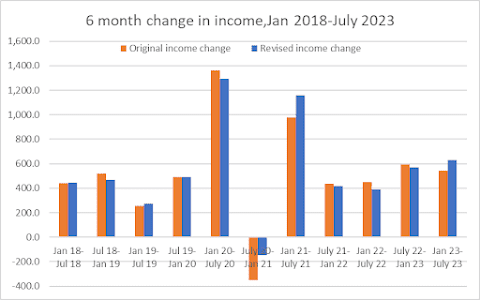

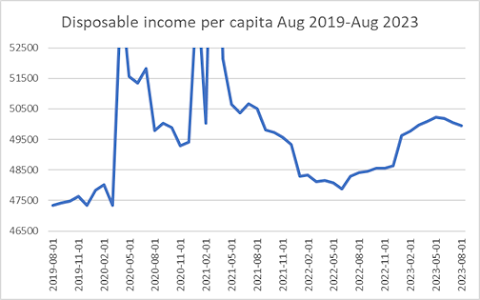

The other big number in the report that many look at is the PCE price index, which was also up 0.4%. But much of that was the rise in gasoline in August that was not repeated in September, and the "core" inflation number (outside of food and gasoline) was only up 0.1%. To be fair, consumer spending outside of gasoline was basically flat, so a bit of a warning of a slowdown, especially if it repeats in September. But more interesting to me was that the spending and income numbers were also updated for several years before, and corresponding with the updates in GDP that we saw early in the week. Those updated numbers show that even as inflation has waned in the last year, the amount of income growth has gone up, and 2023's growth is even better than originally reported. But that lack of income growth from mid-2021 to mid-2022, which happened as prices were rising by 8-9%, reduced the real income gains that happened from stimulus in 2020 and 2021, and the updated data has indicated that that stretch of inflation was likely more stressful to many than we would have thought. Those inflation-related losses have now reversed for much of 2023, showing steady growth with lower inflation. Consumption numbers were also updated, and not only did it reiterate the boom that happened in early 2021 (as the first round of COVID vaccinations came in, and the economy reopened in wider levels), that recovery was even faster than we knew. But we've also had more moderation in spending growth in 2022 and 2023. 2022 and 2023 also coincides with rapid interest rate hikes by the Federal Reserve, which were intended to....slow down the economy and price growth. But it also makes me ask why we'd risk turning the slowdown into recession by continuing to choke off the housing market and increasing the cost of credit. These updated numbers show the Fed was clearly late in moving interest rates off of the near-zero levels they were at for much of 2021 (in fairness, I probably was worried they and Congress were trying to choke off the recovery too soon). But they've also overshot at this point, and need to reduce the Fed Funds levels back to a balanced place, instead of the multi-decade highs that we are at today.August personal income (blue) +0.4% m/m vs. +0.4% est. & +0.2% in prior month … personal spending (orange) +0.4% vs. +0.5% est. & +0.9% in prior month pic.twitter.com/11R9piTowu

— Liz Ann Sonders (@LizAnnSonders) September 29, 2023

Ventings from a guy with an unhealthy interest in budgets, policy, the dismal science, life in the Upper Midwest, and brilliant beverages.

Saturday, September 30, 2023

Incomes, spending solid in US, and 2023's figures look better, with inflation ghost fading

Thursday, September 28, 2023

GDP looks solid. Savings are higher, but home sales are lower. So why keep rates high?

But while the 2nd quarter numbers didn't change much, and shouldn't change our evaluations of where things are, the bigger story to me is that the GDP report also included revisions to past years. And in particular, look at the positive revisions to income and savings.Headline Q2 GDP unrevised at +2.1% annualized. Some movement beneath the surface, though: Consumption revised down, investment revised up.

— Ben Casselman (@bencasselman) September 28, 2023

Gross domestic income revised up two tenths to +0.7%.https://t.co/5yloav17qb

Current-dollar personal income is now estimated to have increased $369.8 billion in the first quarter [of 2023], an upward revision of $91.9 billion from the previous estimate. The revision primarily reflected an upward revision to compensation (led by private wages and salaries). Disposable personal income increased $701.8 billion, or 15.5 percent, in the first quarter, an upward revision of $113.9 billion from the previous estimate. Real disposable personal income increased 10.8 percent, an upward revision of 2.3 percentage points. Personal saving was $948.2 billion in the first quarter, an upward revision in change of $132.9 billion. The personal saving rate—personal saving as a percentage of disposable personal income—was 4.8 percent in the first quarter, an upward revision of 0.5 percentage point.That means that real wage growth was better than we knew at the start of the year, and that American consumers were saving more in a time of higher interest rates. These are things that the Federal Reserve allegedly should welcome, as higher savings rates lessen the threat of inflation. At the same time, the 1st Quarter gross domestic purchases price index was revised down to 3.6% from the originally-reported 3.8%. And then Q2's inflation got lower than that. Yet the Fed looks at this, and continues to think they have to keep interest rates at a multi-decade high. And now we are starting to see that home-buying activity is getting frozen, as people don't want to take on higher interest rates to borrow for a house.

But jobless claims are back down to their lowest levels since February, and if the Fed actually cared about the Main Street economy, they'd realize that inflation isn't a threat now, the economy is in good balance, and they'd lower interest rates back into a balanced state as well. And start it sooner than later, before the high interest rates turn our leveling off of spending into a straight-up decline that translates into job losses.Pending home sales come in well below consensus expectations, declining 7.1% in August 2023, with all 4regions of the U.S. posting month-over-month and year-over-year declines in transactions. Pending Home Sales Index generally leads Existing-Home Sales by a month or two...(2/n) pic.twitter.com/SxYdA1XMAV

— Odeta Kushi (@odetakushi) September 28, 2023

Wednesday, September 27, 2023

Oil is back toward $100. And it's due to Wall Street, not Main Street

US oil prices topped $94 a barrel on Wednesday for the first time in over a year, threatening to push up prices at the pump and inflation across the economy. The latest gains came after federal data showed crude inventories fell by more than expected last week. Stockpiles at the closely watched Cushing, Oklahoma, storage hub plunged to nine-year lows. “There’s not a lot of oil there and that’s causing some nervousness,” said Tom Kloza, global head of energy analysis at Oil Price Information Service.But while gasoline availability is not exactly the same as oil availability, I'll note that gas in late September remains more plentiful in America than it's been in any year that wasn't smack dab in the middle of a pandemic. And Americans continue to moderate their gasoline consumption, using significant less gas than we were in the late 2010s. And if the shutdown lasts for a significant time, then it might slow the US economy (at least temporarily). So why would oil futures keep rising?

