That gets Q3 off to a good start, with solid consumption growth and inflation staying in check. In fact, inflation was below 2% on an annual rate for July, since PCE price index only rose by 0.155% for the month, and it’s only up 1.16% over the last 6 months (or just above 2.3% on an annual rate). The income side also painted a good picture if you want that “middle ground” between something that might re-fire inflation, and something that might lead to recession. Wage and salary income grew by 0.35% and total personal incomes were up 0.31%. It’s more proof that we’ve been in a new post-COVID equilibrium of wage/income growth that runs at an annual rate around or just below 4% while inflation stays a little over 2%. We’ve also had growth in real per-capita income for each of the last 3 months, and in 5 out of 7 for 2024. In addition, post-inflation per-capita income has gone up more than $1,000 since the end of 2020, and 6.6% since the end of 2019. So yes, Americans are generally better off than they were 5 years ago, and they have regained almost everything that was lost to the inflation spike from mid-2021 to mid-2022. And that's before we discuss the large increases in wealth for homeowners and stockholders in 2023 and 2024. The one big concern is that the savings rate dove below 3% due to consumption growth outpacing income growth. And it’s legitimate spending, as for the first time in 2024, the amount of non-mortgage interest payments made by Americans dropped. But that hasn’t been true over the last 2 years as the Federal Reserve has jacked up interest rates to 23-year highs. As a result, between the end of 2021 and late 2023, the amount of non-mortgage interest payments for Americans more than doubled, and has stayed at or near that high level since then. This is yet another reason why the Federal Reserve has been behind reality when it comes to cutting interest rates. The higher amount of interest and higher cost of housing are both burdens that can be lessened with lower interest rates, and the real threat to Americans maintaining our generally solid economy n 2024 is if more Americans lose their jobs, especially in the interest-rate sensitive manufacturing and construction industries. So while some might complain that this income and spending data is too good to allow for a 50-point rate cut in 2 1/2 weeks, I'd argue that the Fed should catch up to the 1/4 point they should have done back in July, instead of staying behind the curve if they choose to have their first cut be 1/4 point in September. But given that unemployment claims have stayed low in August and gas prices have dropped by 5% this month, I would imagine the next income and spending report that comes out for this month will be another good one.US July Personal income, spending & PCE price index: Disinflation amidst strong spending and solid income gains. Spending up 0.5%, income 0.3% & real spending 0.4%. PCE price index up 0.2% m/m & 2.5% y/y while the core advanced 0.2% & 2.6%. Disposable income up 0.3% nominally and…

— Joseph Brusuelas (@joebrusuelas) August 30, 2024

Ventings from a guy with an unhealthy interest in budgets, policy, the dismal science, life in the Upper Midwest, and brilliant beverages.

Saturday, August 31, 2024

Incomes up, spending up, and inflation staying under control

Thursday, August 29, 2024

Q2 growth up to 3%, and inflation measure down to 2.5%

In digging through the components of the report, real consumption had a nice rebound from a slow 1st Quarter. Higher interest rates led to a decline in residential home building, but higher inventory builds made for a higher GDP number. That inventory number made me want to break down the GDP figures a bit further, and do another measure that I like to do. One which removes increases or decreases in government spending and the change in inventories, to get an idea about the underlying strength or weakness of the economy. And when looked at that way, we've had some weakening from the strong numbers that we had in much of 2023. Another revision in the report mentioned that the PCE price index (which the Fed allegedly uses as the best indicator of inflation) was dropped from 2.6% in the first report to 2.5%. The "core" PCE index also was revised down by 0.1%, from 2.9% to 2.8%. It was also a welcome decline from the bump up that we had in PCE inflation at the start of 2024, and back down toward the lower levels that we were seeing in the last half of 2023. All of this looks like pretty good news. The overall economy continued to grow at a good pace in the 2nd Quarter of this year, and prices weren't going up by as much. And the underlying slower growth and ivnentory builds should continue to keep inflation under control, and pave the way for interest rate cuts starting in less than 3 weeks. I'll take it. And we'll see if July's income and spending report continues the good direction when that comes out tomorrow.GDP growth was even better than we had realized in Q2, coming in at a revised 3.0% annual rate (the first estimate was 2.8%).

— Jason Furman (@jasonfurman) August 29, 2024

A big upward revision in personal consumption means that my preferred "core" measure for GDP (C + fixed I) grew at 2.9%, revised up from 2.6%. pic.twitter.com/1c71Z46MZa

Tuesday, August 27, 2024

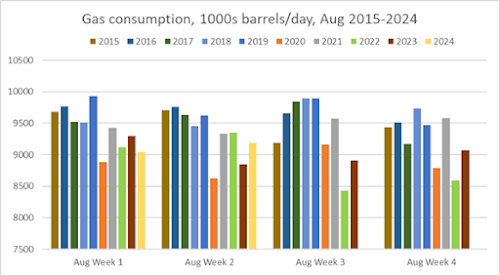

Sure, gas prices are up under Biden. They also rose under Trump. And we use less gas now.

A combination of falling real gasoline prices and increasing vehicle efficiency resulting from higher fuel economy in internal combustion engines, as well as shifts to hybrid and battery electric vehicles, means we expect aggregate gasoline expenditures will be less in 2024 and 2025 compared with 2023,” the EIA noted in the [Short Term Energy Outlook (STEO)]. “Additionally, rising incomes mean U.S. aggregate expenditures on gasoline will represent about 2.3 percent of disposable income in 2024 and 2.2 percent in 2025, which would be slightly less than the 2015–23 average and approaching two percentage points less than the 2005–14 average,” it added… The EIA’s latest STEO projects that regular-grade gasoline in the U.S. will average $3.41 per gallon in 2024 and $3.47 per gallon in 2025. Regular-grade gasoline came in at $3.52 per gallon in 2023, the STEO showed. Broken down quarterly, the EIA expects regular-grade gasoline in the U.S. to average $3.49 per gallon in the third quarter of this year, $3.33 per gallon in the fourth quarter, $3.35 per gallon in the first quarter of next year, $3.58 per gallon in the second quarter, $3.55 per gallon in the third quarter, and $3.38 per gallon in the fourth quarter, the STEO revealed. “We forecast regular-grade gasoline prices will average around $3.50 per gallon in 2025 and gasoline consumption will average 8.9 million barrels per day,” the EIA said in its July STEO.And if you look at average US gas prices over the years, you’ll see that cost of a gallon of gasoline rose brisky from the multi-year lows we enjoyed in early 2016 (Thanks Obama?), peaking at $2.96 a gallon around Memorial Day 2018, and was still at $2.86 as late as May 2019. Even with a decline in prices from Summer 2019 through Winter 2020, we still had a significant 4-year increase in the price for a gallon of gas during the pre-COVID Trump years. Average regular gasoline prices, US

