While projections of the so-called "X date" have put it sometime over the summer, Treasury Secretary Janet Yellen said in January the U.S. would be able to avoid default through at least early June as it uses "extraordinary measures" to pay its bills. At that time, the Bipartisan Policy Center estimated the date would likely arrive this summer or early fall. Economists at Bank of America expect Yellen to update her guidance on the X date by early May and anticipate she will stick with the early June estimate. But with tax revenues down, economists at multiple banks have started moving up their own estimated timelines for the threat of a default.... Goldman Sachs economists have also noted the potentially shifting timeline, pointing out that tax receipts are running 35%, or $138 billion, below last year. "At this rate, an early June deadline looks nearly as likely as the late July deadline we project," they wrote. Their economic research team continues to put the debt limit deadline in late July, but they noted if tax receipts continue to undershoot in the coming days, the odds tilt "slightly in favor" of an early June deadline. The Treasury is expected to receive another round of tax payments around the mid-June estimated tax deadline, which the bank economists believe would provide sufficient funds through the end of June.It's especially perplexing because there have been a lower percentage of federal tax returns that have had refunds in tax year 2022 vs tax year 2021, and the refunds have been for lower amounts. At the same time, more Americans are working than ever, and with wage increases of 5-6% compared to a year ago.

Now maybe there's an effect from 2022's inflation, as tax brackets were indexed higher by 7% for 2023, which would be a back-door tax cut for a lot of Americans, especially at the start of the year before more raises and boosts from changing jobs sink in. We also may be seeing this effect state taxes in Wisconsin. The recently-released state revenue figures for March shows that individual income tax revenues and corporate tax revenues are both down compared to where they were last year. Now, you will notice the 88% increase in income tax revenues March 2023 vs March 2022, but that's something that was expected, as the Legislative Fiscal Bureau noted in their revenue estimates from earlier this year.The Fed's favorite measure, seasonally-adjusted.

— Mike Konczal (@mtkonczal) April 28, 2023

It's interesting - there was a *lot* of interest in the January print of ECI, less so today. Markets are also not moving on anything. But this could play a role in FOMC thinking here. /3 pic.twitter.com/wpU8tdZaKB

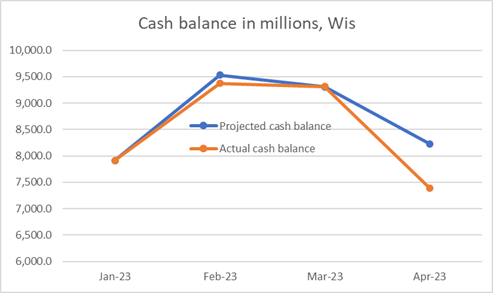

Based on preliminary collections information through December, 2022, individual income tax revenues for the current fiscal year are 12.9% lower than such revenues through the same period in 2021. This is primarily due to decreased withholding collections following the withholding table update that took effect January 1, 2022. However, individual income tax revenues are expected to increase at a rate of 21.1% over the next six months relative to the same period a year prior. The primary factor for this estimated revenue increase is an expected decline in refunds paid to taxpayers in 2022-23 relative to 2021-22. The income tax rate reduction included in 2021 Act 58, which took effect beginning in tax year 2021, caused refunds to spike when taxpayers filed their corresponding income tax returns in 2021-22. However, because the income tax withholding tables were later updated beginning January 1, 2022, to reflect the rates, brackets, and standard deduction in effect for current law, the amounts withheld from taxpayers during tax year 2022 incorporated the Act 58 rate reduction for the first time. As a result, when taxpayers file the corresponding returns in Spring of 2023, their refund amounts will be lower (all else equal) than the refunds they would have received had the withholding tables not been updated.And March is a big month for tax refunds in Wisconsin, as people file earlier if they are getting refunds. In looking at the first 3 months of 2023 in total, income tax revenues are up 19.8% from the first 3 months of 2022, so that's mostly in line with what LFB thought so far. One other warning sign came with a report on the state's cash balance, which is different than the budget balance, but is a good proxy for figuring out where things are going. And while the first two months of cash activity was in line with projections, March fell well short. With the big tax payment month of April coming to a close, let's see what those numbers tell us, both at the Federal and State levels. But if those revenue numbers are disappointing, that's going to change both the estimation of when we may be facing the country's (unenforceable) debt limit, and it'll affect the updated Wisconsin revenue estimates that the LFB will put out some time in the next 10 days. From the state side, lawmakers are still going to have billions to play with in this state budget, but I'm getting a sneaking suspicion the cushion that we'll have on June 30 won't be as massive as we thought it would be. And if GOPs in Congress are successful in sabotaging the economy by messing with the debt ceiling, those shortfalls may show up in the projections as well.