Analysts say bullish bets by hedge funds and other market speculators have helped fuel the latest rally. “They are gunning for $100 and at this rate they’ll get there. It has a self-fulfilling element to it,” said Robert Yawger, vice director of energy futures at Mizuho Securities. “The sky is the limit.”There it is. All speculation and BS. Very frustrating, especially if this causes prices as the pump to jump past $4 in these parts in the next month. It's not based on structural realities, just a cynical hope.

Monday, September 25, 2023

WisGOPs want to stop taxing retirement income.....for rich people

Exclusion for Retirement Income. Beginning in tax year 2023, AB 386 would exclude the first $100,000 of retirement income currently subject to state tax received by each individual who is at least 67 years of age before the close of the taxable year. For married-joint filers where each spouse has attained age 67, the maximum exclusion would equal $150,000. For married-separate filers who have attained age 67, the exclusion claimed by each spouse could not exceed $75,000. [For comparison, the estimated average state-taxable retirement income under current law for individuals with retirement income in tax year 2023 is $37,530 for married-joint filers and $22,140 for all other filers.] The bill would prohibit a taxpayer who claims this exclusion from claiming any state income tax credits provided under current law in the same tax year... Retirement income, for purposes of the exclusion, would be defined as payments or distributions received each year by an individual from a qualified retirement plan under the Internal Revenue Code under 26 USC 408 [such as distributions from a pension, 401(k), or 403(b)] or from an IRA established under specified provisions of federal law, which are generally subject to RMDs. The proposed exclusion would not apply to any retirement income which is already exempt under any of the aforementioned provisions of current state law (to prevent an exclusion from being claimed twice on the same income). Distributions from qualified after-tax retirement plans for which tax had already been paid (such as a Roth IRA, Roth 401(k), or Roth 403(b) plan) would not receive an additional tax benefit under the bill.So we're talking about the richest retirees getting this tax break, especially when you remember what type of "reitree income" is already exempt from Wisconsin income taxes.

Under current law, the following retirement income categories are excluded from Wisconsin AGI: (a) Social Security benefits; (b) payments from the U.S. military employee retirement system and U.S. government retirement payments received by members of the U.S. Coast Guard, the Commissioned Corps of the National Oceanic and Atmospheric Administration, and the Commissioned Corps of the Public Health Service; (c) income from certain public retirement systems if the individual was a member of, or retired from, that system prior to 1964; and (d) up to $5,000 of retirement income for taxpayers aged 65 or over with federal AGI of less than $15,000 per filer or less than $30,000 for married-joint filers. Together, these provisions are estimated to reduce individual income tax revenues by nearly $950 million in tax year 2024 under current law (the exclusion for Social Security benefits accounts for an estimated $900 million [95%] of this total).In addition to the regressive nature, I had not heard about that provision which says that taking this tax break for "retirement income" would make elderly taxpayers ineligible for other tax credits. Take a look at the list that the LFB included with their analysis. Itemized deduction credit that gives you 5% back for things such as charitable donations and mortgage interest? Property tax credits? Homestead Credit? Property tax credits for veterans and surviving spouses? Is that worth writing off some IRA distributions for, or your investment income? Only if you make a lot of money. This is why I'd like to see the upper limit of this retiree tax break reduced to $25,000 single/$50,000 for married-joint filers. And I bet it would reduce the price tag by quite a bit. I'd also like to see older Wisconsinites be able to use property and Homestead tax credits that are key for homeowners (and particularly elderly homeowners). I'd also disassociate it from the reduction in income tax rates that is part of this bill, and separate both out. Perhaps that would help in getting some kind of compromise between the Legislature and Governor Evers, instead of blowing the entire surplus in 2 years. But I have a feeling that the WisGOPs are less interested in passing anything into law, and more into playing poser games that sound good to low-info voters.

Catching up from a weekend in the North.. of Indiana

Grabbed the lead! #NOvsGB | #GoPackGo pic.twitter.com/YxUp1wbEQT

— Green Bay Packers (@packers) September 24, 2023

First win at Lambeau! @CJW_21 | #GoPackGo pic.twitter.com/YyQ51rMxBi

— Green Bay Packers (@packers) September 24, 2023

That was a pleasant surprise, wasn’t it? And not a bad way to end a sports-centric weekend that made for a good break from what is often an infuriating larger world. Top it off with getting surprisingly good grub from City BBQ (complete with a $5-off coupon for a birthday I had 3 weeks ago!), and I can’t complain whatsoever. Now it’s time to get back to normal in a more normal work week….Well, at least until the Brewers can win 1 more game and clinch the division. Would have been nice if that happened this weekend, but I guess I couldn’t get it all. That’s OK, I got plenty of good things from those 3 days, and I hope you did too."That is the most resilient performance I've ever seen in my life."

— Green Bay Packers (@packers) September 24, 2023

Down 17-0 & still got it done 💪#NOvsGB | #GoPackGo pic.twitter.com/q95gfzKn0U

Wednesday, September 20, 2023

Powell and other Fed bankers plan to keep interest rates high, no matter what reality is telling them

Key Takeaways:

— Bloomberg (@business) September 20, 2023

- Fed leaves rates unchanged, signals one more hike this year

- Powell says central bank to "proceed carefully" on rate path

- Upgraded growth forecast bolsters soft-landing view

- Two-year Treasury yields flat after initial surge https://t.co/Joksixy0SY

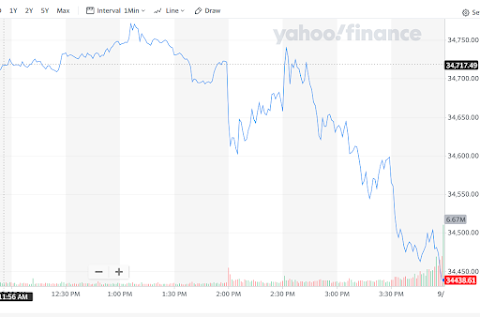

But while the Fed thinks the real economy will be in better shape, you also should notice that they project interest rates to stay at these elevated levels for the rest of 2023, at a 1/2 point higher for 2024 and 2025 than they projected back in June. Guess what that did to stocks, especially after Fed Chair Jerome Powell's press conference around 2:30 Eastern reiterated the "higher for longer" outlook on interest rates? Still trying to crush an inflation ghost that has long since been diminished. And why President Biden doesn't pressure Powell the way Donald Trump did when the Fed Funds rate wasn't even 1/2 as high as it is now is beyond me.What a big jump in the Fed's economic growth (GDP) forecasts:

