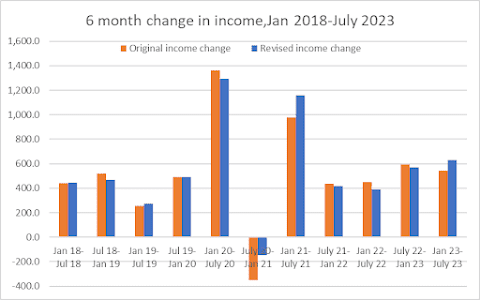

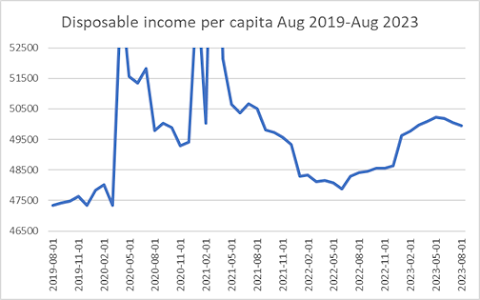

The other big number in the report that many look at is the PCE price index, which was also up 0.4%. But much of that was the rise in gasoline in August that was not repeated in September, and the "core" inflation number (outside of food and gasoline) was only up 0.1%. To be fair, consumer spending outside of gasoline was basically flat, so a bit of a warning of a slowdown, especially if it repeats in September. But more interesting to me was that the spending and income numbers were also updated for several years before, and corresponding with the updates in GDP that we saw early in the week. Those updated numbers show that even as inflation has waned in the last year, the amount of income growth has gone up, and 2023's growth is even better than originally reported. But that lack of income growth from mid-2021 to mid-2022, which happened as prices were rising by 8-9%, reduced the real income gains that happened from stimulus in 2020 and 2021, and the updated data has indicated that that stretch of inflation was likely more stressful to many than we would have thought. Those inflation-related losses have now reversed for much of 2023, showing steady growth with lower inflation. Consumption numbers were also updated, and not only did it reiterate the boom that happened in early 2021 (as the first round of COVID vaccinations came in, and the economy reopened in wider levels), that recovery was even faster than we knew. But we've also had more moderation in spending growth in 2022 and 2023. 2022 and 2023 also coincides with rapid interest rate hikes by the Federal Reserve, which were intended to....slow down the economy and price growth. But it also makes me ask why we'd risk turning the slowdown into recession by continuing to choke off the housing market and increasing the cost of credit. These updated numbers show the Fed was clearly late in moving interest rates off of the near-zero levels they were at for much of 2021 (in fairness, I probably was worried they and Congress were trying to choke off the recovery too soon). But they've also overshot at this point, and need to reduce the Fed Funds levels back to a balanced place, instead of the multi-decade highs that we are at today.August personal income (blue) +0.4% m/m vs. +0.4% est. & +0.2% in prior month … personal spending (orange) +0.4% vs. +0.5% est. & +0.9% in prior month pic.twitter.com/11R9piTowu

— Liz Ann Sonders (@LizAnnSonders) September 29, 2023

Ventings from a guy with an unhealthy interest in budgets, policy, the dismal science, life in the Upper Midwest, and brilliant beverages.

Saturday, September 30, 2023

Incomes, spending solid in US, and 2023's figures look better, with inflation ghost fading

On Friday, we got the always-important information on income and spending for August. And the numbers seemed OK in the US on that front.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment