Look, I know that Republicans are losing college towns and the college-educated, but what they did last night was ridiculous and petty.

Let me remind you that this "anger at DEI programs" is entirely Astroturf, and directed by RW oligarchs at ALEC and other "think tanks" as a distraction from real issues.

Let's take a step back and remember that it's not like the UW has been getting much help from the state to begin with over the last 12 years.

The Legislative Fiscal Bureau noted that the System was already under a significant squeeze after years of defunding and extra challenges from the COVID pandemic.

2. To show the long-term trend of GPR funding for the UW System, the UW System's internal budget document (the Redbook) can be used to show GPR funding allocated by spending purpose. Excluding debt service, GPR funding for UW System operations totaled $930.5 million in 2012-13. (Redbook numbers include funding for the State Laboratory Hygiene and the Veterinary Diagnostic Laboratory.) For 2022-23, the comparable number is $1,027.1 million GPR, an increase of 10.4%. However, over that time, the consumer price index (CPI) increased by 27.5%, meaning the GPR funding increase was less than half the increase in inflation over the period. Table 1 shows the UW System's GPR operating budget from 2012-13 through 2022-23.

3. Since Spring, 2020, the COVID-19 pandemic has had a significant impact on UW System's operations and financial condition. UW estimates a loss of approximately $513 million due to COVID-19-related enrollment declines including forgone tuition and forgone auxiliary revenues such as housing and dining revenue. Other significant costs related to the pandemic include testing, personal protective equipment (PPE), and technology/telecommuting. As of March, 2022, the most recent data available, UW System estimates a net loss due to the COVID-19 pandemic of approximately $210 million.

So with $7 billion slated to be in the bank at the end of the 2023 Fiscal Year and a few billion more in additional revenue coming over the next 2 years, you'd think it would be a good time to have UW funding catch up to inflation. But the WisGOPs are going the exact other way.

The first 2 items in

the WisGOPs’ motion on the UW System all deal with cuts and conditions in some form.

1. General Program Operations (LFB Paper #810). Delete $15,940,900 GPR annually and 188.80 GPR positions beginning in 2023-24 from UW System's general program operations appropriation. Require that the 188.80 positions that are cut are positions that perform functions related to diversity, equity, and inclusion.

2. Workforce Development. Place $31,881,800 GPR in the Joint Committee on Finance's supplemental appropriation in 2023-24 for release to UW System upon request and approval for performance on the workforce metrics under outcomes-based funding in s. 36.112.

So not only is DEI symbolically targeted (a terrible message to send to prospective students and employers who might want to locate/stay here), but the GOP-run Finance Committee would only restore the budget cut if the UW System grovels to them and gives them some report that they can say “yes or no” to. Just absurd micromanaging from a bunch of hacks who don’t seem to have a clue how business really works in the 2020s.

And unlike what I originally thought, it doesn’t look like Evers could do a line-item veto to restore those cuts to the UW System’s operations budget. While the Governor can use the veto pen to

reduce funding, and he likely can use it to remove the DEI-related restrictions on funding, he can’t use them to

increase spending, or even to restore budget cuts that the Legislature has put in.

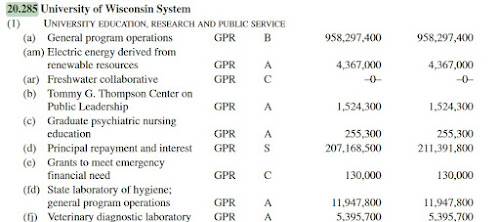

That’s because a budget bill sets new total spending amounts for all areas of state government, with schedules that look like this.

So it’s an all-or-nothing scenario on whether Evers accepts the UW budget cuts. Given that there are lots of boosts to key parts of the budget, including K-12 public education, Medicaid services,

Corrections officer pay ($342 million in add-ons, higher base pay and other assistance over the next 2 years!), and road funding, it would be a heckuva risk for Evers to turn that down and try to have the gerrymandered WisGOP Legislature come up with another bill that would be nearly as helpful. Those lowlifes would probably laugh as funding flatlines for everyone, and things quickly go downhill and get tenser over the next 2-3 months.

The cuts in state funding and micromanaging of UW are bad enough, but WisGOP added this on top of the budget cuts and conditions.