— Heather Long (@byHeatherLong) September 20, 2023

2023: 2.1% (versus 1% forecast in June)

2024: 1.5% (versus 1.1% forecast in June)

**The Fed is starting to believe in a 'soft landing'**

Unemployment and core inflation both lowered for 2023 as well. pic.twitter.com/7c1i8F32iW

Tuesday, September 19, 2023

As Fed meets, does higher gas prices in August mean INFLATION WATCH is back?

— Liz Ann Sonders (@LizAnnSonders) September 13, 2023Uh oh! Largest one-month inflation in over a year? That's not good. But that second graph explains why - a jump in gasoline prices which has not continued in September. And according to AAA, prices have even dropped in Wisconsin vs where we were a month ago. But the oil markets are sending a signal that prices may head back up in the near future.

Oil prices rose to 10-month highs on Tuesday before easing, as investors took profits following three sessions of gains that followed extended production cuts from Saudi Arabia and Russia. Global benchmark Brent crude futures settled 9 cents lower at $94.34 a barrel. Earlier, it hit a session peak of $95.96 a barrel, their highest since November..... Feeding supply concerns, OPEC+ members Saudi Arabia and Russia this month extended combined supply cuts of 1.3 million barrels per day (bpd) to the end of the year.However, the

Monday, September 18, 2023

WisGOP releases Brewers stadium plan. And it needs a lot of work

This was followed by Assembly Speaker Robbin’ Vos and two other WisGOPs having a dog-and-pony show at AmFam Field today.Republican legislative leaders will be rolling out their plan for funding renovations at American Family Field.

— A.J. Bayatpour (@AJBayatpour) September 18, 2023

Sources tell me it includes $600 million in public funding: $400M from the state, $135M from Milwaukee Co. and $67M from the city of Milwaukeehttps://t.co/0kQEYou6Wa

This has since been updated with additional details, reactions, etc...https://t.co/gh6B75VFGA

— TomDaykin (@TomDaykin) September 18, 2023

The Republican plan calls for the state to spend around $411 million through 2046. After an initial $60.8 million payment to the stadium district those annual payments would be capped at $20 million, according to the legislation. Another $50 million would be available through short-term loans by the state to the stadium district through 2045. Most of the state money would come from income taxes on Brewers' employees, including players, and on visiting team players. Those payments would go directly to the stadium district, said Sen. Dan Feyen, R-Fond du Lac, a legislation co-author.How is the money from MLB-related employees going to go “directly to the stadium district”? Is there some kind of segregated fund that is going to be set up by the Wisconsin Department of Revenue (likely without any funding for the extra government work that’ll be required to do so)? Or is this just some estimate of “jock [income] taxes” that’ll be paid in to the state, with a set amount sent back out. Much like we do with the income taxes generated by the Bucks and NBA players? Relying on “jock taxes” from highly-paid Brewers and visiting players is also quite the irony, given what Republicans in the Legislature have voted for earlier this year. An official with the Koch-funded Americans for Prosperity group in Wisconsin took note.

Nice little two-step there, guys. Wonder if they’ll be asked about it. Despite an earlier resolution from the Milwaukee County Board saying they would not pay local tax dollars toward future stadium repairs, the WisGOP plan has that happening anyway.Here’s what bugs me - the idea that income taxes will cover things. Well does that mean we are done trying to flatten or zero out the income tax? Because otherwise this deal falls apart. https://t.co/nGsrAwfKpF

— Matt Henkel (@mhenks05) September 18, 2023

Milwaukee County and City of Milwaukee would together pay $7.5 million annually, totaling around $200 million. "They have the most to benefit by having professional baseball in their community," Feyen said. Meanwhile, the state sales revenue generated by the Brewers benefits all Wisconsin communities, he said.That part of the package led to immediate pushback from the other side 0f the aisle. Dem Assembly Leader Greta Neubauer and Dem Assembly Number 2 Kalan Haywood released a statement saying that they were willing to help on a Brewers stadium deal. But they had a concern over how much Milwaukee would have to pay.

“Throughout negotiations, Democrats have been optimistic about reaching a deal that keeps the Brewers in Wisconsin. However, the Republican proposal released today falls short of recognizing the regional benefit of American Family Field and places too great of a financial burden on the city and county of Milwaukee.Senate Dem Leader Melissa Agard sounded a similar tone – we want to help, but don’t lay so much on Milwaukee. And Milwaukee writer Dan Shafer notes that the GOP package connects back to the shared revenue deal from earlier this year, and how the City and County are now basically expected to kick back some of their new sales tax funds to the Brewers Stadium.

You could translate that as another way that the gerrymandered GOP Legislature is trying to micromanage Milwaukee’s finances (I sure do). And Milwaukee community board member Jordan Morales brought up that the Brewers’ own studies show that a majority of attendees come from outside of Milwaukee County.Since it will now include local contributions from Milwaukee (both City and County), it's going to be impossible to divorce the Brewers stadium funding proposal from the shared revenue and local sales tax deal from earlier this year.

