredibly fast thanks to strong gov't aid and the vaccines.

18 million jobs already back (out of 22 million lost)

In 2021 alone, over 5.8 million jobs have come back. pic.twitter.com/gMwZmX7IL2

Thursday, November 25, 2021

Next 2 months will show what Wisconsin will do with infrastructure bill....if WisGOPs don't sabotage it

IIJA includes reauthorization of funding for existing federal surface transportation programs as well as for new program initiatives funded from the segregated federal Highway Trust Fund (HTF). HTF funding is considered contract authority, against which states may obligate funds, however, subsequent appropriations legislation is needed to fund these obligations. In addition, IIJA provides supplemental federal general fund (GF) monies for transportation programs, some of which are also subject to subsequent, annual appropriation (GF-STA) legislation. This section of this memorandum provides information on these programs as well as the funding levels that would be provided under the Act.The LFB says that there will be about a 25% increase in available Federal highway funds that Wisconsin can pretty much use as it needs over the next 5 years. The state is also slated to get $225 million in the next 5 years on a new bridges program, nearly $79 million as part of an electric vehicle program, and $2.2 million for ferryboats and ferry terminals. There also is a sizable boost in transit funding flowing into Wisconsin, starting with a 30-40% increase in annual funding for everyday operations. Wisconsin can also expect to get a part of the $21 billion in additional funds to buy buses and fix up other physical transit infrastructure, and boosts in assistance for both passenger rail and freight rail. Given that we're about 1.6% of America, that might mean somewhere around $320 million for these funds instead of having local tax dollars pay for it, or to defer the projects to a later time. Seems pretty good so far. So with these numbers, I wanted to look at how things were handled with the last time we had a stimulus program with a big boost for highway spending, which was back in 2009 with ARRA. At the time, the Doyle Administration sent down a list of plans to the Dem-controlled Joint Finance Committee, and you can click here to see an example of these requests. Like most highway funds, larger communities are allowed to handle funds at their own discretion while WisDOT gets applications from smaller communities and parcels up the money in some fashion from there.

The State of Wisconsin will receive a total of $529.1 million in funds under the highway formula component of the American Recovery and Reinvestment Act of 2009 (federal economic stimulus act). Of this amount, the Department has established a policy of making $158.7 million available for local highway and bridge projects, and the federal act requires a set-aside of $15.9 million for transportation enhancements projects. Of the set-aside for local highway and bridge projects, $38.7 million is reserved for projects in the Milwaukee urbanized area, $9.8 million is reserved for projects in the Madison urbanized area, and $0.6 million is reserved for the portion of the Round Lake Beach, Illinois, urbanized area that lies in western Kenosha County. These amounts are determined under a federal formula for areas with a population exceeding 200,000. Federal transportation law requires that the metropolitan planning organization (MPO) for each of these areas must approve any use of federal funding within those areas.... At the time that the earlier request was submitted, the Department of Transportation indicated that local governments had been given a deadline of April 7 to submit applications for highway, bridge, and transportation enhancements projects to use the remaining stimulus funding. The projects included in the Governor's present request are all projects that were determined to be eligible for federal funding and that could be constructed in calendar year 2009.So it was a mad scramble for a bit, but then the Federal money was able to get out and pay for projects that otherwise would not have happened. It should be noted that a central problem with the 2009 stimulus was that Wisconsin's state and local governments were in major budget deficits because of the Great Recession, so in many cases, the federal money merely prevented further layoffs and stabilized the economy instead of giving a major economic jolt of job and income growth. It's the opposite today. Wisconsin has billions of dollars in surplus at the state level, and local governments are getting help for the next couple of years under ARPA. So there are plenty of projects that can use those funds from DC and have plenty of state highway funds left over to take care of additional needs. It also can buy time for the state's Transportation Fund without having to raise the gas tax or other user fees. The other major change compared to 2009 is that we have a GOP Legislature that doesn't want things to get too good before the 2022 midterms. And that could well play a role in what these funds ultimately end up doing....if they do anythinbg. Let's take a step back and let you know about Wisconsin statute 84.03, which mentions some budget procedures regarding Federal highway funds. WisDOT is required to send information to the Joint Finance Committee by either December 1 or 30 days after the US DOT’s budget is decided for a certain Federal Fiscal Year. Given that the “Roads, Bridges and Broadband” bill became law on November 15, that deadline should be coming in the next 2-3 weeks. But if there is a sizable increase (or cut) in what those funds compared to what was in the current state budget, then WisDOT has to explain what will happen to the money.

[(b)]2. The secretary is required to submit a plan under subd. 1. only if the department's most recent estimate of the amount of federal funds that the department will be appropriated under [the WisDOT budget] in the current state fiscal year is less than 95 percent or more than 105 percent of the amount of federal funds shown in the schedule for the appropriations under [the WisDOT budget] in that fiscal year.And this is where it could get interesting with the GOP-controlled JFC.