3. Remove Vacant Positions (Page 668, #15). Delete 142.00 vacant and unfunded GPR positions beginning in 2023-24. Because the budget for the UW System is determined using filled positions, there is no funding associated with these vacant positions.

So that’s a cutting of 330 positions in all in a time when the state has billions of dollars in its bank account. I wanted to know if Evers could line-item veto the job cuts, but in

looking at the Legislative Fiscal Bureau’s Informational Paper on the State Budget Process, I don’t think Evers can do that either.

Although the dollars appropriated to an agency are specified by program and fund source in the budget bill, the number of authorized staff positions is not. There is, however, backup budget detail that is considered an integral part of the budget process which specifies that number. Generally, positions may only be authorized for agencies in one of three ways: (1) by the Legislature as a part of budget enactments or by other separate legislation; (2) by the Joint Committee on Finance; and (3) by the Governor for federally-funded positions. The Department of Administration reports quarterly to the Joint Committee on Finance on the total number of authorized positions for each state agency.

Even more interesting is that the UW might be able to add back a lot of these positions on their own, in a part I’ll put in bold.

There are, however, exceptions provided to the authorization of positions. One exception allows the University of Wisconsin (UW) Board of Regents or the Chancellor of UW-Madison to unilaterally change the number of positions authorized for the UW System -- but only for positions funded from program revenue, segregated revenue, or federal revenue accounts. The UW Board of Regents is required to report, by November 1 of each year, to the Department of Administration and Joint Committee on Finance on any position changes made under this provision. A second exception also relates to the University of Wisconsin System. This provision allows the UW Board of Regents or the Chancellor of UW-Madison to create or abolish academic staff or faculty positions funded from the University's GPR appropriation for general program operations of the University. The Board and Chancellor are required to report, by September 30 of each year, to the Department of Administration and the Joint Committee on Finance on the number of such positions created or abolished under this authority in the prior fiscal year.

And the

overwhelming majority of Regents have now been appointed by Evers, so they might well be fine with keeping and/or adding back the positions that have been taken away, especially with DEI initiatives. The GOPs in the Legislature might pitch a fit, but what could they really do about it? And do WisGOPs want to be seen doubling down on racism, arrogance and regressive BS closer to an election, especially with the strong possibility of new maps in November 2024?

Cutting state funding for the UW for this very specific, ALEC-driven reason seems to be completely stupid for another reason – it isn’t going to be “those hippies in Madison” that will be hurt by these budget cuts. UW-Madison is one of the few UW System schools that weren’t in a deficit at the end of this fiscal year because of Bucky’s increased enrollment and a much larger research grant and donor base than other UW schools.

Most of the regional UW campuses have not been so fortunate. A number of state universities have gone into the red in recent years. That's due in large part to state lawmakers taking away the UW System Board of Regents' ability to increase residential, undergraduate tuition rates in 2013. Then, in the 2015-17 state budget, Republican lawmakers and former Gov. Scott Walker approved a $250 million cut to the UW System's budget.

Those factors and precipitous declines in enrollment forced many UW campuses to outsource things like custodial staff, offer retirement buyouts to faculty and spend down tuition reserves to make ends meet.....

The tuition freeze was in place until lawmakers lifted it in 2021. Regents raised in state, undergraduate tuition by an average of 5 percent in March.

The UW is slated to bring in a higher-than-expected $71 million a year in tuition revenue, which

LFB inidcated was a reflection of "changes in enrollment", and more tuition funds from out-of-state students and graduate students. The boost in in-state tuition is expected to bring in another $75 million a year, but that’s barely a 1% increase in total available funds to the System - nowhere near what’s needed to catch up to the inflation of the last 2 years, let alone the additional costs likely to happen over the next 2 years.

Ironically, the only place where UW is going to have more funding made available is as part of the increase in salaries and fringe benefit funding that the Finance Committee gave for state employees (UW grabs a portion of that). But we'll see how many workers (and campuses?) will be able to take advantage of that extra funding, after the WisGOP foolishness from last night.

New maps are coming, and I don't think this anti-UW stuff is going to fly in the majority of Wisconsin. I just hope the ongoing vandalism to one of the few things that gives Wisconsin an advantage is able to be redeemed from the WisGOP wrecking crew.