— Dan Shafer (@DanRShafer) September 18, 2023

Which begs the question as to why none of the suburban counties would be chipping in tax dollars for future repairs to the ballpark, like they did when then-Miller Park was built. Oh wait, I know why. Because WisGOPs from the 262 cling to this outdated notion that they can get all off the benefits of big cities without having to pay in. To me, there's an obvious solution to the “local contribution” question. Just set up a “Beer District” east and south of the ballpark, and include a ticket tax for events. Yet Brewers’ officials are saying that they are not in favor of having the state give up the land that they own around AmFam Field.62% of Brewers game attendees don’t live in Milwaukee County. The surrounding counties need to contribute! https://t.co/Mf8bgWSEp9

— Jordan Morales (@Morales4MKE) September 17, 2023

I beg to disagree, Rick. I don’t think there would be many Brewers fans losing their chance to tailgate if we got rid of the back half of the Yount and Uecker lots. And I think the ball club would get by just fine without those last thousands in parking revenue. Besides, how many renters get to keep all of the parking revenue from their facility anyway (like the Crew does today)? Milwaukee’s mayor went on the record today saying that he’d like to see a stadium deal allow for more privately-owned land and buildings around the ballpark – not unlike what we saw with the Bucks’ Deer District. And that maybe Milwaukee should continue to have a say about what happens with the ballpark that's located in their community.NEW: Brewers President of Business Operations Rick Schlesinger says stadium funding plan does not include any conversion of parking lot space into new real estate developments. Says the team is protective of its tailgating culture

— A.J. Bayatpour (@AJBayatpour) September 18, 2023

The @MayorOfMKE wants to see the Beer District. He's also not a fan of taxation without representation. https://t.co/45RoACDON4

— Jeramey Jannene (@compujeramey) September 18, 2023

“I’m happy there is a bipartisan push for the Brewers to stay here,” said Mayor Cavalier Johnson in an interview. “Do I have issue with the local contribution? Yeah, I do. And not just with the local contribution, but with the makeup of the board itself.” He also took issue with the lack of development for the “sea of parking” that surrounds American Family Field..... The current proposal calls for a new nine-member board to be established, with four appointees for the governor, two for the senate leader, two for the assembly speaker and one from the Brewers. “That’s taxation without representation,” said Johnson. The current board has 13 members: six appointees made by the governor, one by the mayor, two by the county executive and one appointee by each of the four suburban counties that levied the initial stadium tax.Yeah, I'm with Chevy on that one. It's absurd to make Milwaukee governments pay in and then get no say in what happens to that money. I do think it is worthwhile for tax dollars to go toward the Brewers staying and keeping the ballpark up to standard (and I am aware some of you disagree with funding sports arenas on general principle). And our visit to AmFam Field for Saturday night's Brewer game illustrates why. My wife and I had a great afternoon in MKE before then, including a stop at Black Husky Brewing in Riverwest. I doubt we head into Milwaukee if the Brewers weren’t playing that evening, and we certainly do not visit the 414 nearly as much in MLB’s offseason. But I also think there are plenty of opportunities to improve this deal for both Milwaukee and everyone else in Wisconsin. And while I have enjoyed going to Brewers games for 43 of my 49 years on Earth, it’s also not a “pay any price, bear any burden” situation. So let’s set up the Beer District with new development, put in a ticket tax and/or a special district tax to capture some more of the money that out-of-towners pay when they go to Brewers games, and let’s keep the Crew here for another generation. Now please excuse me on this topic, as the biggest thing I care about with the team right now is seeing a repeat of this picture, hopefully in the next 7-10 days. Then give me some more time to watch the team in October. After the postseason run happens, then we can do more serious talk about the Brewers situation off the field. OK?

Saturday, September 16, 2023

Wisconsin jobs and unemployment up in August

Place of Residence Data: Wisconsin's unemployment rate was 2.9% in August. The number of unemployed people increased 8,400 over the month and decreased 5,400 over the year to 89,500. The labor force gained 8,800 workers over the month for a total labor force of 3,133,500. The number of Wisconsinites employed increased 300 in August for a total of 3,044,000 employed. • Place of Work Data: Total nonfarm jobs increased 5,700 in August to a new high of 3,012,400, an annual increase of 32,800. Private sector jobs increased by 6,600 over the month and 34,300 over the year. Healthcare and social assistance jobs grew 2,600 over the month and 12,900 over the yearNice spin on that "number of unemployed" number. What's not mentioned is that the state's unemployment rate went up, from 2.6% to 2.9%, because very few of the new entrants to the state's work force were able to find jobs last month. That resulted in a sizable increase of Wisconsinites identifying as "unemployed", reversing the downward trend that we had for the first few months of 2023. But we are still in a strong position for the state's job market overall. And on the payrolls side of the report, we hit another all-time high for jobs. It continued a steady rise in state payrolls that we've seen for pretty much the entire Biden Presidency. And as the release mentions, health care led the way in job growth, much as it has done for the country as a whole. It is the largest growth sector over the last year in Wisconsin (+12,900 jobs), and accounts for almost 40% of Wisconsin's overall job growth over that time period. But construction also had a leap of 2,000 (seasonally adjusted) jobs in August, and more than 11,000 construction jobs added since the Biden stimulus bill was signed in March 2021. But much like the rest of the country, manufacturing jobs are falling behind. Wisconsin lost jobs in that sector again in August, and has less people working in that part of the economy now than we did this time last year. So keep an eye on that one, especially as the Fed continues to keep interest rates (excessively) high. Yes, the higher unemployment rate in Wisconsin is worth keeping track of, to see if that continues and/or accelerates for the rest of 2023. But with job growth remaining steady and unemployment still being under 3%, I think we're still in a very good place, and we should try to continue it as much as we can.

Tuesday, September 12, 2023

GOP admits defeat on impeachment scheme. Tries new desperate scheme to avoid fair maps

(Quick, let's play that classic WisGOP game of "FIND THE FEMALE!" Look in the 2nd row.) How do we know this is a panic move after major voter blowback?Assembly Speaker Robin Vos holds news conference to announce “Iowa style nonpartisan redistricting” process which will be on the floor for a vote Thursday and take effect for 2024 election cycle pic.twitter.com/O8MaaxQPwp

— Matt Smith (@mattsmith_news) September 12, 2023

So what is an "Iowa style non-partisan redistricting process", which would require the state's Legislative Reference Bureau to draw maps in 2024, and then send it down to the Legislature? Well, let's go into the bill draft and see how the Legislative Reference Bureau describes it.According to the drafting file, the bill was drafted TODAY.