(c) After receiving a plan under par. (b) 1., the cochairpersons of the joint committee on finance jointly shall determine whether the plan is complete. If the joint committee on finance meets and either approves or modifies and approves a plan submitted under par. (b) 1. within 14 days after the cochairpersons determine that the plan is complete, the secretary shall implement the plan as approved by the committee. If the joint committee on finance does not meet and either approve or modify and approve a plan submitted under par. (b) 1. within 14 days after the cochairpersons determine that the plan is complete, the secretary shall implement the proposed plan. If the joint committee on finance approves a plan under s. 84.555 for a state fiscal year, the joint committee on finance may modify a plan implemented under this paragraph for that fiscal year.It looks like the 84.555 part is about adding bonding to pay for projects, which likely won’t be in play here (other than possibly reducing the amount of borrowing), but note that JFC could do a lot of “modifications” with those funds. One of those WisGOP modifications could be to tell the Evers Administration to tear up the plan and send them another one, which delays usage of the money. These dopes turned down $1 billion dollars of bonus funds to expand Medicaid earlier this year, so it is certainly within their realm of arrogance/stupidity that they would try to limit Federal assistance that could help us get a lot more roads and bridges completed before the 2022 elections. Especially since getting more highway projects finished would be a boost for Democrats’ chances, and a fulfillment of Evers’ promises to “Fix the damn Roads” as governor. Messing with or turning down federal highway funds in early 2022 certainly wouldn’t be the first time WisGOP lowlifes have tried to derail a Democratic President’s infrastructure plans. Side note – Evers should definitely run on getting Amtrak service to Madison as part of Minneapolis-to-Chicago upgrades. Not only is this planned as part of the infrastructure bill’s expanded investment in passenger rail and is now a winning topic with most Wisconsinites, it brings up one of the biggest non-Foxconn blunders of the Walker/Kleefisch era. Especially when Kleefisch claimed Wisconsin didn’t need the rail line because she drove her kids around in a minivan. All of this is likely to come to a head in the next couple of months, so keep your antennae up for any GOP shenanigans that might keep more roads, bridges and broadband from being put in place next year. And make sure that ALL GOPs are held responsible for any sabotage that they try to pull.

Wednesday, November 24, 2021

Corporate profits up 20% in a year? Think I found the inflation

Profits from current production (corporate profits with inventory valuation and capital consumption adjustments) increased$121.4 billion in the third quarter, compared with an increase of $267.8 billion in the second quarter (table 10). Profits of domestic financial corporations increased $13.7 billion in the third quarter, compared with an increase of $52.8 billion in the second quarter. Profits of domestic nonfinancial corporations increased $67.5 billion, compared with an increase of $221.3 billion. Rest-of-the-world profits increased $40.1 billion, in contrast to a decrease of $6.2 billion. In the third quarter, receipts increased $43.1 billion, and payments increased $3.0 billion.And those increases in profits are on top of the record that was set in Q2. That’s an increase of more than 20% year-over-year, and more than 34% since the GOP Tax Scam was signed at the end of 2017, which lowered corporate tax rates. Now tie it together with this other headline from today.

U.S. consumer sentiment plunged in early November to the lowest level in a decade as surging inflation cut into households' living standards, with few believing policymakers are taking sufficient steps to mitigate the issue, a widely followed survey published on Friday showed. The University of Michigan's Consumer Sentiment Index plunged to 66.8 in its preliminary November reading from October's final reading of 71.7. That was the lowest level since November 2011 and was far short of the median estimate among economists of 72.4 in a Reuters poll.I think two things when I see that. 1. I think a lot of this inflation fear is GOPperganda-generated garbage. As a small example, the “skyrocketing gas prices” theme doesn’t match up with what I was paying at the pump on Tuesday. But the real reason I find it to be BS is that another report today showed wages kept growing and consumers boosted their spending well above the rate of inflation in October. With unemployment claims plummeting and job growth continuing, the typical American is keeping up with their bills, so whatever increase in inflation exists isn’t hurting people’s ability to get by. At least not yet. 2. My other thought has to do with the record profits. A 20% increase in corporate profits might explain some of that consumer inflation, eh? And since we have financial and taxation systems that rewards profits over investment, there is a bigger payoff to this type of profiteering.

The Real Inflation Problem Is Corporate Profiteering https://t.co/vqLo2d3Jwv

— Faiz (@fshakir) November 22, 2021

What all these arguments miss is that, despite whatever rising costs exist for raw materials or transportation or other underlying factors, the incontestable truth is profits are way up for the largest corporations in America. And what that means is pretty simple: Corporate America has seized on the fears of inflation to jack up prices on you and make a ton more money. According to The Wall Street Journal, nearly two out of three of the biggest U.S. publicly traded companies had larger profit margins this year than they did in 2019, prior to the pandemic. Not just profits. Larger profits. Nearly 100 of these massive corporations report profits in 2021 that are 50 percent above profit margins from 2019. CEOs are quick to suggest to media that they have been forced to raise prices because of one difficulty or another. However, my organization More Perfect Union reviewed recent corporate earnings calls featuring CEOs of some of the largest companies in the world, like Tyson Foods, Kellogg’s, Pepsi, Mondelez (a huge snack food and beverage company that used to be known as Kraft), and others. And we found jubilant executives revealing that price hikes are great for business.Sure seems like something to amplify and investigate, don’t you think? And maybe some of the incentive to hoard profits over making stuff needs to be taken away. Among other ways, this can be done by increasing competition for services via Build Back Better and other reforms, or flat-out higher taxes and penalties on companies who clearly take advantage of a slanted, monopolistic situation. And if I was a Dem running for office in 2022, I’d sure be hammering the fact that corporations are doing the best they have ever done, while many Americans feel concern over whether they can keep up with prices that have been raised by those same profiteering corporations. Even if the public's “concern” about inflation affecting the economy is mostly BS, the concerns about corporate control over prices and production shouldn’t be. And that’s where our fear and anger should be redirected to.