Feb 2016 $1.764

Feb 2020 $2.442 (+38.4%) That 38% increase over 4 years is more than what the price of gas has gone up in the last 5 years. You know, back in August 2019, when Donald Trump was saying we had “the greatest economy ever”, the Fed was cutting rates, and no one had heard of COVID-19. Average regular gasoline prices, US

Aug 2019 $2.621

Aug 27, 2024 (courtesy AAA) $3.350 (+27.8%) Even the 73 cent increase in a gallon of gas over the last 5 years isn’t very different than the 68 cents a gallon that gas prices increased in the 4 years before COVID shutdowns. Sure, I'm kind of cherry-picking this. But I'd also point out that if you said the average increase in gas prices was 5.5% a year for the last 5 years, you'd shrug and not find it to be a big deal. In addition, gas supplies are as plentiful as they were during the last half of the 2010s, and Americans are still using less gas now than they did during the pre-COVID Trump years. So if you hear any GOP complaining about gas prices being over $3, remind them that 2022 is far over, and that this country is in a much better situation to combat those gas prices because we don't use nearly as much gas as we did during the Trump Administration. And even though most MAGAs won't admit it, many of us aren't having gas costs be any more of a burden to us than they were 5 years ago, and less than they were a decade ago.

Sunday, August 25, 2024

"Migrants" aren't taking jobs from working Americans in 2024. Foreign-born replacing Boomers? Maybe

So what is Trump trying to say when he claims “all new jobs have gone to migrants”, and is it BS? CBS Marketwatch looked into it, and the answer is “kind of, but not in the bad way.”Trump claims that "beyond the number of 100 percent" of job creation has gone to migrants pic.twitter.com/AHFSrwUeSZ

— Aaron Rupar (@atrupar) August 15, 2024

Foreign-born employment is up over the past year, while native-born employment is down, as measured by a Bureau of Labor Statistics household survey. That results in a figure above 100%, which stems from native-born workers retiring as well as a spike in immigration, as MarketWatch’s Steve Goldstein noted in posts on social media. However, the term “migrants” is not typically used interchangeably with “foreign-born workers.” The first term can conjure up images of people who recently crossed the southern U.S. border illegally and are working in construction or on farms, though it can cover migrant workers in white-collar jobs. The second term applies to undocumented immigrants as well, but also to naturalized U.S. citizens who have lived in the country for years — in some cases for decades, and in some cases since childhood. An Associated Press report made the same point, saying that “foreign born” is not the same as “migrant.” About half, according to a recent estimate from Standard Chartered economists Steve Englander and Dan Pan. They offered that estimate in a note dated May 30 as they looked at data covering the federal government’s current fiscal year, which started Oct. 1. The closely watched monthly U.S. jobs reports might look “moderate” or “hardly boom time” if undocumented workers were not counted in them, the economists wrote. Federal Reserve officials who determine interest rates “might be less hawkish if the impact of undocumented immigrants on [the jobs reports] was well estimated and understood,” the Standard Chartered team added.Here's Goldstein's tweets on those stats.

There could be an argument that there’s a bit of a dampening in wages due to the increased immigration, but we also likely wouldn’t see nearly as many people working in America in general (both among the foreign born as well as those born in the US). And as the Congressional Budget Office recently noted, the wave of immigration from 2021-2023 should raise the US’s economic output for future years, and reduce its budget deficit. In addition, America has had a nearly equal amount of births vs deaths in the 2020s, and 2022-2024 are the peak years for Baby Boomers turning 65. So we'd have real capacity problems in this country if it wasn't for more immigration, and likely we'd have seen more shortages and inflation than we had in the post-COVID supply crunch that first jumped prices in 2021. Let's also point out that the percentage of working-age people in America that have jobs is staying at or above the pre-COVID highs of 80.6%. The only time this number was bigger was at the end of the Dot-com Boom in early 2000, which was also when the first Boomers were 54 and aging out of this stat. So it's not like there are many Americans that have had career opportunities being taken away during the 2021-2023 immigration surge. Sure, maybe more of those people working between ages 25-54 are foreign-born compared to prior years, butData: https://t.co/QKGytrtkWr

— Steve Goldstein (@MKTWgoldstein) August 16, 2024

In spreadsheet form pic.twitter.com/ojnEdDEwBj

1. That doesn't mean they're not American citizens, and

2. Even if some of them are not citizens, many immigrants pay into Social Security and Medicare, and almost all take part in transactions in the States outside of work that add to the overall economy. What is likely is that while the number of native-born Americans in jobs has been stagnant in the last year, that doesn't mean Americans have lost jobs to the foreign born, as it is likely a reflection of younger workers born in America and in other countries that are replacing native-born Boomer-aged retirees. But like a lot of other things in Trump/MAGA world, they mash a couple of mostly-unrelated stats together to create a story that sounds right to them, regardless of whether that matches reality. But you don't have to be weak, straw-graspers like those SUCKERS. Know that the increase in immigration in the early 2020s has helped the US economy recover faster than almost any other industrialized country from the wreck of the COVID pandemic. And even if you think there needs to be limits on immigration and safeguards on who is coming into the country (as most sensible people do in America), know that Donald Trump and the GOP are the only ones that stopped significant reforms in immigration policy from happening in 2024.

Saturday, August 24, 2024

Powell admits it - rate cuts are coming

JUST IN: Federal Reserve Chair Jerome Powell on Friday indicated that the central bank would soon begin cutting interest rates. https://t.co/ukeBHHkRh4 pic.twitter.com/FyuLJwd73I

— ABC News (@ABC) August 23, 2024

Under Powell, the Fed raised its benchmark rate to the highest level in 23 years to subdue inflation that two years ago was running at the hottest pace in more than four decades. Inflation has come down steadily, and investors now expect the Fed to start cutting rates at its next meeting in September — an expectation that essentially got Powell's endorsement Friday. “My confidence has grown that inflation is on a sustainable path back to 2%,” Powell said in his keynote speech at the Fed’s annual economic conference in Jackson Hole. He noted that inflation, according to the Fed's preferred gauge, had fallen to [a 12-month rate of] 2.5% last from a peak of 7.1% two years ago. Measured by the better known consumer price index, inflation has dropped from a peak 9.1% in mid-2022 to 2.9% last month. Both are edging closer to the Fed's 2% target. Powell sounded confident that the Fed would achieve a so-called soft landing — containing inflation without causing a recession. "There is good reason to think that the economy will get back to 2% inflation while maintaining a strong labor market,'' he said.I still think a goal of 2% inflation is arbitrary and off-base, given that (as I've mentioned before) the US economy grew plenty of jobs and output with inflation of 3-4% throughout the 1980s and 1990s. But regardless, inflation has cooled off after the

Thursday, August 22, 2024

Wis loses jobs in July. But no need to panic yet.