— Representative Robyn Vining (@RepRobynVining) September 12, 2023

(After a 3:30am spike in google traffic on the “Iowa Model”.) https://t.co/fmH6Eu5rbF pic.twitter.com/lgGHgGnXx7

Iowa law and LRB-4349 set deadlines for key events in the redistricting process. LRB-4349 starts the redistricting process later in the year and sets out a longer timeline. In the event that the legislature fails to pass the initial map proposal, Iowa law requires LSA to produce up to two more proposals; in contrast, LRB-4349 does the same. The Iowa legislature’s feedback must, to the extent allowed by Iowa’s statutes and the Constitution, be incorporated into the second or third map proposal. If a map proposal is vetoed by the governor, the governor’s feedback must be incorporated into the second or third map proposal. LRB-4349 has similar requirements for incorporating the legislature and governor’s feedback between map proposals.... In Iowa, the legislature is permitted to make “corrective” amendments to the first and second map proposals, but can amend the third map proposal in the same manner as it amends other legislation. Under LRB-4349, the Wisconsin legislature can also make corrective amendments to the first and second map proposals and amend the third map proposal in the same manner as it amends other legislation. In Iowa, if no map proposal is enacted by September 15, the Iowa Constitution (Art. III, § 35) directs the Iowa Supreme Court to adopt, or cause to be adopted, a redistricting plan for legislative districts. LRB-4349 does not specify a deadline by which a map proposal must be adopted. In addition, the Wisconsin Constitution does not require the Wisconsin Supreme Court to adopt, or cause to be adopted, a redistricting plan.Oh? The Wisconsin Supreme Court has no role in this? Can't imagine why not! And sure enough, Vos gave away the real reason this bill was brought up in his hastily-arranged press conference.

The move is aimed at bypassing lawsuits before the state Supreme Court that seek to rewrite the current GOP-favorable maps that were adopted in 2021. "Hopefully it means that we will take all of the money that has been wasted by the liberal interests suing us over the maps and instead we get to say we don't need to waste those taxpayer dollars because we can adapt the process that has been used flawless wirelessly in Iowa," Vos said Tuesday.Pathetic and sooo whiny. And by the way Robbin', an "Iowa-style" redistricting law has obvious flaws. Especially if one party is already in control due to past gerrymandering.

Naturally, the gerrymandered WisGOP Legislature would turn down the Reference Bureau's fairer maps until they get to redraw them again, and nothing changes. Does WisGOP really think anyone can't see what the real motivation is with this? Think we're fuckin' stupid, Vos? Tony Evers isn't stupid, and immediately called out WisGOP's desperate garbage.Remember: Iowa-style redistricting means that the state legislature gets the ability to veto the maps created by the independent commission. In other words, it would still allow Wisconsin Republicans the ability to veto new maps https://t.co/EF1VkdieX5

— Blake Allen (@Blake_Allen13) September 12, 2023

If the WisGOPs even try to get this through on Thursday (with no public hearing and no committee action. Always a sign of good legislation), every Dem in the Assembly should say nothing except "YOU LOST. People see through your bullshit, and if you had an ounce of pride, you'd shut up and listen to them." The WisGOPs are on the run, and it's no time to let up. Crushing these pathetic, scheming WisGOPs into dust and throwing Robbin' Vos, Scott Walker, and all of these other lowlifes into the state's trash bin is the only way this state can advance into the 2020s. Which means full speed ahead on the lawsuit, and fair maps for the 2024 elections is the only solution that is acceptable.Republicans, who've been ramping up their efforts to interfere in Wisconsin elections, are now demanding Legislature-picked and Legislature-approved map drawers for legislative districts. That's bogus.

— Governor Tony Evers (@GovEvers) September 12, 2023

Read my full statement ⬇️https://t.co/AVCRosMsvQ pic.twitter.com/kttVVS1QJ7

Monday, September 11, 2023

Hey, I got ESPN back on my cable! But the changes are still coming.

The blackout fight between cable giant Charter Communications and Disney is over. Hours ahead of “Monday Night Football,” which airs on Disney’s ESPN, the companies reached a deal that would allow millions of Charter cable customers to watch the game. Terms of the deal are said to include a discounted wholesale price for subscribers for Disney streaming services, and an increase in marketplace, or subscriber fees, paid to Disney, CNBC’s David Faber reported, citing sources.But how did we get in this dispute in the first place, and what does it mean for both cable companies and cable channels in an environment where we consume TV in a much different way than we did a decade ago? That's where I want to direct you to a summary by Ben Thompson at Stratechery, in an article called "The Rise and Fall of ESPN’s Leverage". UW-Madison graduate Thompson wites most of his items about the tech economy (well, when he's not writing about the Bucks), and he notes that in its early years, ESPN couldn't get enough advertising dollars from its programs to make ends meet. So it developed a model where much of its revenue came from charging cable companies to carry their channel. Thompson quotes the 2011 book Those Guys Have All the Fun, which went deep on the history of ESPN, and how the Worldwide Leader operated in the studio, as well as the boardroom. An early ESPN exec described the setup as follows:

This was, like, ’83; at that time we had boxing one night and skiing, tennis, and a whole bunch of other stuff on the schedule. We were talking one day about the fact that there was a lot of college basketball becoming available. I said, “You know, we could get basketball six nights a week. Our weekly ratings in prime would really go up.” But Roger [Werner] said, “That’s true, we could probably get a better rating. But they’re only numbers. We’re now in the business of subscriber fees. So what we want is as diverse programming as possible. Even if a program like skiing or auto racing gets a lower rating, there are people who will never watch a basketball game. So we should now think a little bit differently.” This was totally contrary to what I had grown up with in the business — rating, rating, rating. Get the highest ratings we can get. But Roger was right. We didn’t want all our ratings from one thing, because it’s only those hundred people who watch the skiing event that’ll yell like hell if the cable operators ever do decide to drop ESPN. His belief that sacrificing a little bit of ratings to have greater variety was going to create more rabid fans of ESPN was absolutely right. Werner was right: ESPN could raise its affiliate fees, and cable operators that tried to drop them in protest were overrun with complaints, quickly adding the channel back. By 1986 ESPN was charging around 27 cents per subscriber, and then they signed a deal with the NFL, adding a 9 cent surcharge to their fees; cable operators could choose to not show the game (and avoid the surcharge), but within weeks nearly every cable operator realized their customers would not tolerate not having access to the NFL.And this system built upon itself for more than 30 years, making ESPN a network that could command major dollars from cable companies. Because cable TV as a product to sell to consumers wouldn't have a lot of value without having channels like ESPN in the lineup. Then when ESPN started getting the rights to broadcast major professional spors on its airwaves, it grabbed more eyeballs, which it used to justify higher asking from cable companies.