Tuesday, November 23, 2021

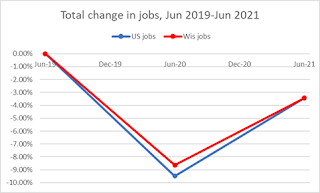

New "gold standard" report says job growth coming back even faster. But still a ways to go

Well, it looks like we’re going to see more upward revisions in the coming months, based on today’s release of the “gold standard” Quarterly Census of Employment and Wages (QCEW), which covered the June 2020-June 2021 time period. Let’s start with total US job growth, which comes in much higher than the monthly jobs reports have indicated. US job growth, June 2020-June 2021“From June through Sep, the @BLS_gov reported it underestimated job growth by a cumulative 626k jobs — the largest underestimate…going back to 1979. If those revisions were themselves a jobs report, they’d be an absolute blockbuster” via @andrewvandam https://t.co/GDX7hmbnK0 pic.twitter.com/Sxk9shBcCt

— Gregory Daco (@GregDaco) November 17, 2021

Monthly jobs report +5.8%

QCEW release +6.7%

That 0.9% difference adds up, given that there were around 138 million jobs (seasonally-adjusted basis) in June 2020 – around 1.2 million jobs. And that 5.8% number in the monthly reports accounts for the revisions through June, which means the numbers are likely to go even higher when annual benchmarking comes around in February. Wisconsin also seems to be in line for more gains with benchmarking. We already had our unemployment rate revised down by 0.5% after more complete data came in, and it looks like our job growth was underestimated earlier in 2021 as well. Wisconsin job growth, June 2020-June 2021

Monthly jobs report +5.2%

QCEW release +5.8%

A 0.6% bump for June 2021 job growth would mean around an additional 16,000 jobs in Wisconsin, which meshes with the revised drop in unemployment, and would further shoot down the claims from the WMC crowd that expanded unemployment benefits were keeping Wisconsinites from looking for (and getting) jobs. That being said, I’ll also note that many of the job gains in Spring 2021 were in service industries that generally hire up as the weather warms, particularly bars, restaurants and hotels. So some of those QCEW gains may not be as high when the benchmarking comes out. But it’ll still probably be more helpful than hurtful. The Q2 2021 QCEW report is a key one in particular because Q2 2020 was the low point of US employment, given the lockdowns that happened as COVID first broke out that Spring. And both Wisconsin and the US still were well below the amount of jobs that existed in June 2019, indicating how deep that hole was, and how far we had to go. The monthly jobs reports have said that another 2.4 million jobs have been added nationwide since June, so that gap has shrunk further on the US side. But given that nearly 800,000 people are DEAD from a pandemic and that more have left the work force through either retirement or just not feeling it was worth it to keep working, getting those last 3-4 million jobs back may prove very hard to reach. We should adjust our expectations and policies accordingly when we look ahead to 2022. That being said, if the “gold standard” jobs report is any indication, we may have less of a hill to climb in both the US and Wisconsin, as job growth may have been better than the strong improvement that we already were aware of.

Sunday, November 21, 2021

Updated data shows Wisconsin at max employment, unless we get more people

Since the onset of the coronavirus pandemic, BLS has been examining the inputs to the employment and unemployment models for outliers and implementing level shifts in real time, where appropriate, based on statistical evaluation of movements in the inputs. These level shifts help to preserve movements in the published estimates that the models otherwise would have discounted. The implementation of a level shift due to an outlier identified in the Current Population Survey input to the Detroit-Warren-Dearborn, MI Metropolitan Statistical Area unemployment model for January 2021 produced some distortions in the pro-rata benchmarking factors across the modeled areas within the East North Central census division that have increased over subsequent months. The modeled areas within the East North Central census division include the states of Illinois, Indiana, Michigan, Ohio, and Wisconsin, as well as the Chicago-Naperville-Arlington Heights, IL Metropolitan Division and the balance of Illinois, the Detroit-Warren-Dearborn, MI Metropolitan Statistical Area and the balance of Michigan, and the Cleveland-Elyria, OH Metropolitan Statistical Area and the balance of Ohio.So let's dig into how those 5 states were changed as a result. 4 of the 5 had reductions in their unemployment rates, but Michigan had a significant jump of 1.7%. And the reasons for the changes varied. Illinois, Indiana and Wisconsin had small changes in the labor force but sizable increases in the number of people working, while Michigan had many more people in their work force, but many less people working. We got another level of information about the labor market in the states on Friday, with the state-level Job Openings and Labor Turnover (JOLTS) survey. And it also indicates that Wisconsin is near a level of maximum employment, with the amount of people being hired no different than in Summer 2020, but the number of people quitting and the need to fill positions is significantly higher. So with the state maxed out, it seems like it's time for workers to take advantage by grabbing better wages, and to have our state find ways to improve its amenities and quality of life so that we can get more people to want to come here, and fill those many positions. And those people aren't going to want to come to a cold-weather place that has backwards social policies and a Legislature that would rather rig elections than get things done. You'd think our state's "business leaders" would understand that. But they're too busy trying to grab market share and profits to actually want to make things better in Wisconsin, so they keep funding regressive dopes that would rather keep our state stagnated. So it's up to Governor Evers to use the boost of Federal support that's coming in to go around the WMCs and other oligarchs, and take real steps to close the wage and labor gap that this state is under in late 2021.

Saturday, November 20, 2021

In late November, COVID is the hunter up North

Friday, November 19, 2021

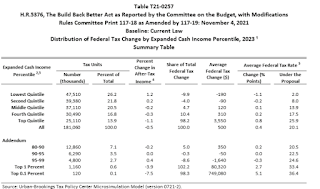

Build Back Better - Fiscally fine, and good enough that it scares GOPs

Change in Revenues over 10 years +$1.269 trillion

Net change in total deficit over 10 years +$367.1 billion BUT, there's also this.

