After last week's report,

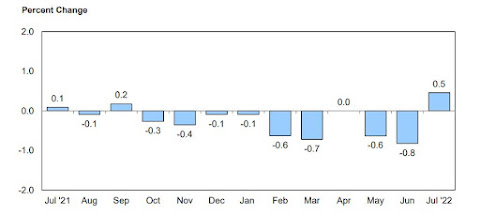

is INFLATION WATCH on hold for a while? U.S. consumer prices were unchanged in July due to a sharp drop in the cost of gasoline, delivering the first notable sign of relief for weary Americans who have watched inflation climb over the past two years.

The Consumer Price Index (CPI) was flat last month after advancing 1.3% in June, the Labor Department said on Wednesday in a closely watched report that nevertheless showed underlying inflation pressures remain elevated as the Federal Reserve mulls whether to embrace another super-sized interest rate hike in September.

"No increase in overall price levels" is great to hear, but it was heavily driven by gas prices going down by 7.6% in July. The big concern I have with the consumer inflation numbers is that while gasoline declined, food prices continued to rise.

And in reading

the full CPI report, the Bureau of Labor Statistics says that's especially true for groceries, which are seeing double-digit price increases vs last year.

The food index increased 1.1 percent in July; this was the seventh consecutive monthly increase of 0.9 percent or more. The food at home index rose 1.3 percent in July as all six major grocery store food group indexes increased. The index for nonalcoholic beverages rose the most, increasing 2.3 percent as the index for coffee rose 3.5 percent. The index for other food at home rose 1.8 percent, as did the index for cereals and bakery products. The index for dairy and related products increased 1.7 percent over the month. The index for meats, poultry, fish, and eggs rose 0.5 percent in July after declining in June. The index for fruits and vegetables also increased 0.5 percent over the month.

The food away from home index rose 0.7 percent in July after rising 0.9 percent in June. The index for limited service meals increased 0.8 percent and the index for full service meals increased 0.6 percent over the month.

The food at home index rose 13.1 percent over the last 12 months, the largest 12-month increase since the period ending March 1979. The index for other food at home rose 15.8 percent and the index for cereals and bakery products increased 15.0 percent over the year. The remaining major grocery store food groups posted increases ranging from 9.3 percent (fruits and vegetables) to 14.9 percent (dairy and related products).

Which is why the topline foods stats in

the Producer Price Index report was concerning, in that July’s numbers at the final demand stage rose.

The index for final demand goods fell 1.8 percent in July, the largest decline since moving down 2.7 percent in April 2020. The July decrease can be traced to a 9.0-percent drop in prices for final demand energy. Conversely, the indexes for final demand foods and for final demand goods less foods and energy rose 1.0 percent and 0.2 percent, respectively

But that same report also indicated that foods and other products had prices

decrease further "up the line."

The index for processed goods for intermediate demand fell 2.3 percent in July, the largest decline since moving down 3.4 percent in April 2020. Most of the broad-based decrease in July can be traced to a 9.0-percent drop in prices for processed energy goods. The indexes for processed materials less foods and energy and for processed foods and feeds also moved lower, 0.2 percent and 0.1 percent, respectively….

Prices for unprocessed goods for intermediate demand fell 12.4 percent, the largest decline since moving down 14.4 percent in April 2020. Most of the broad-based decrease in July is attributable to a 21.2-percent drop in the index for unprocessed energy goods. Prices for unprocessed nonfood materials less energy and for unprocessed foodstuffs and feedstuffs also declined, 6.9 percent and 0.8 percent, respectively. For the 12 months ended in July, the index for unprocessed goods for intermediate demand increased 27.5 percent.

With that in mind, you would hope that top-line PPI and CPI for foods would also start tracking lower soon. It also appears that

the futures markets are planning on food prices to level off and/or decline. Not only has there been selling in the current month contracts, but traders are also expecting prices to come down in future months.

I also want to add that while overall prices went flat in July, average hourly wages continued to rise. Which resulted in the first real increase in average hourly wages since last September.

We’ve seen nominal wage growth be consistently strong over the last 2 years, and it outpaced the increase in prices for the last half of 2020 and the start of 2021. The inflation got moving, and price growth has jumped well past the average wage increase, so that there was a big gap to start making up for this Summer (on a macro level, at least).

But US job growth continued in July, so labor demand is keeping up and likely will contunue wage growth going for the near future. If that can be passed ahead as part of prices, then that might keep inflationary pressures on (although I’d argue that wage/job based inflation is the “good type” vs an increased cost of supplies). If not, then this gap could start to narrow quickly.

Republicans may be rooting for recession, but I would think most reasonable Americans would rather have our current, brightening economic situation over that. And I dare other GOPs to

take Ron Johnson’s cue and put Medicare and Social Security benefits on the chopping block, as a way to solve the “problem” of everyday Americans having more jobs, more money and raising their overall demand for products.

Yes, the high inflation of later 2021 and the first half of 2022 still lingers, and it is something that still is giving strain to quite a bit of Americans. We can’t ignore that reality, but let’s also admit that strong job and nominal wage growth is much better than a recession where jobs are being lost and people can’t afford their bills because of a lack of income vs higher prices (which are easier to adjust spending habits to).

No comments:

Post a Comment