Preliminary employment estimates for July 2024 showed Wisconsin's seasonally adjusted unemployment rate was 3.0%, which is 1.3 percentage points below the national unemployment rate of 4.3%. The state's labor force participation rate held steady at 65.5% in July while the national rate was 62.7%. • Place of Residence Data: Wisconsin's unemployment rate was 3.0% in July, 1.3 percentage points below the national rate of 4.3%. Wisconsin's labor force increased 2,800 over the month and increased 1,800 over the year. The number of people employed increased 1,300 over the month to a record-high 3,049,700 employed. • Place of Work Data: Total nonfarm jobs decreased 6,500 over the month and increased 25,700 over the year to 3,035,100 jobs. Private sector jobs decreased 8,500 over the month and increased 17,900 over the year to 2,625,700 private jobs.That is not good, and it mostly wipes out the gains we saw since March. However, I also don’t think this jobs report means we plunged into recession last month, and not only because month-to-month variances at the state level can be jumpy. I’ll note that the biggest drop in jobs in July happened in the Leisure and Hospitality sector, with a seasonally-adjusted decline of 4,400 jobs. However, I’ll note that this isn’t due to a wave of bars, restaurants and hotels closing, but instead is due to the sector having an lower-than-normal increase in positions for July (+3,400 overall, and +3,700 in accommodations and food services). We’ll see if this reverses in the coming months when the seasonal adjustments count on layoffs in this sector as the Summer ends. Likewise, while it’s concerning to see the previously-growing Construction (-1,000 jobs, seasonally adjusted) and Manfacturing (-200) sectors lose out in July, it also reflects lower-than-normal seasonal hiring. So while I don't like to see the seasonally-adjusted decline in Construction since March, let's see if that is just a lack of hiring instead of cutbacks. And the overall trend of manufacturing is still in a good direction. So while Wisconsin did have a bad jobs report for July, I’ll hold off on the panic until we see the seasonal-adjusted numbers in September and October. And in the wake of lower revisions for US job growth after the release of the Quarterly Census of Employment and Wages (QCEW), I wanted to see if Wisconsin's past job growth might also be reduced. It looks like there is a slight difference, but nothing that changes the overall story (+0.6% in the QCEW, +0.75% in the monthly job reports). So to summarize, July's jobs report for Wisconsin was lacking, but I'll wait for the coming months of data before I think it shows any kind of turning point from what had been decent job growth in 2024 before last month.

Wednesday, August 21, 2024

Job growth revised down by a lot, makes Fed delay in rate cuts look worse

Each year, the Current Employment Statistics (CES) survey employment estimates are benchmarked to comprehensive counts of employment for the month of March. These counts are derived from state unemployment insurance (UI) tax records that nearly all employers are required to file. For National CES employment series, the annual benchmark revisions over the last 10 years have averaged plus or minus one-tenth of one percent of total nonfarm employment. The preliminary estimate of the benchmark revision indicates an adjustment to March 2024 total nonfarm employment of -818,000 (-0.5 percent). Preliminary benchmark revisions are calculated only for the month of March 2024 for the major industry sectors in table 1. The existing employment series are not updated with the release of the preliminary benchmark estimate. The data for all CES series will be updated when the final benchmark revision is issued.Breaking it down by month, you can see that the bigger monthly revisions will likely come with the second half of 2023, as 12-month job growth was closer to 1.5% than the 2%+ rate that was originally reported. The financial media especially took note of this, because the booming job growth that was being reported in late 2023 and early 2024 (something I was guilty of touting at the time) has now been reduced to just over 2 million for the 12 months between March 2023 and March 2024. Now let's take a step back and admit that 2 million jobs added and a 1.3% rate of growth is still pretty good, especially when we consider unemployment was at 3.5% in March 2023, so there was only so much more we could have grown. It’s no different as the 12-month rate and amount of job gains that we saw in 2019 and pre-COVID 2020 under Donald Trump, when we had a similarly low level of unemployment, and just below what we did in 2018. But the difference is that when job growth slowed down in a full-employment situation in 2019 (as shown by the red line), the Federal Reserve caved to Donald Trump and began cutting the Fed Funds rate that Summer from a not-that-high 2.25%-2.5% down to 1.5%-1.75%. Those 3 rate cuts happened before we even knew COVID-19 was a thing. In 2024, despite clear signs that job growth, inflation, and nominal wage growth have been going lower, the Fed has refused to cut interest rates from a level that is more than double where we were in 2019. The economic situation isn’t much different than what it was 5 years ago, except that in 2024 unemployment has been slowly rising in the last few months (albeit still low at 4.3%), unlike 2019, when the unemployment rate stayed below 4% all year. The downward revisions in job growth means that the Fed is even more behind the curve on reducing these punitive interest rates than we first thought, which fed even more speculation on Wall Street as to how fast and how much the Fed will cut starting in September. Then the Fed released the minutes of their last Open Markets Committee meeting from 3 weeks ago, which gave insights as to what they felt was the economic situation, and why they chose not to start cutting rates. In reading those minutes, it looks committee members at the Fed acknowledged that things had slowed down, with some members wanting a cut last month, but they were outnumbered by the rest of the FOMC, and held off for another 6 weeks.