And it appears that the CBO counted the $80 billion in expenses but NOT the $207 billion in new revenues from IRS enforcement, so the net change in the deficit would be $160 billion in 10 years, or $16 billion a year. That's 1.6% of the US's budget deficit of 2019, before COVID and all of these relief packages were a thing. If anything, there will be a lot less government support in 2022 and 2023 than there is today, so this is a good way to redirect our priorities. The Biden Administration claims the CBO score means there is no addition to the deficit at all, because they say the amount of revenues that increased IRS enforcement would bring in is closer to $400 billion. But either way, Build Back Better doesn't do much to the country's budget deficit, and the out-of-pocket savings to people for items such as universal pre-K, limiting prices for insulin, improving Veterans homes, and allowing Medicare to cover hearing and vision would mean that a whole lot of Americans end up better off. That's before we even mention the added financial stability and investments into technologies that fight climate change, which reduces social costs and lays the groundwork to re-skilling workers for a 2020s economy (along with making the planet more inhabitable, which isn't a bad side benefit). This thing is far from done, and I'm pretty confident the Senate will change a few of these things. It might even hack out much of it and fold it into the 2022 Federal Budget (which has to be figured out in the next 2 weeks). But it's still a big step, and I would think quite a few of these popular items will make their way through and become a first step or re-balancing our rigged economy. And you know how I am certain this is a good thing that will change outcomes for the better for a lot of Americans? Because look at how hysterical the House GOP's "Leader" got as he lamely posed against Build Back Better last night.CBO estimates that the funding for tax enforcement activities provided by H.R. 5376, the Build Back Better Act, would increase outlays by $80 billion and revenues by $207 billion, thus decreasing the deficit by $127 billion, through 2031. https://t.co/GrbShPusVK

— U.S. CBO (@USCBO) November 18, 2021

Not sure those mediocre white men have the temperment to lead, you know. But hey, if Kevin is so concerned about debt, he can reduce the $768 billion we are slated to spend on the military next year.Yes. You ok? pic.twitter.com/UXGcBAZlpr

— MeidasTouch.com (@MeidasTouch) November 19, 2021

Thursday, November 18, 2021

Rural Wisconsin got the bigger boost from COVID aid in 2020

If you look at Wisconsin, you'll notice a lot of pale yellow, indicating smaller increases than most counties. But not all, and it's telling which Wisconsin counties had increases well beyond the state’s 5.1% increase in 2020 - rural places with relatively low per-capita incomes overall. Largest increases in per capita income, Wisconsin counties 2020See how personal income in your county measured up in 2020; read our latest blog: https://t.co/yfzVWv1vYb. pic.twitter.com/4p0lBk0H5U

— BEA News (@BEA_News) November 16, 2021

Lafayette +12.1%

Taylor +10.7%

Richland +9.8%

Pepin Co. +9.7%

Buffalo +9.2%

Grant Co. +8.9%

Jackson +8.7%

Kewaunee +8.6%

Clark Co. +8.6%

Langlade +8.5% That’s reflective of the stimulus and expanded unemployment payments that was the same amount no matter where you lived, and (mostly) regardless of how much income you made. These areas also were less likely to have densely populated areas and needs for shutdowns and spcae limitations like urban areas did. And I'm betting Trump's bailouts to farmers didn't hurt, either. Likewise, I noticed that the lowest increases in per-capita income generally happened in counties with still-high levels of income, or communities with large Native American or college student populations. Bottom 10 counties for per capita income growth, Wisconsin 2020

Florence -3.2% (still 8th in state for 2020 per capita income)

Ozaukee +2.2% (1st in state)

Sauk Co. +2.5% (13th in state)

Waukesha +2.8% (2nd in state)

St. Croix Co. +3.3% (6th in state)

Dane Co. +3.8% (4th in state)

Douglas +3.9% (62nd in state)

Winnebago +3.9% (33rd in state)

Pierce Co. +4.1% (50th in state)

Menominee +4.1% (72nd in state) You could argue that 2020’s shutdowns and increased remote work had a bigger effect here than in rural Wisconsin, but I’d take that trade-off for better public health, which largely has been the case in these counties (other than the COVID breakout happening in NW Wisconsin these days). It also illustrates that there was serious help for those most in need with 2020 relief packages, and I would imagine we see the same in 2021. Fortunately, wage growth has been strong at the lower ends of the wage scale, and richer people are more likely to be invested in the rising stock and housing markets. The biggest drag on consumer sentiment these days is coming from GOPperganda about “inflation” which reflects this jump in demand and COVID-induced tightness of supply (along with record corporate profits). But the government-driven part of our boost in income is fading away, and you gotta think the easy money policy of the Fed is going to be leveling out soon enough, which means there is a significant danger of people having the floor taken out from under them as 2022 goes along. Much of this has already happened, and if the refundable and expanded Child Tax Credit cannot be extended in the Build Back Better bill (shown in light blue in this chart), another key source of income will go away. It’s one of the best arguments for Build Back Better that there is, as we know the music will stop at some point on wage increases as demand-supply levels out for both supplies and labor for lower-wage service jobs. It's all the more important to have supports and options for services be available as those economic re-adjustments come up, so it isn’t as easy for employers and insurers to take advantage of Americans, and gives aid to the elderly and other vulnerable populations that haven’t been able to get those wage increases in 2021. And it also makes it all the more absurd that it's largely rural states and counties that are "represented" by Republicans who are trying to pull out all the stops to prevent further stimulus help. Know why? BECAUSE IT WORKS AND PEOPLE LIKE IT, and that can't happen under a Democratic president in GOPWorld.

