JUST IN: US inflation cooled to 3.1% in November. Other than 3% in June, that's the lowest inflation rate since March 2021.

— Heather Long (@byHeatherLong) December 12, 2023

Housing (mainly rent) continues to be the biggest driver. Gas prices were down in November. pic.twitter.com/QZIvdQeSKU

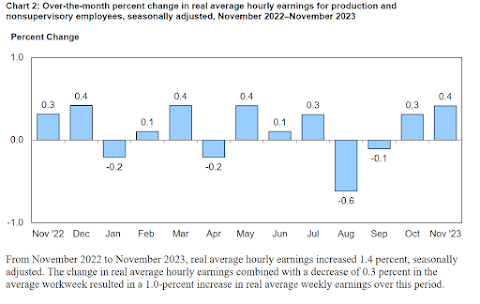

Overall prices only rose 0.1% for the month of November, and have only gone up 2.1% since February. Even grocery prices have calmed down in the last year, with food at home only up 1.7% in the last year. With gas prices staying low in December and oil futures at their lowest point in nearly 6 months, there doesn't seem to be much that would cause inflation to fire back up in early 2024. With prices taming down, we continue to see inflation-adjusted wages recover the losses they took on in 2022.The core CPI rose 0.3% in November from October, in line with expectations.

— Nick Timiraos (@NickTimiraos) December 12, 2023

This held the 12-month core inflation rate at 4% and brought the six-month annualized rate down to 2.9% in November, from 3.2% in October.https://t.co/mnXQgghn4v pic.twitter.com/tSggtQBlJG

That's after another positive month for overall inflation-adjusted average hourly wages, (this time up 0.2%), making it 7 out 9 months for real gains since February, and up 0.8% for the last year. The news is even better for everyday workers, as non-supervisory employees are seeing even larger gains in the last 2 months. In fact, real average hourly wages for non-supervisory workers are higher now than they were in November 2021, even with all the price hikes in 2022. Another year of wage gains like that wouldn't hurt when it comes to making sure democracy still exists in this country. Know what else wouldn't hurt? Having the Fed realize that inflation really was a post-COVID transitory thing for the last half of 2021 and first half of 2022, and having them reduce rates from the punitive 5.4% that they have imposed on us. There's no logical reason to have real interest rates of more than 1%, let alone 2%, and I would hope we see some indications this week that this lower-inflation reality has sunk in to the Central Bankers, so they loosen up in 2024.Real wages are rising. pic.twitter.com/NEUlYChjl7

— Justin Wolfers (@JustinWolfers) December 12, 2023

Aren't you the very same one who always rails against a frothy stock market, rampant speculation, stock buybacks, all the behavior that is DRIVEN by near-zero interest rates?? Oh yeah, you actually are, but because you're a public-sector drooling MORON 'educated' at the University-of-I-Don't-Know-FUCK, you can't even figure out or probably remember WHAT the vacant shit is that bounces back and forth between your ears day to day.

ReplyDeleteYou do realize there is a lot of range between 0% and 5.4%, right? And that we tax stock buybacks now, so at least some value gets created from it?

DeleteI actually find the bullish reactions of coked-up stock traders to be funny. But I can understand why a MAGAt like you might be upset with today's headlines of DOW 37,000 and more proof that Bidenomics is working. Everyday people might realize that they've been a fed a boatload of Faux News on the economy, and GOPs sure don't want that.

In fact, you never seem to be able to say what you want. You just complain about me and call names and never address the subject at hand, likely because you (like most GOPs) have absolutely nothing.

Jake