In their consideration of monetary policy at this meeting, participants observed that recent indicators suggested that economic activity had continued to expand at a solid pace, job gains had moderated, and the unemployment rate had moved up but remained low. While inflation remained somewhat above the Committee's longer-run goal of 2 percent, participants noted that inflation had eased over the past year and that recent incoming data indicated some further progress toward the Committee's objective. All participants supported maintaining the target range for the federal funds rate at 5-1/4 to 5-1/2 percent, although several observed that the recent progress on inflation and increases in the unemployment rate had provided a plausible case for reducing the target range 25 basis points at this meeting or that they could have supported such a decision. Participants furthermore judged that it was appropriate to continue the process of reducing the Federal Reserve's securities holdings. In discussing the outlook for monetary policy, participants noted that growth in economic activity had been solid, there had been some further progress on inflation, and conditions in the labor market had eased. Almost all participants remarked that while the incoming data regarding inflation were encouraging, additional information was needed to provide greater confidence that inflation was moving sustainably toward the Committee's 2 percent objective before it would be appropriate to lower the target range for the federal funds rate. Nevertheless, participants viewed the incoming data as enhancing their confidence that inflation was moving toward the Committee's objective. The vast majority observed that, if the data continued to come in about as expected, it would likely be appropriate to ease policy at the next meeting. Many participants commented that monetary policy continued to be restrictive, although they expressed a range of views about the degree of restrictiveness, and a few participants noted that ongoing disinflation, with no change in the nominal target range for the policy rate, by itself results in a tightening in monetary policy. Most participants remarked on the importance of communicating the Committee's data-dependent approach and emphasized, in particular, that monetary policy decisions are conditional on the evolution of the economy rather than being on a preset path or that those decisions depend on the totality of the incoming data rather than on any particular data point. Several participants stressed the need to monitor conditions in money markets and factors affecting the demand for reserves amid the ongoing reduction in the Federal Reserve's balance sheet. In discussing risk-management considerations that could bear on the outlook for monetary policy, participants highlighted uncertainties affecting the outlook, such as those regarding the amount of restraint currently provided by monetary policy, the lags with which past and current restraint have affected and will affect economic activity, and the degree of normalization of the economy following disruptions associated with the pandemic. A majority of participants remarked that the risks to the employment goal had increased, and many participants noted that the risks to the inflation goal had decreased. Some participants noted the risk that a further gradual easing in labor market conditions could transition to a more serious deterioration. Many participants noted that reducing policy restraint too late or too little could risk unduly weakening economic activity or employment. A couple participants highlighted in particular the costs and challenges of addressing such a weakening once it is fully under way. Several participants remarked that reducing policy restraint too soon or too much could risk a resurgence in aggregate demand and a reversal of the progress on inflation. These participants pointed to risks related to potential shocks that could put upward pressure on inflation or the possibility that inflation could prove more persistent than currently expected.Now what if the Fed knew that the number of jobs in America was quite a bit less than what was being reported at the time? I got a feeling they would have cut, to the relief of many Americans and businesses. Even with the data that we had at the time, it made little sense to me why the Fed wasn't cutting earlier this year. Data for July that has come out since that Fed meeting include a disappointing jobs report, tame inflation figures, and a significant drop in housing starts. All of these items support a move to lower interest rates. So now the question becomes whether the decision-makers at the Fed have to catch up to the interest rate cut that they should have made 3 weeks ago, and put in a cut of 50 basis points in mid-September. It would be a drastic move, but given that the new data indicates the Fed made the wrong choice in July based on what the economic situation dictated, it would only be fair if they doubled a 25-point cut to make up for it.

Sunday, August 18, 2024

Inflation stays tame in July, and any econ panic is now gone.

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent on a seasonally adjusted basis, after declining 0.1 percent in June, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.9 percent before seasonal adjustment. The index for shelter rose 0.4 percent in July, accounting for nearly 90 percent of the monthly increase in the all items index. The energy index was unchanged over the month, after declining in the two preceding months. The index for food increased 0.2 percent in July, as it did in June. The food away from home index rose 0.2 percent over the month, and the food at home index increased 0.1 percent. The index for all items less food and energy rose 0.2 percent in July, after rising 0.1 percent the preceding month. Indexes which increased in July include shelter, motor vehicle insurance, household furnishings and operations, education, recreation, and personal care. The indexes for used cars and trucks, medical care, airline fares, and apparel were among those that decreased over the month. The all items index rose 2.9 percent for the 12 months ending July, the smallest 12-month increase since March 2021. The all items less food and energy index rose 3.2 percent over the last 12 months and was the smallest 12-month increase in that index since April 2021. The energy index increased 1.1 percent for the 12 months ending July. The food index increased 2.2 percent over the last year.

The low increase in inflation also means that the tepid gain in average hourly wages still beat the CPI for July, allowing for a third straight month of higher real hourly wages. We also got an indication this week that businesses aren’t being constrained by higher costs either, as the Producer Price Index had a mild increase of 0.1% for July. In addition, the PPI has only gone up by 0.3% in the last 3 months, and 2.2% over the last 12 months. Oh, and remember all the panic less than 2 weeks ago after a subpar jobs report (that still showed we added jobs) and fears of a blowup in the tech sector caused a big selloff? The DOW Jones lost more than 2,100 points in 4 days at the time. What's happened since then? No further panic or bad news in the sector, unemployment claims have stayed low, and the DOW has already regained more than 90% of what was lost in that decline. The DOW is now back above 40,000, and while the Fed still bungled this by not cutting sooner (as shown by shelter prices staying high in no small part due to a lack of supply, as higher rates are discouraging the selling and construction of homes), we are also in a steady enough place that we don’t need an inter-meeting cut (which would have caused even more panic on Wall Street because it would indicate things were falling apart). But in all, we are in a good place, and unless the Fed decision-makers are completely in the bag from Trump, the only question is how big next month's rate cuts will be. No wonder why Mitch McConnell’s dark money group is going to pollute our state’s airwaves with millions of ads that seem to say nothing beyond “SCARY DARK PEOPLE. BLAME TAMMY BALDWIN.” They really can’t counter much when it comes actual policy that Baldwin has supported, and can’t moan about inflation any more (especially since GOPs have no clue how to slow it down beyond screwing workers), except to complain about what happened 2 years ago. So racism and fearmongering for shut-ins it is!JUST IN: A great inflation report. In July, annual inflation cooled to 2.9% — the first time it’s been below 3% since early 2021.

— Heather Long (@byHeatherLong) August 14, 2024

Falling car prices and flat energy costs helped bring inflation down. The monthly increase was 0.2% (as expected)

It’s looking more and more like… pic.twitter.com/Guiz9HSOsf

Saturday, August 17, 2024

Consumers still spending, but housing falling. All the more reason to cut rates

Consumer spending held up even better than expected in July as inflation pressures showed more signs of easing, the Commerce Department reported Thursday. Advanced retail sales accelerated 1% on the month, according to numbers that are adjusted for seasonality but not inflation. Economists surveyed by Dow Jones had been looking for a 0.3% increase. June sales were revised to a decline of 0.2% after initially being reported as flat. Excluding auto-related items, sales increased 0.4%, also better than the 0.1% forecast. There was also good news on the labor market front: Initial unemployment benefit claims for the week ended Aug. 10 totaled 227,000, a decrease of 7,000 from the previous week and lower than the estimate for 235,000. Gains in sales were propelled by increases at motor vehicle and parts dealers (3.6%), electronics and appliance stores (1.6%), and food and beverage outlets (0.9%). Miscellaneous retailers saw a plunge of 2.5% while gas stations saw receipts climb just 0.1% and clothing stores were down 0.1%.With consumers being around 70% of US economic growth, it's a good sign that Americans keep spending at the stores. But there was one dark cloud on an otherwise bright week of economic news. We found out on Friday that there were a sizable decline in new housing activity for July.