….ESPN paid $153 million over three years for those NFL rights; the first broadcast reached 45 million homes, earning the network an incremental $4.05 million/month, just about enough to cover the NFL rights. What was more important is that the NFL attracted new subscribers which paid ESPN’s full fees, which amounted to over $12 million a month. Moreover, ESPN also got rights from the NFL for unlimited access to highlights: that fueled studio shows like NFL Primetime and SportsCenter that cost very little to produce, yet both attracted large audiences (for advertising), and made the NFL and other sports even more popular. The flywheel was fully engaged.And that worked for decades, but as streaming and Internet-based TV viewing has become more common in recent years, the cable broadcasting-centric way of doing business has broken down. And it's the "watch TV via cable" part that has especialy diminished, making TV services a loser for cable companies.

Of course for a long time it was very profitable to carry both [cable channels and Internet], along with voice: cable companies offered “triple play” bundles that included TV, Internet, and telephony. Over time the telephony part dropped off, as people used mobile phones exclusively; cable carriers have since moved into the mobile carrier space as well, fueled by profits from TV and broadband Internet. What made the Internet part the most valuable, though, is that the cable companies didn’t need to pay for content: everything was just a packet. That, though, was also the problem: some of those packets reformed themselves as Netflix video streams, which ate into time spent watching TV. Worse, Netflix’s stock was rising and rising as it acquired ever more customers, much to the chagrin of Hollywood, which felt entitled to those multiples given they were the ones producing the most compelling content. That resulted in the fateful decision to start their own streaming services, impoverishing the TV bundle…Right after ESPN went dark on their stations, Charter gave a presentation to its investors, and Thompson pointed out a part where the cable company indicated it might look to disconnect from some cable channels, including a final panel noting that "the video product is no longer a key driver of financial performance." Now that people are cutting the cord and getting their broadcast content directly from providers like Hulu or YouTube TV, it lessens the ability for cable companies to charge those higher fees from ESPN and other channels onto consumers. Thompson's article also included another slide from Charter's presentation which describes this downward spiral, especially when it comes to sports programming. Now that people can use what Charter describes as SVOD (streaming services), it's a lot easier to get the channels you want without having to get a cable package, and sports channels are no longer a “need-to-have” for cable companies. So now it becomes a question of whether cable companies like Spectrum are able to negotiate better prices with stations like ESPN, or whether Spectrum still needs channels like ESPN to keep having customers subscribe to their TV packages, and will pay up. Or if both go lose-lose, ESPN stays off of Charter, and we go into an entirely new paradigm. Thompson mentions that the current situation may lead to a new type of "bundle", where streamers might use cable companies as their means of access. And it makes sense, because you need the Internet to get the streamers, so why not have an upgraded Internet speed that allows you to maximize Netflix, Hulu, and sports apps? Which comes back to today's agreement. I was surprised Disney was able to get more money from Charter….until I looked at the press release describing the agreement. In addition to the ability to order Disney-owned streaming channels through a Charter cable package, I note that Charter is now set up to be a place you can get bundles of other streaming services through.

Charter will also use its significant distribution capabilities to offer Disney’s direct-to-consumer services to all its customers – in particular its large broadband-only customer base – for purchase at retail rates. These include Disney+, Hulu and ESPN+, as well as The Disney Bundle.And in what seems to be a significant concession by the Mouse, Spectrum is going to be allowed to drop quite a few channels from its lineup.

Effective immediately, Spectrum TV will provide its customers widespread access to a more curated lineup of 19 networks from The Walt Disney Company. Spectrum will continue to carry the ABC Owned Television Stations, Disney Channel, FX and the Nat Geo Channel, in addition to the full suite of ESPN networks. Networks that will no longer be included in Spectrum TV video packages are Baby TV, Disney Junior, Disney XD, Freeform, FXM, FXX, Nat Geo Wild and Nat Geo Mundo.Love the “more curated” euphemism. Ah, Corporate-speak. You figured this was where it was heading, right? Where streaming would be absorbed into cable in some fashion, and that the companies that controlled the streaming outlets would get more money for doing so, while also shunting off some of the sales/accounting duties onto the cable company (since consumers would pay the cable company and not the streaming). Now let's see if cable companies actually become the place where we start to buy our streaming services. And to see if this adds competition and possibly lower prices for these services, or if it cuts off competition, and raises prices for everybody. But despite getting ESPN back on our cable box, it's likely not the last time we will see a dispute like the Charter/Disney one, and a lot of us are going to have to prepare to roll with whatever new formats and availability of service may exist.

Saturday, September 9, 2023

WisGOP tax cut might not "bankrupt" us. But Gov is right that it's too much, and needs more work.

Evers made those comments after the Legislative Fiscal Bureau released their analysis of the GOP's tax plan. So let's take a look at it, and the numbers their report had in it. To start, the LFB estimates the GOP's tax cut would reduce over $3 billion from the state's projected $4 billion surplus over the next 2 years. That would open a hole in revenues for this year that is a little less than the one that would have occured with the original GOP tax cut plan during budget deliberations this Spring. And interestingly, LFB says that the budget hole for Fiscal Year 2025 would be even larger than what was projected with the GOP's first tax cut scheme. Not sure why that is, unless the LFB anticipates that retirees will take extra advantage in 2024 and 2025 from the new tax cut's plan to write off all income for older, richer Wisconsinites. And not surprisingly, that lack of revenue gets rid of most of the $4 billion cushion the state currently has, as spending outpaces the lower amount of revenues. But where Evers gives his concerns about "bankruptcy" comes from the LFB's analysis of what happens in the next state budget for 2025-27.I'll veto it. Plain and simple.

— Governor Tony Evers (@GovEvers) September 6, 2023

I’m not going to sign an irresponsible Republican tax cut that jeopardizes our state’s financial stability well into the future and the investments we need to be making today to address the real, pressing challenges facing our state.