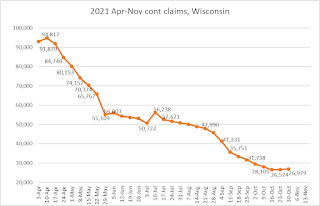

Stunner in Wis jobs report - unemployment not 3.9%. It's 3.2%

The Department of Workforce Development (DWD) today released the U.S. Bureau of Labor Statistics (BLS) preliminary employment estimates for the month of October 2021. The data shows that Wisconsin's total non-farm jobs decreased by 1,000 in October 2021 when compared to September 2021 while Wisconsin's private-sector jobs increased by 2,000 in the month of October. Wisconsin's unemployment rate in October was 3.2 percent, down 0.2 percentage points from September's revised rate of 3.4 percent.Meh, not a big – WAIT A SECOND! 3.2% unemployment? September at 3.4%? I thought it was 3.9%?? What’s going on?

September's unemployment rate was revised downward significantly – this was due to a data distortion that was discovered by the BLS retrospectively in a neighboring state's data. The distortion affected data from all states in our region, including Wisconsin's. It is important to note that the drop in the unemployment rate was not due to any economic event; it was a series adjustment. Data from September 2021 through December 2021 should not be compared to data from January 2021 through August 2021. Data from January through August will be revised during the benchmarking process that occurs in [the following] January and February each year. The BLS website has additional information on the event.I guess I’ll check that BLS website then! Let’s see what they say.

Since the onset of the coronavirus pandemic, BLS has been examining the inputs to the employment and unemployment models for outliers and implementing level shifts in real time, where appropriate, based on statistical evaluation of movements in the inputs. These level shifts help to preserve movements in the published estimates that the models otherwise would have discounted. The implementation of a level shift due to an outlier identified in the Current Population Survey input to the Detroit-Warren-Dearborn, MI Metropolitan Statistical Area unemployment model for January 2021 produced some distortions in the pro-rata benchmarking factors across the modeled areas within the East North Central census division that have increased over subsequent months. The modeled areas within the East North Central census division include the states of Illinois, Indiana, Michigan, Ohio, and Wisconsin, as well as the Chicago-Naperville-Arlington Heights, IL Metropolitan Division and the balance of Illinois, the Detroit-Warren-Dearborn, MI Metropolitan Statistical Area and the balance of Michigan, and the Cleveland-Elyria, OH Metropolitan Statistical Area and the balance of Ohio….. Both seasonally-adjusted and not-seasonally-adjusted unemployment data for modeled areas were impacted. Data for non-modeled substate areas are controlled, or forced to sum, to the not-seasonally-adjusted totals for their respective model-based areas. Hence, distortions across the modeled areas within the East North Central census division attributable to the January level shift were transmitted proportionally to the non-modeled substate areas through unemployment additivity adjustment up through the September preliminary estimates. By extension, the modification to the outlier intervention effective the October production cycle reduced distortions for the September revised and October preliminary estimates for non-modeled substate areas in proportion to the mitigation for their respective model-based areas’ not-seasonally-adjusted unemployment estimates. Similar to the plan for model-based areas noted above, distortions to data for non-modeled substate areas for prior months in the year will be addressed during the upcoming annual revision cycle, with the 2021 revisions for non-modeled substate areas expected to be issued by BLS in mid-April of 2022.Well then! In Wisconsin's case, these adjustments both raised the number of people estimated to be working, and slightly lowered the amount of people in the work force. Revisions vs prior data Sept 2021, Wisconsin

Labor Force: -4,200

Employed: +11,900

Unemployed: -16,100

Unemployment rate: 3.4% vs 3.9% original (-0.5%) Well that changes the assessment of where we’re at, doesn’t it? No wonder why employers couldn’t find anyone to fill jobs this Summer – we were already at surplus employment. It also matches up with the significant decline in unemployment claims that has happened with since Spring. These revisions also show what a bunch of crap that WisGOP talking point was about how higher unemployment benefits were keeping people from searching for work. Especially since the labor force in Wisconsin declined in October – after the expanded benefits expired. It doesn’t look like the data revisions had as much of an effect on the payrolls side, which kind of makes sense since birth-death rate and other demo data isn’t that much of a factor when you’re asking businesses how many jobs they have. Revisions vs prior data Sept 2021, Wisconsin

Total jobs: +1,400

Private jobs: +500 And if we’re at 3.2% unemployment, there’s a real question as to how much more growth of jobs that we can get, especially as Winter hits and COVID goes back up in our state. So what we need to be doing is putting in supports for both wages and services to give workers options and lessen the chances that businesses backslide on what they offer workers. Because you know they’ll try to if given the chance. This shocking revision to 3.2% unemployment should be a front-page headline throughout the state, and sure seems to be a lot more important than 6.2% inflation these days. And maybe we should pound that reality into the heads of those in corporate media.

We are objectively in a historic jobs boom and yet everyone thinks the economy is bad because that's what the TV people have decided and keep saying. Does no one see how crazy that is? How much it challenges decades of conventional wisdom?

— Will Stancil (@whstancil) November 18, 2021

Wednesday, November 17, 2021

In defense of raising the SALT Cap - just be smart about it.

The Tax Policy Center recently released an analysis of who would benefit the most from the plans on Build Back Better regarding the SALT Cap, and says ends up being quite regressive.No SALT, no deal! I am confident it will be part of the final deal.