Housing starts fell to a 1.24 million annual pace from 1.33 million in June, the government said Friday. That's how many houses would be built over an entire year if construction were at the same rate each month as in July…. Housing starts fell to the lowest level since May 2020. Outside of the pandemic, new-home construction was at its lowest level since March 2019. A big drop in single-family construction pulled the overall figure down, even as multi-family starts moved up. Building permits, a sign of future construction, fell 4% to a 1.4 million rate.It's a 5th straight month of declining single-family housing starts, and single-family and multi-unit permits have also been down in recent months. That's noticeable deterioration, and all the more reason to show that the Fed screwed up by not cutting interest rates at its meeting last month. Home-building and home affordability continues to suffer with these excessive rates, and it’s the biggest drag on our economy at this time. In addition, with the lack of new housing being built, we also need lower rates to encourage more existing homes to go on the market (since selling out of a 3-4% mortgage isn't worth it when you have to borrow at 6-7%). That home-building and affordability drag is being overcome for now by the fact that the overall US economy is still in a good place. Wages are still exceeding a dwindling amount of inflation, unemployment claims are staying low, and consumer spending continuing to grow. But if the housing sector isn’t turned around soon, and activity does stop sliding, that’s the kind of thing that then starts tipping over into job losses and real problems.

Wednesday, August 14, 2024

When it comes to WisGOP tricks, Wisconsin voters say HELL NO

Wrote about the defeat of two constitutional amendments on yesterday’s August primary ballot. My big takeaway here: the “No” side revealed the value of “expanding the scope of conflict”, especially in the face of a strategically timed election. https://t.co/4H17qCDQ7V

— Philip Rocco (@PhilipRocco) August 14, 2024

The “No” campaign was thus wise to go beyond partisan appeals and to focus on the substantive implications of the legislation for the release of federal emergency aid, as well as their violation of core small-d democratic values, including the legislature’s use of the constitutional amendments to undermine “checks and balances.” Well-timed ads by groups opposing the amendments were buoyed by a raft of op-eds and letters to the editor in publications around the state. The voices opposing the amendment included not just popular Democratic Party leaders but small-business owners, first responders, and farmers. This not only dragged the amendments into the harsh light of day, it illustrated a broad, cross-cutting coalition of Wisconsinites opposed to them for a variety of reasons. By casting a spotlight on the amendments’ effects, the opponents also forced the “Yes” side to identify themselves, and to put their arguments into the public sphere. This expanded the scope of conflict further still by illustrating that the only visible public constituency in support of the amendments were the allies of Republican legislators, who would gain greater power if they were enacted.And it further ID'd the amendment as self-absorbed partisan BS that didn't have any principles behind it beyond being yet another power grab by a soon-to-be-ungerrymandered Legislature. Putting the vote in August instead of November made it seem even more sleazy, and the tactic likely backfired on Robbin' Vos, Tyler August Devin LeMahieu and other Koched-up GOP dweebs who think they are much more clever than they actually are. the And as is habit when Dems win big in this state, the NO votes didn't just come from Milwaukee and Madison, but from throughout the state.

I'll especially note that NO went down in all three of the BOW counties in the Fox River Valley (Brown, Outagamie and Winnebago), even though much of that area had a heavily contested Republican primary for Congress. Yesterday's vote also continued a big movement toward Dems and Dem-supported positions in Milwaukee suburbs that has happened over the last 10 years. It has turned an area that used to be the bedrock of the state's GOP and a source of huge statewide Raepublican margins into an increasingly purple area that more than offsets any losses Dems have taken in rural Wisconsin.2) While “No” vote heartland was in Dem strongholds (Dane County saw huge increases in number of votes from ‘22 party primary), this was not just a partisan vote. “No” vote outperformed Evers ‘22 results in virtually every county. Mobilization likely had spillover effects. pic.twitter.com/32EEvkrJn7

— Philip Rocco (@PhilipRocco) August 14, 2024

Hey Duey Stroebel, I see that you're trying to stay in the Legislature for another 4 years by taking a Senate seat that is largely made up of Ozaukee County and the very blue Milwaukee County North Shore suburbs. And you're the public face of the type of behind-the-scenes WisGOP legislative obstruction that everyday voters overwhlemingly rejected yesterday. Good luck running on that record this Fall, Due-bag. As Professor Rocco notes, Wisconsin voters are tired of the GOP's games, and Ben Wikler and other WisDems made the public aware of what's going on behind the scenes at the Capitol. When the voters were given the plain facts about what the GOPs were trying to sneak behind their backs, they revolted, and the GOP went down hard.Hi from Ozaukee County, which went from 70% for Scott Walker 10 years ago to 50-50 in yesterday's amendment votes.

— A.J. Bayatpour (@AJBayatpour) August 14, 2024

The GOP chair here says they have to hit 56% to win statewide. Dems chair still recalls the state party refusing to give yard signs in the '90s bc it'd be a waste pic.twitter.com/VOKRDmDcJe

First, it shows that Wisconsin voters simply do not support the aggrandizement of the legislature’s power. We saw a similar result in Janet Protasiewicz’s victory in the 2023 State Supreme Court election — a result which led to the historic reversal of the state’s legislative gerrymanders. Even in a sleepy, low-turnout August primary, a majority of voters in the Badger State came out to derail a legislative power grab. Second, Tuesday’s vote illustrates the value of expanding the scope of conflict. Over the last few decades, the safe bet is that if a constitutional amendment is on the ballot, Wisconsin voters will support it. ... [but] [w]ith a strong enough “No” campaign, voters could more easily see — and resent — vagueness and obfuscation in constitutional amendments. Strategic ambiguity can only be called “clever” and only works in the absence of a mobilized electorate.Sure seems like a theme of "get a Legislature that listens and gets things done that you want" is a good way for Dems to clean up this November. GOPs at all levels have to be reeling, and especially this guy, who "represents" a district that overwhlemingly voted NO yesterday.

Dumb, wrong and LOSING. That's Small-D Van Orden for ya! It's really gonna hurt that guy when he gets Cooked this Fall. And I am here for it!Washington DC sends money to Madison then Madison sends money to Madison and Milwaukee.