....[F]or 2025-26, the general fund would have an estimated imbalance of -$651 million after meeting commitments under Act 19 and AB 386. In 2026-27, an imbalance of -$1,612 million would occur, resulting in a cumulative balance of -$2,263 million. It is important to note that the amounts shown...represent commitments under Act 19 and AB 386. No assumptions are made regarding revenue modifications in 2025-27 due to such unknowns as future law changes or economic factors. Likewise, no assumptions are made to appropriations regarding changes in caseloads, population estimates, enrollments, employee compensation, or inflation.Given that revenues could grow and/or there could continue to be help from DC to fund some items, I wouldn't quite call this structural deficit "a path to bankruptcy" for the state. But it would likely cause budget cuts to be imposed on people who can least afford the lack of support, and doing that in order to give a significant tax cut to people making 6 figures in this state doesn't seem like a winning strategy to me. But as I've mentioned before, there is room for a solution and compromise here. The GOP has come up with some innovation with the tax cut for seniors, but given that we already exempt Social Security benefits from state income taxes, we can lower the amount of additional income to be written off to something like $50,000/$75,000 instead of the $100K/$150K. Likewise, we could go along with the part of the GOP's tax cut of the 5.3% income tax bracket to the 4.4% bracket, but we don't need it to include Wisconsinites that make $300K to $400K. Cut that in half as well, or even limit it to real middle-class/upper middle-class Wisconsin families that make $125,000 or less. Which is in line with what Evers wanted to do in his original budget proposal back in February. Sure, it would make for a bit of imbalance for the future. But it would give tax relief to the people that need it, while stil allowing for a cushion that doesn't leave the state in an unfavorable fiscal situation if the economy flatlines and/or declines some time in the next 2 years. That would be a logical move for both sides. But given that today Wisconsin GOP is more willing to play games than actually try to get anything done to help everyday Wisconsinites, I'm not counting on much getting modified when the gerrymandered Legislature takes up these tax cut bills next week. And they'll probably force Evers to choose "all of nothing", and we end up with "nothing". Till we start it all over in 2024...maybe.

Wednesday, September 6, 2023

If WisGOPs try an illegal impeachment, Dems plan to nuke them. And the Justices should ignore them

If the Assembly were to vote to impeach, Protasiewicz could not perform the duties of her office without being acquitted by the Senate. If she were removed from office Democratic Gov. Tony Evers would appoint a successor to fill the remainder of her 10-year-term.But if the Senate does nothing (and avoids putting their members under the spotlight ahead of an election year), then Protasiewicz’s status and the liberal majority would theoretically be in limbo unless she resigned her seat. In the meantime, that stalling maneuver would increase the chances of the GOP’s gerrymander staying in place for the 2024 elections instead of fair maps that would make the Republicans have to work harder to stay in power. So you can see why some hack GOPs would do such a thing. Which is why it was heartening to see that Wisconsin Dems are preparing to go after any Republican legislators that are even thinking of going along with this garbage.

I’ll explain what’s going on shortly. But first, know this: the GOP hasn’t acted yet. Most of the public has no idea what the Republican legislature is plotting. So we’re launching a DEFEND JUSTICE campaign to fight back. Get involved & spread the word: https://t.co/2R8q6ErjDv

— Ben Wikler (@benwikler) September 6, 2023

The Democratic Party of Wisconsin and a coalition of unnamed "allied groups" plan to spend at least $4 million on an effort to dissuade Republican lawmakers from initiating impeachment proceedings against the state Supreme Court's newest justice, former Milwaukee County Judge Janet Protasiewicz. The possibility of a legislative attempt to remove her from office looms over Protasiewicz as she assumes her duties on the court one month after being sworn in and flipping its ideological majority from politically conservative to politically liberal. Democratic Party of Wisconsin Chairman Ben Wikler told reporters during a Tuesday night briefing that the party and other "democracy defending" groups will launch an "intensive, multi-pronged statewide campaign" on Wednesday "to make clear to Wisconsin Republicans that an attempt to impeach Janet Protasiewicz would be an absolute political, moral and constitutional disaster."Put me in for a quarter on this one, Ben. That’s part of the response that the VosGOP BS requires, but there are other parts that should happen as well. First of all, a decision by the state’s Judicial Commission may well make any WisGOP impeachment effort ILLEGAL.

A state judiciary disciplinary panel has rejected several complaints lodged against Wisconsin Supreme Court Justice Janet Protasiewicz that alleged she violated the judicial code of ethics for comments she made during the campaign. It's a setback to Republicans who argued those remarks could warrant impeachment. Protasiewicz on Tuesday released a letter from the Wisconsin Judicial Commission informing her that “several complaints” regarding comments she had made during the campaign had been dismissed without action…. The commission did not give a reason for why it dismissed the complaints, but [Commission Executive Director Jeremiah] Van Hecke said that it had reviewed her comments, the judicial code of ethics, state Supreme Court rules, and relevant decisions by the state and U.S. supreme courts. In one of the cases cited, a federal court in Wisconsin ruled there is a distinction between a candidate stating personal views during a campaign and making a pledge, promise or commitment to ruling in a certain way.Now let’s go to the part of the state constitution that deals with impeachment. It includes the explanation of how Protasiewicz could be sidelined if the Assembly would vote for impeachment.

The court for the trial of impeachments shall be composed of the senate. The assembly shall have the power of impeaching all civil officers of this state for corrupt conduct in office, or for crimes and misdemeanors; but a majority of all the members elected shall concur in an impeachment. On the trial of an impeachment against the governor, the lieutenant governor shall not act as a member of the court. No judicial officer shall exercise…office, after hav[ing] been impeached, until…acquittal. (gendered language removed) Before the trial of an impeachment the members of the court shall take an oath or affirmation truly and impartially to try the impeachment according to evidence; and no person shall be convicted without the concurrence of two-thirds of the members present. Judgment in cases of impeachment shall not extend further than to removal from office, or removal from office and disqualification to hold any office of honor, profit or trust under the state; but the party impeached shall be liable to indictment, trial and punishment according to law.But note that the Assembly is only allowed to impeach for “corrupt conduct in office, or for crimes and misdemeanors.” What has Protasiewicz done in the one month she has been on the Supreme Court that would qualify under this? SHE HASN’T EVEN HEARD A CASE! The Judicial Commission’s OK of Janet’s conduct in the campaign pre-empts any charge AssGOPs can give on that one. So unless and until Protasiewicz agrees to hear and decides on a case in a manner where the Assembly can claim she displayed “corrupt conduct”, there is nothing to impeach for. “But Jake, you know Vos and most of those Republicans will just make up a reason.” , Oh, I get that, but the Judicial Commission decision also clears the way for an immediate lawsuit/injunction against any impeachment attempt, since there is no basis to do so under the law. To go further, if the majority four liberal justices agree that the Assembly’s reasoning is BS and that the impeachment is illegitimate, who’s going to stop them from proceeding with business as usual, and hearing and deciding cases?