— Tom Suozzi (@RepTomSuozzi) October 28, 2021

The plan TPC analyzed would boost the annual cap on the SALT deduction to $80,000 from 2021 through 2030 and restore the $10,000 cap for 2031. But because the cap would expire completely after 2025 under current law, very high-income households that pay large amounts of state and local tax would pay more in taxes with a $80,000 cap after 2025 than they would if the SALT cap completely disappeared. Despite what its promoters say, raising the cap to $80,000 would provide almost no benefit for middle-income households. It would reduce their 2021 taxes by an average of only $20. Even those making between $175,00 and $250,000 would get a tax cut of just over $400 or about 0.2 percent of after-tax income. By contrast, the higher SALT cap would boost after-tax incomes by 1.2 percent for those making between about $370,000 and $870,000 (the 95th to 99th percentile).That analysis has the SALT Cap going from $10,000 to $80,000, which is quite a difference and is even above the $72,500 that I've seen listed in the bill. Combine the higher SALT Cap of $80K with the other tax changes in the bill (including a continuance of the $3,600/year Child Tax Credit and higher taxes on incomes past $10 million, the Tax policy Center says most Americans would pay lower taxes under Build Back Better in 2022, but the middle and upper-middle classes would pay a bit more in 2023 as the larger Child Tax credit and EITC expansions are slated to end. But Build Back Better doesn't have to be that regressive due to the SALT Cap - or even being regressive at all. If the Cap is $72,500 or $80,000, then yeah, rich people will get a huge write-off and most of the benefit. But there are a lot of other ways to clean that up and not have it give away so much to those who don't need the help. It's worth noting that the SALT Cap is the same no matter if the filers are single people, or a married couple filing together. That penalizes dual-income married couples, unlike provisions that double up exemptions for married joint filers. One simple change would be to double the exemption for married hoint filers, to avoid that marriage penalty on two-earner families. The SALT Cap has also never been changed off of that $10,000 cap, despite 4 years of inflation. That's also unusual for tax provisions, most of which are indexed to price increases. By comparison, the standard exemption (which many former deducters are pushed into taking due to the SALT Cap) has been allowed to rise due to inflation, going from $12,000 single/$24,000 joint in the first year of the Tax Scam to $12,550 single/$25,100 joint when we file taxes this Winter, and $12,950/$25,900 in the year after that. If you only raise the SALT Cap to say, $15,000 for single filers and $30,000 for married joint filers, that limits how much the rich can write off, while still giving a benefit for a lot of two-earner married couples that own houses. Then the SALT Cap should be indexed for future years, to make sure no one loses their exemptions because of inflationary increases. There is also a question as to whether raising the SALT Cap gives you more bang for the buck than other types of tax credits and adjustments, Alyssa Flowers and Simon Ducroquet in the Washington Post gave their own SALT Cap analysis this week, and noted that the ending of Child Tax Credits in 2023 along with a very high SALT Cap could make for another disparity that benefits the rich more than working families.

The rich are poised to gain more from the SALT cap increase than lower-income people are from other elements of the bill, such as the child tax credit. According to the CRFB, a household in D.C. making $1 million a year would benefit 10 times as much from the SALT cap as a middle-class household would from extending the increased child tax credit for one year, which would provide an extra $1,600 for children under 6 and an extra $1,000 for older children. "We're debating about whether to give lower- and middle-class families a thousand dollars more a year through the child tax credit, while giving upper-class families $10,000 or more through SALT," said Marc Goldwein, senior policy director at the CRFB. "That's counter to everything the Democrats have been saying Build Back Better is about and everything they said about the Trump tax cuts."And that can definitely seem like a mixed message, except the SALT Cap was something that Dems railed against with the Trump tax cuts from the first time filers started getting screwed by it. In addition, most middle-class and upper-middle class parents would see benefits from both moves, if they have enough deductions to benefit from a higher SALT Cap. It would be even better for them if the Child Tax Credit was made permanent beyond 2022. So what needs to be figured out with the SALT Cap is that it needs to be high enough that it and other deductions like mortgage interest and charitable contributions don’t get surpassed by those figures, but low enough that it isn’t giving everything away to the rich. In the case of my wife and I, if we had a SALT Cap limit at $15K/$30K or even $10K/$20K, we wouldn’t hit either of those limits, but we would be able to write off (slightly) more than the standard deduction. But I'd argue the bigger benefit goes beyond the small amount of extra money we would have. It's having that tax write-off for our house and for our charitable contributions, and the change in incentives that results. That’s something Dems should emphasize. I think that’s a win-win, especially if you combine it with the surtax on $10 million and $25 million incomes, and use those funds to expand supports and services for those who are most in need of the assistance. We’ll find out soon enough just how the SALT Cap changes would affect how much money is available for Build Back Better, as the CBO says they will release their score of all of those provisions by the end of the week. There will have to be a lot of finessing in both the House and Senate to get this done, whether as a part of Build Back Better, or as a standalone in the 2022 Federal Budget, which also needs to be hashed out in the next 2 weeks. I think a modest raising and indexing of the SALT Cap would work out, and would target a specific type of traditional GOP voter that has been trending Dem in the 21st Century (upper-middle class homeowners). So if Dems want to hold onto Congress in November 2022, I’d recommend they get the SALT Cap figured out at the end of 2021.

Cynical WisGOP CRT Fauxtrage at UW requires a fierce response.

