Oh noes!

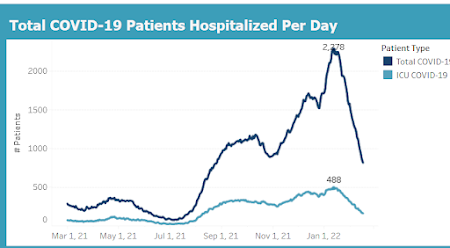

Inflation keeps rising! U.S. consumer prices rose solidly in January, leading to the biggest annual increase in inflation in 40 years, fueling financial markets speculation for a hefty 50 basis points interest rate hike from the Federal Reserve next month.

The broad increase in prices reported by the Labor Department on Thursday was led by soaring costs for rents, electricity and food, and could heap more political pressure on President Joe Biden, whose popularity has been declining amid anxiety over the rising cost of living.

The consumer price index gained 0.6% last month after a similar increase in December. Food prices rose 0.9%, with the cost of food consumed at home increasing 1.0%. There were strong increases in the prices of cereals and bakery products, dairy, fruits and vegetables. Meat prices rose moderately. Electricity prices jumped 4.2%, offsetting cheaper gasoline and natural gas.

In the 12 months through January, the CPI jumped 7.5%, the biggest year-on-year increase since February 1982.

1982? Great year!

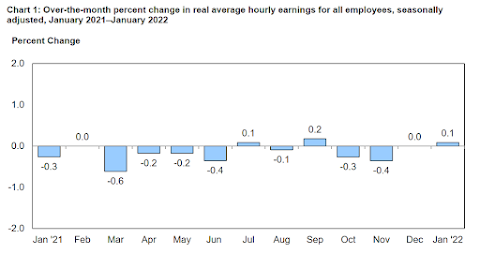

Well, 1982 isn't so great when you’re talking about the economy. But unemployment today is nearly 5% below the 8.9% that it was at back then. In addition to there being more people working, workers today have had their wages largely keep up with the rising prices in the last 7 months, after losing ground in the first half of 2021. We even

eked out a small gain for January in this stat.

Real average hourly earnings for all employees increased 0.1 percent from December to January, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. This result stems from an increase of 0.7 percent in average hourly earnings combined with an increase of 0.6 percent in the Consumer Price Index for All Urban Consumers (CPI-U)….

Still it’s not great when you widen the picture out to the last 12 months.

Real average hourly earnings decreased 1.7 percent, seasonally adjusted, from January 2021 to January 2022. The change in real average hourly earnings combined with a decrease of 1.4 percent in the average workweek resulted in a 3.1-percent decrease in real average weekly earnings over this period.

I know doing a lot of “on one hand…but on the other hand” with this report, and here’s another when it comes to looking at that 12-month drop in real wages. Don’t forget that there were large increases in average wages in the first year of the pandemic, while prices didn’t go up much at all. Even with the decline in real wages that has happened since the start of 2021, we are still well above the real wages that we had 2 years ago.

Now I don’t want to minimize that some people are likely worried as they see prices continue to rise, but when you combine that reality with child tax credits, stimulus checks and other COVID relief, I would bet that most Americans haven’t seen their real INCOMES fall over the last year. That’s a good thing.

When I dig into the data, I keep coming back to finding

corporate greed to be one of the main sources of this inflation. And

the recent Bureau of Labor Statistics report on productivity at the end of 2021 adds to that theory. The BLS says that businesses didn’t have to lay out that much more to make more products, because workers were working more efficiently by the end of the year.

Unit labor costs in the nonfarm business sector increased 0.3 percent in the fourth quarter of 2021, reflecting a 6.9-percent increase in hourly compensation and a 6.6-percent increase in productivity. Unit labor costs increased 3.1 percent over the last four quarters. (See chart 2 and table A1.) BLS calculates unit labor costs as the ratio of hourly compensation to labor productivity. Increases in hourly compensation tend to increase unit labor costs and increases in productivity tend to reduce them.