— Derrick Van Orden (@derrickvanorden) August 12, 2024

We are forgotten out here.

Vote:

Question 1: YES

Question 2: YES

No governor should have a private slush fund. pic.twitter.com/6LdFtWkWbp

Monday, August 12, 2024

Evers action to pay for long-term care shows yet another reason to VOTE NO tomorrow.

The increase would come from a pool of pandemic relief aid that the federal government sent to the state health department specifically for assisted living and home-based care industries. The Wisconsin Department of Health Services earlier this year sought to increase Medicaid payments to providers. But doing so first required review from the Republican-controlled Joint Committee on Finance. That additional legislative oversight resulted from an effort by former Republican Gov. Scott Walker and allies to erode gubernatorial power during a lame-duck session in late 2018 before Evers succeeded him. Walker signed a series of laws that increased the oversight authority of several legislative committees. That included giving the finance committee veto power over administration proposals to significantly increase Medicaid reimbursements. The finance committee refused to schedule a hearing on the latest proposal after a member anonymously objected in April, blocking it from implementation. Committee leaders say they worry about the annual $103 million general revenue cost of maintaining higher Medicaid reimbursement rates once pandemic relief runs out.In a time period when long-term care needs in Wisconsin continue to grow, and there is already a lack of caregivers in the state, there needs to have drastic action taken to improve quality of life for the most vulnerable. And yes, that requires real money to be invested to bridge the gaps in coverage and workforce. And we can't allow GOPs to prevent these needs from being met, especially in such a scuzzy, anonymous manner where only 1 member of the gerrymandered JFC can say no, and none of the GOPs in the Legislature ever have to vote YES OR NO on the subject. If we're able to vote down these pathetic amendments tomorrow, we then get a chance to take another step toward affording and meeting our health needs in this state, by getting a legitimate Legislature in place that will finally expand Medicaid, and have the Feds make available and pay for more of the services that older and disabled Wisconsinites are in need of. It also should remind you that while the damage from the Walker era has been contained with some progress made in the last 5 1/2 years, there is still a lot of work left to be done to get us back to where we can and should be. And we can prevent having another barrier to progress happen if enough of us VOTE NO tomorrow.

Sunday, August 11, 2024

As Summer winds down, US gas prices and inflation overall are being held in check

According to new data from the Energy Information Administration (EIA), gas demand fell from 9.25 million b/d to 8.96 last week. Meanwhile, total domestic gasoline stocks rose from 223.8 to 225.1 million barrels. Gasoline production increased last week, averaging 10.0 million barrels per day. Crude oil production hit an all-time high of 13.4 million barrels per day. Lower gasoline demand, rising supply, and stable oil costs may lead to sliding pump prices. Today’s national average for a gallon of gas is $3.45, five cents less than a month ago and 37 cents less than a year ago.That was what it looked like on Thursday. AAA says that national gas prices have dropped by another penny since then, while in 2023, prices were bumping up by 2 cents. This means we are now down 40 cents from this time last year, a decline of more than 10%, which likely means the CPI reading in September (which comes right before that month's Fed meeting) will be a tame one. Which makes it all the more ridiculous to try to see Republicans like Eric Hovde try to make "high inflation" something that's a major problem in 2024, and tries to blame the spending of Tammy Baldwin and other DC Dems for higher costs. It's just not true, and a big reason why is because of bills that Senator Baldwin and Dems pushed which encouraged alternative uses of energy and reductions in gasoline consumption. But when you're Republicans, and you really don't have any solutions on the ecconomy, you gotta try the "baseless whining" and hope the low-info voters fall for it, I suppose.

Saturday, August 10, 2024

What is up with these whiny, right-wing dudes?