It has been brought to my attention that under the guise of violence prevention, UW-Madison has allowed its University Health Services division to push their own political beliefs and agenda on its graduate students through a mandatory “Graduate and Professional Students Preventing and Responding to Sexual and Relationship Violence” course. Students are not only required to take this course and pass with a 100% score in order to enroll in classes but they are also required to agree that whiteness means privilege. The course states that Critical Race Theory and Critical Race Feminism can help students understand privilege better and “how a regime of white supremacy and its subordination of people of color have been created and maintained in America… not merely to understand the vexed bond between law and racial power but to change it” (Crenshaw, et al. 1995, xiii). The course labels white/Caucasian, Christian, men, middle-or upper class, native English speakers, U.S. citizens, non-disabled, etc., as privileged groups in the United States. I am appalled by the blatant attempt by UW-Madison to force students to agree with one set of beliefs to attend the University as a graduate student. I would like an explanation as to why this course is mandatory for graduate and professional students to enroll in classes at UW-Madison. Why is this a graduate prerequisite? Are undergraduate students required to take a similar course? Why does the university find this an appropriate course to require students to take? Who developed this course? What was the impetus for this course and how was it developed? If students voice opposition to this mandatory course, what is the university’s response?I seem to remember a time when Republicans used to say "suck it up, buttercup" and not be so sensitive. All the way back in the late 2010s. This made me investigate further, and I found the link that explains what this “course” is - a benign webinar.

The program is designed to promote the health and safety of the campus community by increasing students’ understanding of: Dynamics of sexual assault, sexual harassment, dating and domestic violence, and stalkingMuch of this is typical new student orientation stuff, letting people know where to go if they’ve been victimized. It also could have the benefit of raising self-awareness for a few people, which might keep them from these types of abusive behaviors. And it certainly isn’t “forcing” students to buy into anything. If you can get in to a grad program at UW, but your world is somehow so sheltered that hearing new info and other perspectives makes you want to cry, then you’re probably not cut out for that level of schooling. Or any leadership that requires dealing with other members of the public in diverse, 2021 America. Sorry, bro. But Robbin’ and Rebecca aren’t talking to grad students at UW. They’re using this as another “divide and conquer” move to show the rubes they’re standing up to THOSE PEOPLE at “liberal” UW-Madison. They count on those rubes to have no clue what this training is or know what is actually being discussed. The rubes are just told it’s “CRT” (whatever that is) and makes white people like them feel bad. The reason GOPs and their AM radio spokespeople do this is to poison the atmosphere enough that whatever facts exist get ignored for how it feels to the average low-info listener. They also hope to create enough of a spectacle that legit media decides they have to follow up on this non-issue, and by the time the facts are discussed, the WisGOPs and AM 1130/1310/620 are onto the next topic of Fauxtrage. And on that level, the WisGOP cynicism has done its job, as Kelly Meyerhofer of the Wisconsin State Journal dutifully reported on this non-issue today.

Safe and effective prevention strategies they can use

. Available campus and community resources for confidential support

Victim rights and reporting options

In response to Vos/Kleefisch claims that a couple of slides in a 90-minute webinar reference white male privilege and connects prejudice to how people iuse their power to abuse others (true, by the way), the UW reps try to explain themselves instead of telling Vos and Kleefisch to shove it up their whiny asses.The mandatory training for graduate students is about sexual violence prevention but Assembly Speaker Robin Vos said it instills the idea that students should feel guilty because of their race. https://t.co/yERLf9GIrt

— Wisconsin State Journal (@WiStateJournal) November 17, 2021

University Health Services Violence Prevention developed the webinar in response to a 2016 survey conducted by the American Association of Universities, a national higher education organization of which UW-Madison is a member. The survey findings relevant to UW-Madison found that graduate students were not well informed about campus policies and resources for sexual misconduct. The [brief] reference to critical race theory has been included in the training since it went live in 2017, [UW-Madison spokesman John] Lucas said. "Offering a webinar like this is an important part of the university’s sexual violence prevention efforts," he said. "We will continue to review the webinar, as we do with all of our programs, and make any appropriate changes for Spring 2022."How UW-Madison officials and Dems should respond (NOW) is like this: “Why does the GOP not want to do anything about sexual assault on campus, and to take steps to reduce violence against women? And what in the world does this have to do with race or the fee-fees of white people?” (One other tip for Dems/UW - yes violence against transgender people is also part of this webinar. While needed, it gets into the weeds and isn’t worth bogging down the argument for everyday people). Drill these cynical bastards, do not let up, and MAKE THEM ANSWER THE QUESTION. After the initial heat is blown back on the WisGOPs, and they’ve stammered around with their non-answers, add in this reality. Grad-level and professional students are people whose future jobs often will require them to be experts that craft policy and strategies to combat social problems like sexual violence. So how are we going to attract talent to Wisconsin if those future leaders and workers aren’t seen as keeping up with the needs of a 21st Century society? See, WisGOPs don’t want us to compete and evolve to the needs of modern society, they just want to stay cocooned off in their own mediocrity. And if that makes Wisconsin less competitive, they are perfectly fine with it. So let’s play a little “divide and conquer” of our own, and show Dems to be the party that wants to move Wisconsin ahead in the 2020s. That should be a central attack on the GOPs any time they try to drum up these stupid cultural issues to distract low-info, low-experience voters.

Tuesday, November 16, 2021

Retail sales up big in October - well above the "scary" rate of inflation.

