Even though COVID-19 started to flare back up in July, it didn’t seem to have much of an effect on the month’s income and spending report, as we saw today.

U.S. consumers saw an increase in personal income and spending in July of 1.1% and 0.3%, respectively, the Commerce Department said today. This comes in spite of looming economic uncertainty coupled with pandemic-related reluctance.

Dig into the actual report, and you can see it was a combination of COVID relief measures, along with a strong overall economy that had gained 2.5 million jobs in the previous 3 months.

The increase in personal income in July primarily reflected increases in government social benefits and compensation of employees (table 3). Within government social benefits, an increase in "other" social benefits (more than accounted for by advance Child Tax Credit payments as authorized by the American Rescue Plan) was partly offset by a decrease in unemployment insurance, reflecting a decrease in payments from the Pandemic Unemployment Compensation program. Within compensation, the increase was primarily in private wages and salaries, reflecting Bureau of Labor Statistics Current Employment Statistics.

The wages and salaries part was especially strong, going up by $98.5 billion (annual basis), the biggest one-month increase in 2021. Combined with the continued decline in unemployment payments (both due to fewer recipients and because of some red states opting out of certain programs and expanded benefits), and income has finally increased more from jobs than from unemployment since COVID first broke out.

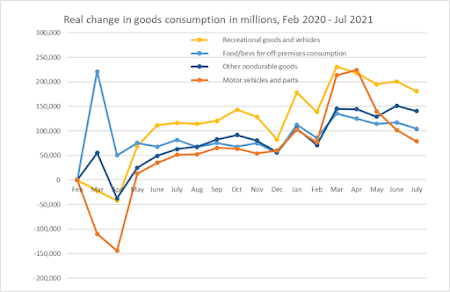

On the spending side, we continue to see the shifts back toward services and away from goods in 2021, as part of a reversion to pre-COVID spending habits.

The $42.2 billion increase in current dollar PCE in July reflected an increase of $102.6 billion in spending for services and a decrease of $60.4 billion in spending for goods (table 3). Within services, increases were widespread across all spending categories, led by food services and accommodations. Within goods, decreases were widespread across most spending categories, led by motor vehicles and parts, recreational goods and vehicles, as well as clothing and footwear. These decreases were partly offset by an increase in gasoline and other energy goods.

Add in the 2021 shift away from goods with shutdowns and supply constraints at auto makers, and that sector has taken a serious dive since April after blowing up in the two months after February.

But food services and accomodations continued its recovery from COVID-inflicted damage, and is now basically back to its pre-COVID levels of February 2020. Spending in travel and recreation services also continued to come back

Given that so many people were laid off in these industries in the first half of 2020, and that many others are seeing extra hazards to being in these industries in the COVID era as not being worth the low wages many of these jobs had, and you can see why there are still issues with finding enough workers to meet this recovering demand.

With COVID spiking back up in August, it’ll be interesting to see if spending shifts again – or if there is little to no shift at all. Lot of crossroads for this economy at the moment, and with the earlier Biden stimulus measures wearing off, it seems like it's time for government to be supportive of bpoth public health and the disruptions that continue to happen as Fall 2021 looms.

No comments:

Post a Comment