The League of Wisconsin Municipalities and other local government-based organizations have actively called for these loopholes to be removed, citing the costs to defend their assessments against these businesses, and the tax shift that results if the big boys win. But after active lobbying against those anti-loophole measures, Assembly Speaker Robbin’ Vos and other Republican “leadership” at the Capitol refused to take up a bill this session that would have clarified assessment rules and removed many of these loopholes. You may recall the seamy sequence.

There's a bit of a line pic.twitter.com/JDyNsrrzkR

— Andrew Beckett (@abeckettwrn) February 23, 2018

.@SpeakerVos says no deal could be reached on "dark stores" bill. He says @WisconsinMC was willing to compromise, but @LeagueWIMunis wasn't. There had been talks all night about trying to reach a deal on the issue that pits big box stores against local communities

— Scott Bauer (@sbauerAP) February 23, 2018

The LWM has continued its call for legislation against dark stores, and noted in its recently-released State of Wisconsin’s Cities and Villages that these appeals are becoming more common. This results in large amounts of tax burdens being shifted onto everyone else.

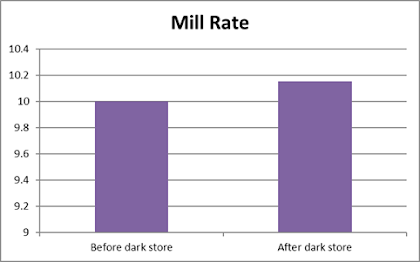

Local officials reported a rise in 2017 in the number of dark store appeals of property tax assessments. These challenges are made by businesses, especially larger retailers, seeking to lower their assessments by contending that local officials are using the wrong method to value their property. Local officials said that in 2017 they had 79 tax appeals that they listed under the dark store rubric, up from 63 challenges in 2016 and 66 in 2015. (See Figure 3.1.) Most of the appeals continue to involve cities and villages with more than 15,000 residents, though smaller communities accounted for much of the growth in these cases in 2017…Let me illustrate how this property tax shift affects a local government’s financing. To use a crude example, let’s say a community has $100 million in total property value for next year, and is planning to levy to its state limit of $1 million for 2019. This means there would be a “mill rate” of $10 per $1,000 of value.

The dark store issue impacts how the local property tax “pie” is divided. When the local assessor calculates a given property’s value, this assessment also determines what share of the overall tax levy will be paid by the parcel’s owner. If a retailer or other property owner successfully appeals an assessment, and the total tax levy and assessed values of other properties in that city remain the same, then the store’s share of the property tax levy will decline while homeowners and other businesses will pay a larger share. Given that these types of appeals involve properties with substantial property values, they can result in sizable tax shifts, which helps account for the controversial nature of the dark store issue.

Now assume the business that has a $2 million property value is able to successfully argue that their property value should be $500,000, due to the “dark store” loophole. This now reduces the overall property value in the community to $98.5 million.

The amount of property taxes collected by the community won’t change, but the rate will, which means homeowners and others have to pay more. Let’s use a $150,000 home as an example of this effect.

And that’s just the municipality’s share of the property tax bill. The same effect would be repeated with property taxes designated for schools, and the property taxes paid to the county.

With this effect becoming more common, local communities in Wisconsin are increasingly demanding action to close this loophole that is shifting taxes away from the big-box stores, and onto homeowners and other property taxpayers. 91% of West Allis residents voted last week to recommend that the dark store loophole be taken away, and voters in counties such as Kenosha, Racine and Washington will all either have or are considering advisory referenda during November’s elections.

The LWM also notes that businesses are getting their assessments lowered through another argument that was allowed under the Wisconsin Supreme Court’s Walgreen’s vs City of Madison decision in 2008.

In addition to dark store challenges, another type of tax appeal involves businesses with long-term leases that require the tenant to pay extra costs beyond just rent, such as property taxes, insurance, and repairs. Over the past decade, pharmacies with this type of lease have brought successful appeals, arguing that assessors should not be allowed to use a business’s “above market rent” to assign a higher value to the property.The LWM supported a bipartisan bill that would have clarified this situation and removed this tax break from Walgreen’s and other companies that have similar arrangement, but that was also shot down by Robbin’ Vos, Scott Fitzgerald and the Republican leadership in the Legislature after WMC’s “advice” got through.

The survey suggests this type of appeal may be becoming less frequent, with local leaders reporting that appeals in this category dropped to 38 in 2017 from 51 in 2016. (See Figure 3.3.) This may reflect the fact that some of these businesses have won their appeals, leading assessors to change their practices. Local leaders have said they believe the trend might still grow, however, if this type of lease is adopted by other kinds of companies.

After the major tax breaks given to corporations through the GOP’s Tax Scam in Congress, and several other pro-corporate measures that have been shoved through at the state level (including the M&A “big giveaway” to manufacturers and Big Ag, and wage suppression measures to help corporate profit margins), do these guys need even more help through dark store loopholes and Walgreen’s -style? Especially given that it’s coming at the expense of the “hard-working taxpayer” that Scott Walker loves to claim that he cares about?

Notice that Walker has said nothing about dark stores or Walgreen’s-type cases because he values the donations from corporate greedheads over helping the majority of taxpayers in the state. This gives a huge opening for Tony Evers and other Dems to call for more tax fairness by removing these loopholes, and keeping Wisconsinites from having their taxes raised by this legal maneuvering that very few people outside of connected corporates approve of.

Do you have a list anywhere of the cities that have settled with big box retailers?

ReplyDeleteI don't know if there is a site with a full list, but if you Google "dark,stores Wisconsin", you'll see plenty of stories that have a list of decisions where big-box stores got their taxes cut and made others pay more.

ReplyDelete