The solid report from the Commerce Department on Tuesday suggested high inflation was not yet dampening spending, even as worries about the rising cost of living sent consumer sentiment tumbling to a 10-year low in early November. Rising household wealth, thanks to a strong stock market and house prices, as well as massive savings and wage gains appear to be cushioning consumers against the highest annual inflation in three decades. "It's more important to look at what consumers do than what they say," said Gus Faucher, chief economist at PNC Financial in Pittsburgh, Pennsylvania. "They are concerned about higher inflation, but they are still in good shape and are continuing to spend." Retail sales jumped 1.7% last month, the largest gain since March, after rising 0.8% in September. It was the third straight monthly advance and topped economists' expectations for a 1.4% increase. Sales soared 16.3% year-on-year in October and are 21.4% above their pre-pandemic level.That 1.7% increase in retail sales for October is nearly double the 0.9% increase in inflation that all of DC asnd Wall Street media freaked out about last week, and a 16.3% increase in sales over the last 12 months is a whole lot more than the 6.2% increase in CPI over the last year. Those numbers indicate we have a booming economy with strong demand driven by wage gains and a waning of COVID (in some parts of the country, anyway). So how does President Biden get such negative marks on the economy, driven by "inflation concerns"?

One retail area in particular had lost a lot in recent months, but had a welcome bounce-back in October.I despair of screaming this into the void, but voters are not primarily responding to inflation, they are responding to a massive, highly coordinated propaganda campaign across multiple media designed to freak them out about inflation.

— David Roberts (@drvolts) November 16, 2021

Sales were led by motor vehicles, with receipts at auto dealerships advancing 1.8% after gaining 1.2% in September. The rise reflected the first increase in unit sales in six months, as well as higher prices. The tight supply of automobiles because of a global semiconductor shortage is driving up prices.Combined with a report of US auto production rising by 11%, down trends in the car sector on both the demand and supply sides have recently reversed. Even if you take out the strong auto sales and the inflation-driven rise in gasoline sales, retail sales were up 1.4% last month. Department stores, big box stores and Non-store retailers seemed to have a jump on that increased holiday spending, and there also was evidence of a switching back toward other sectors that benefitted the most from the change in spending habits that coincided with the first year of the pandemic. But one down spot for the month had spending at bars and restaurants continue to flatline after a tiny increase in September. Not sure if that is COVID overhang or if it is reflective of the high level of quits and resulting worker shortage in that area of the economy. That being said, there may be a bright side as the weak sales may be helpful in an odd way, as it buys time for that industry to catch up on hiring. But let's not let the softness in food/drink service spending take away from the fact that overall this was a great sales report that goes along with a massive increase in jobs for October. So if COVID doesn’t derail things for the Holidays, it’s starting to look like we’re headed for big growth to wrap up 2021 – well beyond the hyped-up levels of inflation.

Monday, November 15, 2021

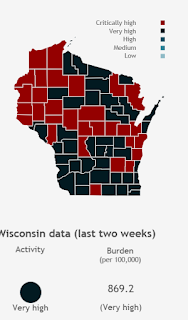

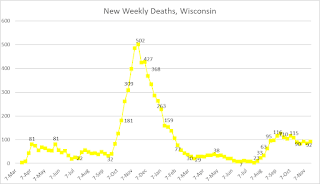

Wis COVID cases keep rising, and the unvaxxed should be called out for it

If anything, the disparities are even wider as those numbers suggest, because almost all deaths and hospitalizations among the vaccinated are with people age 65+, who are more likely to have significant health issues if they catch any kind of virus - COVID-19 or otherwise. Among ages 18-64, you are between 9 and 17 times more likely to be in the hospital with COVID, and there are virtually no deaths among vaccinated Wisconsinites under 65. Even among the elderly, the non-vaccinated are 13 times more likely to die of COVID than those who are vaccinated. Another disparity is where those cases are happening throughout the state, and take a small guess what that matches up to.Today's #COVID19_WI update includes illness after vaccination data. Remember, you are less likely to be infected, hospitalized, and die from #COVID19 if you are fully vaccinated.

— WIDeptHealthServices (@DHSWI) November 15, 2021

➡ See the data: https://t.co/fCpD0Wcr9q

➡ Find vaccine near you: https://t.co/se6dPR6VRp pic.twitter.com/bLnipcZTjC

Seems like maybe you should stay at the deer cabin and not go wandering into that Up North town too much over the coming days, eh? Getting shots to children between the ages of 5-11 is going to be a big factor as to whether we break this surge in the virus. Especially since for the first time ever in October, we saw the number of COVID cases among vaccine-eligible kids age 14-17 go lower than the number of cases in kids under those ages 9-13 (in yellow) and kids 4-8 (in orange). Us adults that aren’t COVID-iots also need to do our part and get ourselves boosted now that it’s been 6-8 months since we got our first group of shots done. My wife and some of my friends have already done so, I’m getting jabbed on Friday, and all of the cool kids are doing it – which allows us the chance to do the things we want to do in the places we want to be this Winter. We also need to directly be calling out the mental weaklings who have allowed the pandemic to continue through their own selfish refusal to listen to the science and the data because of…reasons. That isn’t Joe Biden’s fault, it’s the fault of misinformers like Ron Johnson and the Former President who actively covered up information on COVID last year in a desperate attempt to give the impression that things were fine. Those MAGAt lowlifes don’t care how much damage they cause to this state and this country by their self-absorbed actions, but we need to be making the spotlight shine brightly on them, and rightfully cast the blame where it belongs. This 3rd straight month of DHS data comparing vaxxed vs unvaxxed lays clear just how wrong and destructive it is to avoid vaccination, and any politician that still says the unvaxxed need to be “listened to and respected” are doing so for one reason and one reason only. SAY IT, DEMS!#Wisconsin in three maps. pic.twitter.com/zvSFEjqcrH

— Jay Bullock #TeamCav (@folkbum) November 14, 2021