Labor productivity, or output per hour, is calculated by dividing an index of real output by an index of hours worked by all persons, including employees, proprietors, and unpaid family workers. In the fourth quarter of 2021, both output and hours worked increased for the sixth consecutive quarter following historic declines in those measures in the second quarter of 2020. The fourth-quarter 2021 output index is 4.1 percent above the level seen in the fourth quarter of 2019, the last quarter not affected by the COVID-19 pandemic, while the hours worked index remains 0.4 percent below its fourth quarter 2019 level….

Combine the big jump in prices, along with increases in productivity and relatively muted labor costs per unit, and you get big-time profit for business owners. And they know it.

In manufacturing, those unit costs went up by a little more than other jobs in 2021, but nowhere near the 7.5% increase in prices.

Unit labor costs in the total manufacturing sector increased 4.2 percent in the fourth quarter of 2021, reflecting a 3.4-percent increase in hourly compensation and a 0.8-percent decrease in productivity. Manufacturing unit labor costs increased 3.2 percent from the same quarter a year ago.

With manufacturing productivity rising by 1% vs Q4 2020, that would translate into decent wage growth in a time of higher prices in a normal economy.

But that’s not happening as much as it should. Manufacturing is one area that has lagged in wage growth over the last year, making inflation bite a bit harder on workers, while giving extra profit to employers to sell products at those higher prices.

Change in wages, manufacturing vs other private jobs

Increase in CPI, Jan 2021-Jan 2022 – 7.5%

Avg hourly wage, Manufacturing +5.2%

Avg hourly wage, Other private jobs +6.9%

Avg Weekly wage, Manufacturing +4.2%

Avg Weekly wage, Other private jobs +5.4%

You know, if people want to have a strike/convoy, maybe it should be because their company is getting rich off inflation while you can barely keep up. Just a thought.

The danger now is in reacting the wrong way to and these prices increases while we have a hot economy. As alluded to in that news report, Wall Street now fears that interest rates won’t just go up in March, but it’ll rise by half a point instead of ¼, which will bring their cocaine party to a quicker and harsher end.

To me, jacking the daylights out of interest rates like its 1979 and inducing 1982-style unemployment is the absolute wrong way to deal with our current economic situation. Instead, 2022 seems like the perfect time to rejigger our economy with a better safety net, strong regulation against profiteering, and encouragement of public competition for drug prices, child care and medical needs.

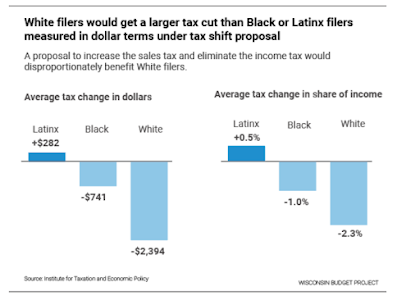

It also seems like a good time to return taxes on corporations and rich people to at least they levels they were at 5 years ago (i.e., before the GOP Tax Scam), to discourage the hoarding of gains and possibly heading off the damage caused by the bursting of asset Bubbles caused by speculation. Funny, all these ideas sound a lot like Build Back Better, don't they?

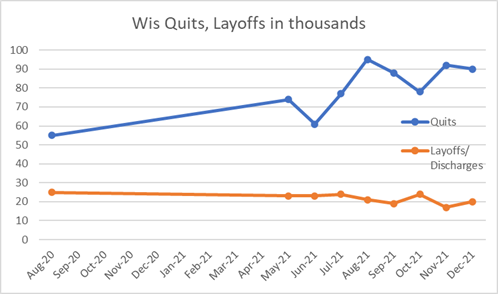

As 2021 ended and 2022 began, you could sense that working people recognized they don’t have to settle for the crumbs they got for much of the last 30-40 years. And they aren’t going to accept going back to hearing that businesses and governments can’t afford to help them achieve a high standard of living. Our current demand-and-profit-induced inflation should not be used as an excuse to screw them over.