There was a national economic report that offered a major surprise in it. It's known as the

Business Employment Dynamics report, and it tracks a large number of private employers over time, seeing if they are adding employees, or if jobs are being lost. And the newly-released numbers from Q2 made me do a double-take.

From March 2022 to June 2022, gross job gains from opening and expanding private-sector establishments were 8.3 million, a decrease of 185,000 jobs from the previous quarter, the U.S. Bureau of Labor Statistics reported today. Over this period, gross job losses from closing and contracting private-sector establishments were 8.5 million, an increase of 1.6 million jobs from the previous quarter. The difference between the number of gross job gains and the number of gross job losses yielded a net employment loss of 287,000 jobs in the private sector during the second quarter of 2022.

Net employment loss of 287,000 private sector jobs?? That’s quite a difference between what monthly jobs reports from the BLS were saying. It listed seasonally-adjusted job

growth of more than 1 million jobs in those 3 months.

Both can't be true, so what do we got? And how does the "gold standard" Quarterly Census of Employment and Wages (QCEW) play in, which also has released their Q2 numbers? Fortunately, the Business Employment Dynamics report has a whole section that gives the universe of respondents for all 3 surveys, and it fills in some of the blanks.

Employment and wage data for workers covered by state UI and Unemployment Compensation for Federal Employees (UCFE) laws are compiled from quarterly contribution reports submitted to the [State Workforce Agencies] by employers. In addition to the quarterly contribution reports, employers who operate multiple establishments within a state complete a questionnaire, called the “Multiple Worksite Report,” which provides detailed information on the location of their establishments. These reports are based on place of employment rather than place of residence. UI and UCFE coverage is broad and basically comparable from state to state.

Major exclusions from UI coverage are self-employed workers, religious organizations, most agricultural workers on small farms, all members of the Armed Forces, elected officials in most states, most employees of railroads, some domestic workers, most student workers at schools, and employees of certain small nonprofit organizations.

So are we seeing a huge increase in people that are “self-employed” in some way in the post-COVID world, or a massive increase in start-ups that the Employment Dynamics Report isn’t catching? On the flip side, have we been missing a lot of the layoffs that happen as the COVID-related boom in tech and other areas, possibly because these individuals have funds and aren’t filing unemployment?

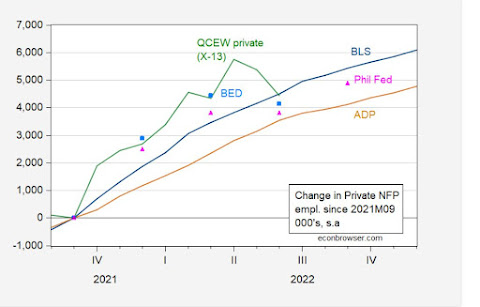

UW-Madison's Menzie Chinn took on this question at Econbrowser, and includes this chart which shows the seasonally-adjusted trend of a few employment indicators since September 2021.

That private-sector QCEW is something I'm keeping an extra eye on, because there is certainly a disparity between what happened in that report in Q2 2022, and what the monthly job reports indicated. For background, Q2 in general adds a lot of jobs in the US as the weather warms, with many of those gains being adjusted down in the seasonally-adjuted monthly jobs reports.

But in Q2 2018 and Q2 2019 (the last 2 pre-COVID reports, a situation closer to Q2 2022 vs 2020 or 2021), the QCEW said many more private-sector jobs were added than what was added in Q2 2022. But tbe monthly jobs reports indicated that many more jobs were added last year vs those other 2 years.

I’m now quite interested in seeing what happens with the annual benchmarking of employment figures, which will come out with the January jobs report this coming Friday. Do the huge job gains of Q2 2022 get diminished, and did we

underestimate the growth of prior months? And that mean the Fed was too late to tighten, and now is over-tightening based on incorrect data? Or does it stay up, and this Employment Dynamics report is missing a major change that’s happening in the post-COVID economy?

That one report is making me do a bit of re-evaluating, both in how much of Biden Boom we had in 2021 (even bigger than we thought?), and how the resulting labor shortage and spiking inflation may have put a major limit on Summertime hiring for 2022. And now are we back to normal, without a need to keep tightening because that inflationary spike is over with?

No comments:

Post a Comment