Look at these dweebs....the biggest overlap is their respective fan bases: predominantly white, aggrieved, disaffected young men with Gulf of Mexico–size reserves of anger toward women. As Jonathan Haidt discusses in his recent book, The Anxious Generation, many of these young men grew up attached to screens and never developed the social skills to communicate with employers or women. Many are incels, addicted to porn and video games. (Ross himself was banned from Twitch after visiting the site PornHub while livestreaming the Super Bowl.) Threatened by diversity and the elevation of women in the workplace and society, they yearn for a return to a world of male domination. Many are also racist and antisemitic and hold extreme right-wing political views. So it is no surprise that they gravitate toward the only presidential ticket that represents their views. We might take inspiration from Tim Walz and call them “weirdcels.” The Trump campaign and supporting PACs have been trying to tap into this group for a while, back before a middle-aged, biracial woman replaced an old white guy atop the Democratic ticket. But now—rather than attempting a course correction, to appeal to the women voters shifting toward Harris—the Trump campaign and its allies seem to be doubling down on their outreach. Last week, a pro-Trump PAC called Send the Vote launched with a goal of raising $20 million for outreach to men under 30. The effort is headlined by the Nelk Boys, right-wing Canadian American vloggers and podcasters who recently sat down with J.D. Vance, in a rather awkward fashion, looking like bar bros meeting with a Goldman Sachs exec. But it is Vance himself, the too-online weirdo of “childless cat ladies” fame, who is perhaps the ideal figure for the type of demographic the campaign is trying to reach. He’s a Marine veteran and former venture capitalist who claims (somewhat disingenuously) to hail from Appalachia and who, much like Trump, doesn’t hesitate to equate femininity with weakness. The idea of a strong woman is frightening to him just as it is to the young men they’re trying to reach. Any man who serves under a woman cannot be a real man, as they see it. That’s why they’ve taken to calling Harris’s running mate “Tampon Tim.” The nickname seems to have originated with former Trump adviser and close ally Stephen Miller, and quickly became a meme. Trump posted a clip Wednesday of Jesse Watters using it as a slur. The Trump team claims the term is a critique of Walz’s support of a Minnesota law he signed that mandated tampons in both girls’ and boys’ bathrooms (since transgender boys can still experience periods), but it seems rather convenient that the nickname fits into their overall message of emasculation.Look, I was once a sexually frustrated young guy, so I get some of this. But the difference is that I would blame myself for not getting any action, and use feedback to figure out what I was doing wrong. By comparison, these whiny dopes stay in their basements, think they're just fine, and blame women and "others" for their failures in life. Nah, dudes, it couldn't have anything to do with the fact that you don't work and seem incapable of having any type of level, one-to-one relationship with a female, nooooo. The other article I want you to check out is from the always-excellent David Roth of Defector, with the great title of "Men on the Edge of a Nervous Breakdown," and how GOP dudes have become increasingly pathetic and repellent as they try to come up with more things to be angry about.The result of that work is a chunky slurry of gossip and fantasy and rank bigotry blasting from a thousand gilded hydrants at every hour of the day; it amounts to a grim sort of fan service catering to an even grimmer fanbase. This has limited public appeal, just in the sense of not being the sort of thing that most people are interested in hearing about, let alone to the exclusion of any other topic and in the most vexed n' fervid keening imaginable, and that poses an obvious problem for a political party that has entirely given itself over to the making of this kind of noise. The bigger issue, though, is that these imperatives only run in one direction—louder, uglier, more confrontational, further out, more. If the obvious tactical challenge here is that this shit absolutely sucks and most people hate it, the more fundamental one is that the internal incentives are such that it can only ever get worse. The fantasy of a chastened or refined Trump is, and has long been, the dumbest dream of political media dorks; the followers that put this prissy old dunce at the center of their world, and the mediocrities and opportunists who identified his rancid charisma as their own tickets to ride, know that they can only ever and always do more. This is the nature of this type of content-creation gig, which can never turn off or calm down, but also this is the dead end that conservative politics was steering towards long before Trump took the wheel. A politics whose most fundamental idea is Make Progress Stop Happening would inevitably find itself fetishizing the torment of having to live in a world in which other people, who are not even you, are somehow supposed to matter just as much... Again, some of this is just how conservative politics works; in lieu of any solution to any problem, lavishing attention upon the problem and identifying it as what the other guys want becomes the move more or less by default. But the limitations of this approach are not just obvious but overbearing. If the only answer available to the vice presidential nominee when asked What stuff do you like is a tremulous Go fuck yourself, something has gone wrong; if the only possible engagement with any or every other person is to antagonize or dominate, you will wind up lonely. There's no levity or recognizable human brightness to be found here, but there is also no air, nothing but grievance and its performance. Again, a lot of this is just a politics built around one strange man mirroring that man's decline and serving his catastrophic tastes; as Trump's former insult-comic zest has slumped into recursive and increasingly obscure complaint, his movement has followed suit, to the point where aspirants like Ron DeSantis seem somehow to have un-learned how to smile as a strategic gambit. A political movement built on conservatism's signature combination of servility, sadism, and selfishness would naturally be inclined towards someone like Trump, who authentically embodies those, uh, let's call them "values." But installing someone that relentlessly corrupt and fundamentally unhappy atop a movement so inclined towards degrading mimesis would eventually turn it inward in destructive ways. The crises and anxieties feed on and fight with each other; they multiply, and grow louder and more chaotic. It gets weirder and weirder without any of the people inside of it noticing. They are all always saying the same things, but somehow never in any kind of harmony.And Republicans continue to climb further up their own asses by the day, talking in some online language that no one with a real life and a real job cares about. And it's why the Harris-Walz theme of "Trump/GOP is a bunch of weirdos" is so effective. It not only is accurate, it also takes away any perceived power and dominance that these dead-enders try to portray to others, because instead of telling others how scary they and their ideas are, it reduces them to mockery. I think most voters are tired of the constant stresses and idiocy that are a defining characteristic of 2024 Republicans, and want everyday life to be fun and enjoyable. And it's going to be a reason that I think Dems are going to be in a better position as we approach November. Along those lines, I'm going to try for my own fun and enjoyment in a couple of hours as I join several friends and a few thousand others at the Great Taste of the Midwest. Have a good weekend, and try not to have the incels and freaks drive you down to their pathetic levels.

Wednesday, August 7, 2024

Sorry GOPs, but CBO says Biden-era immigration has increased growth, and will lower deficits

The number of people entering the United States has increased sharply in recent years. Most of the increase comes from a surge in people whom the Congressional Budget Office categorizes as other foreign nationals. Some of them have received permission to enter or remain in the country, and some have not; more detail on the composition of immigrants in that category is provided below. On the basis of pre-2020 trends, CBO would have expected the net immigration of people in that category to average around 200,000 per year. In the agency’s projections, the net immigration of other foreign nationals exceeds that rate by a total of 8.7 million people over the 2021–2026 period.And unlike what the longtime trope of “immigration hurts our services and costs us” claims, the CBO says the 2021-2023 increase in immigrants is going to have a mostly positive impact on our economy and overall budget situation. This is mostly due to increased tax payments and economic activity.

CBO estimates that the immigration surge will add $1.2 trillion in federal revenues over the 2024–2034 period. The annual increase in revenues grows over time and reaches $167 billion (or 2.2 percent of total revenues) in 2034 in the agency’s projections. Individual income taxes and payroll taxes paid by immigrants who are part of the surge are responsible for most of the effects on revenues. In addition, the surge is projected to boost economic activity and, in turn, tax revenues. The immigration surge adds $0.3 trillion to outlays for federal mandatory programs and net spending for interest on the debt over the 2024–2034 period in CBO’s projections. Annual outlays for certain mandatory programs increase over time as more immigrants in the surge population and their children who are born in the United States receive benefits. In 2034, those benefits add $23 billion (or 0.4 percent) to total mandatory spending. In addition, the economywide effects of the surge boost annual spending by growing amounts that reach $27 billion in 2034. Most notably, spending for interest on the government’s debt increases, primarily because of the higher interest rates resulting from the surge in immigration. In total, projected outlays in 2034 are boosted by $50 billion because of the surge.

CBO expects the immigration surge will put pressure on the budgets of many programs and activities funded through discretionary appropriations, including some administered or undertaken by the Department of Homeland Security and the Office of Refugee Resettlement (in the Department of Health and Human Services). Funding for certain discretionary activities related specifically to immigration totaled $37 billion in 2024—an increase of $1 billion from the 2019 amount after the effects of inflation are removed—and the Administration has requested additional funding for 2024. In addition, the surge is likely to affect other discretionary programs whose operations are affected by the size of the population, including those that provide funding for elementary and secondary education, income support, and infrastructure. If discretionary funding for the broad budget categories that are likely to be affected by a larger population was increased in proportion to the increase in the population from the surge, those funding increases would total $24 billion in 2034 and $0.2 trillion over the 2024–2034 period, CBO estimates.But CBO says the biggest effect of the increased amount of people coming to America is that our economy and total wages paid grows by quite a bit more over the next 10 years.