Just stay on the job. Sure, Wee Wobbin’ Vos and Bigoted Becky Bradley and soon-to-be-ex-Chief Justice Annette Ziegler will stamp their feet and screech, but what can they do about it? NOTHING. Especially if Governor Evers and AG Josh Kaul shrug and say “we’re not getting involved in this.” Which is what they should do, because after all, they might have business before the Wisconsin Supreme Court, and getting involved would prejudice future cases. You understand, don’t you Robbin’? Wait, there is one way Evers should get involved. And it’s by making a simple declaration: “If Republicans are still considering an impeachment of Justice Protasiewicz before the redistricting case is heard and ruled upon, I will veto all significant bills this Legislature may pass. No tax cuts. No Brewers stadium deal. No extra assistance for the 2024 RNC in Milwaukee. NOTHING.” Do you really think the GOP’s paymasters want that outcome going into what portends to be a rough 2024 for the party? Hey WisGOP, if you want to hit the self-destruct button as a relevant force in state politics, to try to forestall the inevitable overturning of your gerrymandered maps, that’s your call. No matter that you’re still favored under a fair map, if you want to try impeachment, and waste everyone’s time on a fruitless and illegal effort, please proceed. If you even try it, then Ben Wikler, the Wisconsin Dems, and nationwide donors will nuke all of your members to the point that you will glow for the next 14 months. And don’t kid yourselves, as long as you allow Napoleon Vos (and the money he controls) to run things for your caucus all of you are guilty, and none should be spared. Justice Protasiewicz and WisDems should realize that WisGOPs count on Dems to try to follow rules to the letter of the law, while GOPs bend those rules every which way to give themselves an advantage. Instead, WisDems and the majority on the Supreme Court should use the power the voters gave them, and don't play the GOP’s sucker’s game. Because while Robbin' Vos can control some people and a lot of dirty donation dollars, he and the rest of the WisGOP Legislature have no real authority to DO anything.

Monday, September 4, 2023

After a step back in 2022, Labor Day 2023 offers good news in Wisconsin and America for workers

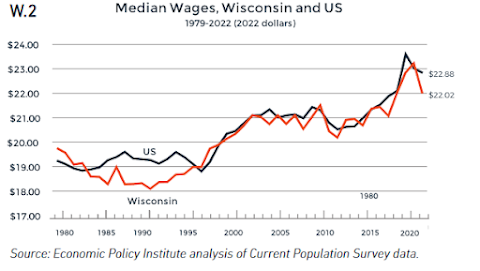

[In Wisconsin], over 2018-2021, wages grew significantly. Wages grew strongly especially across 2020-2021 thanks to sustained job growth and low unemployment. In 2022, inflation spiked and workers faced rapidly rising prices on everything from groceries to housing. Wages rose at the median but not enough to keep up with prices. Both nationally and in Wisconsin, the value of the 2022 median fell below the 2021 level. In terms of purchasing power, Wisconsin’s median wages fell back to 2019 level. The 2022 median wage in Wisconsin was $22.02 per hour, slightly below the national median of $22.88. In a remarkable reversal of patterns of wage growth since 2000, lower wage workers have secured greater wage increases than higher wage workers. Unlike higher wage workers, low wage workers more often secured wage increases that kept them ahead of inflation in 2022. For this reason, Wisconsin’s considerable racial, ethnic, and educational gaps in wages have continued to recede slightly over 2019-2022. Though wage inequalities remain substantial, low unemployment rates appear to have allowed lower wage workers to improve their pay.And here are some of the numbers COWS uses to show how the state's large disparities in wages have shrunken in the COVID-era and post-COVID Wisconsin. Interestingly, the only group not to have wages keep up with inflation since 2019 is white men - even though white guys still make the most money out of any group in the state.

This past year has seen workers at the bottom increase their wages, and this is reflected in the stronger wage growth of Wisconsin’s Black and brown workers, who disproportionately work in low-wage jobs. Workers have taken advantage of the tight labor market to demand more from their jobs. The floor under wages in the state has come up, and this reduces wage disparity.In 2023, the rate of inflation has gone down, but the rate of wage increases hasn't dropped as much, which means we are seeing a restoration of real wage gains. And it means that the median worker is better off than he/she was before COVID was a thing, with a couple of years of stimulus payments added in on top of this.

This year, we are also continuing to see this pattern of higher wage increases for lower-wage and line-level workers. Take a look at the last US jobs report, where the wage growth for non-supervisory and production employees continues to outpace the overall increase in average hourly wages over the last year. These numbers are not adjusted to change in CPI over this time. Change in average hourly wages, Aug 2022 - Aug 2023Senator, as you requested I compiled the following chart to help add some context to your claim. https://t.co/nGeIaOGZ6G pic.twitter.com/hVDLi1PwuZ

— Justin Wolfers (@JustinWolfers) September 1, 2023

All private sector jobs +4.29%

All non-Supervisory/prod. workers +4.50% And goods-producing workers are seeing especially strong wage growth. Services less so, although many of those sectors are still outpacing inflation and overall wage growth Change in avg hourly wage, Non-Supervisory/Production Workers, Aug 2022 - Aug 2023

Manufacturing +5.72%

Construction +5.68%

Utilities +5.65%

Prof/Business Services 5.20%

Leisure/Hospitality +4.72%

Wholesale trade +4.69%

Private Education/Health Services +2.90% Even that last number that shows smaller wage increases in private education/health services masks good news, because over 1 million more jobs have been added in that part of the jobs market over those 12 months, so this likely reflects newer, lower-wage workers joining that work force over wages being suppressed for those that were alread working. The health care sector has especially boomed since the end of 2021. This makes for a rare celebratory situation for this Labor Day, with strong wage growth to go along with a low unemployment rate of 3.8%. And it helps to drive strong consumer spending, as we saw in July. So I ask again, why does the Fed and other Wall Streeters not want this to continue, and why are they especially trying to crush manufacturing and construction with high interest rates that are well above the rate of inflation?