Some of the projected budgetary effects of the immigration surge stem from broader changes in the economy that the surge is expected to bring about. In CBO’s projections, the surge boosts total nominal gross domestic product (GDP) by $1.3 trillion (or 3.2 percent) in 2034 and by $8.9 trillion over the 2024–2034 period. The surge increases the total amount of wages paid each year by a percentage that grows steadily over that period and reaches about 3 percent in 2034. Those additional wages are a major contributor to the boost in revenues because they are subject to both payroll and income taxes. In addition, two main factors resulting from the surge—faster growth of the labor force and greater demand for residential investment—boost the rate of return on capital and put upward pressure on interest rates. The increases in interest rates are a major contributor to the boost in federal spending.Along those lines, the Federal Reserve Bank of San Francisco says that the early 2020s' jump in immigration means more jobs have been able to be added in recent years beyond what we would expect.

Short-run breakeven employment growth is estimated to be higher than long-run growth under each scenario, as shown in Figure 3. Under the baseline scenario, short-run breakeven employment growth is estimated to be around 140,000 jobs per month in the first quarter of 2024 (dark blue line). It is somewhat more elevated under the high immigration Census scenario at 151,000 jobs per month (not shown) and significantly higher at 230,000 jobs per month under the CBO high immigration scenario (red line), reflecting the recent surge in immigration that is projected to largely continue in the near term. Under the baseline projections, short-run breakeven growth will converge on the long-run breakeven growth rate (gray line) by the end of 2025. However, this return to the long-run trend stretches further out to 2027 for the CBO high immigration scenario. These estimates are largely consistent with other contemporaneous work. Edelberg and Watson (2024), for instance, estimate the recent surge in immigration as estimated by the CBO caused an upward shift in short-run breakeven growth of 100,000 jobs per month in 2024, pushing the upper range of the estimate to 200,000 jobs per month (see also Feroli 2024). The estimates in Walker (2024) also are in concordance with our conclusions under the baseline scenario, with an estimate of long-run breakeven growth of 75,000 jobs per month, and a short-run breakeven rate of 125,000 per month in 2024.This also seems to help explain how the US could be adding more jobs than we were in the 2 years before the COVID pandemic broke out, but are seeing unemploynment rise above 4% instead of staying at the sub-4% levels that we had for most of 2018 and 2019. Even with slightly higher (albeit still low) unemployment, I'd argue that the better growth and larger capacity from our early 2020s immigration surge is a good thing, both for keeping growth going now, and for our future economic outlook. It beats stagnation from low population growth and a lack of workers to replace the large population of Baby Boomers that have already retired, and the large number that will retire over the next few years. Lastly, the fact that we've had a large number of new immigrants coinciding with a significant decline in violent crime during the Biden years should be pointed out by anyone that hears Republicans trying the "IMMIGRANT CRIME" scare tactic. And isolated incidents and stories from GOP hacks don't override the boost to the economy and the overall increase in public safety that we've seen in the last 3 years of surging immigration.

Tuesday, August 6, 2024

Happily breaking down the Walz!

— Moira Donegan (@MoiraDonegan) August 6, 2024And the Trump/GOP's attempts to respond to the pick of Minnesota Guv Tim Walz tells you it was the right thing.

Trump campaign email: “Tim Walz will unleash hell on Earth!”

— Meridith McGraw (@meridithmcgraw) August 6, 2024

RADICAL, CRAZY stuff there! I've even heard Wisconsin Republicans say "we don't want Wisconsin to turn into Minnesota" as some kind of attack line. Then I see how Minnesota has a bunch of things that Wisconsinites want (like higher wages and better funded schools and lower property taxes and realioty-based gun safety laws and 21st Century social polciies), and I think "Go ahead with that, WisGOP. Your gerrymander isn't around to save your regressive BS this time." (Related note, VOTE NO in the next 7 days to stop the gerrymander from living on with these BS amendments that the GOPs are trying to sneak through). I watched the Walz part of the rally introducing him as VP today, and he seeemd to be having the time of his life, and the Philly crowd was going nuts for him. I think a lot of that is because of the type of guy Walz is, and is not.They’re right.

— B.W. Carlin (@BaileyCarlin) August 6, 2024

Because hell on earth for conservatives is a world with compassion, free food for children, IVF created families, protected trans people, strengthened education and strong unions https://t.co/2dXd9oagQL pic.twitter.com/kYsqAb8Gns

As a GenX white guy, it is embarassing to see what so many guys in my demographic (and younger!) have become, at least on the political stage. Regressive jerks who are stuck in a toxic combo of "1980s shameless yuppie" for work with beliefs on gender roles that are set back around 1952. But also being whiny little bitches whenever they get called out for being such absurd and arrogant dimwits. These are not people I would ever want to be around, let alone imposing their rules onto the rest of the country. Watching Walz and Harris speak at the VP-intro rally in Philly, both talked about "joy" as something that was important to have as an attribute. I think that's going to play really well when compared to the angry, whiny white men, self-absorbed fundies, and basement-dwelling incels that the GOP parades out on a daily basis.Real living rebuke to the incessant, droning insistence that there’s somehow no model of masculinity for young men that doesn’t entitle them to dominate and humiliate women. Yes there is. He’s holding a piglet.

— Moira Donegan (@MoiraDonegan) August 6, 2024

It reminds me of a line I heard WisDems Chairman Ben Wikler give. "Wisconsin has a red Legislature, votes purple, and has a blue, progressive heart." 100% true. What voters believe in, is progressive. And when you get progressive (or even somewhat-progressive) stuff done, people like it. Do you hear Republicans saying in public that they want to continue 2017's tax cuts for the rich or ban abortion or throw out Obamacare these days? NO WAY! They know it's electoral suicide to tell the voters what they (and their oligarch donors) really want them to do. I just watched Walz say "I learned to compromise, without compromising my values." YES! EXACTLY! And you get elected to get things done, not to grab power and give out funds to your donors. It's why Dems in the Midwest recognize that you have to make changes happen when you get the chance to do so, instead of caring more about staying in power and making connections over doing actual policy (LOOKING AT YOU COASTAL DEMS). And boy would I love a chance to see my state get a fraction done that Walz has been able to do across the St. Croix. This feels great. And you can tell the Republicans have no clue how to answer the momentum that the Harris-Walz ticket has, beyond tired lines and cultural BS that is out of step with the Real America. We just need the good folks to keep pounding for the next 13 weeks, speaking up for the right things, and never apologize for it.and for those knuckleheads who say progressives can't win in middle america, how did Walz win in MN, how did Evers win in WI, how did Whitmer/Nessel/Benson win in MI, how did Fetterman win in PA??? https://t.co/kbhN5KZGtk

— Matthew Dowd (@matthewjdowd) August 6, 2024