To start off, the Budget Project reminds us that Wisconsin’s state and local tax system currently is somewhat regressive, where the richest people pay the lowest percentage in taxes.

Governor Evers proposed to reverse this regressiveness by offering increases in the Earned Income Tax Credit and Homestead Credit in his original budget (which would generally go to lower-income people) and removing Walker-era tax cuts for capital gains and manufacturers, (which overwhelmingly have gone to richer people). The GOP-run Joint Finance Committee removed all of these items in one swoop in May, along with Evers’ proposal to expand Medicaid under the Affordable Care Act.

Interestingly, JFC kept most of Evers’ plans for a lower-and-middle class income tax cut (although it ended up being a bit smaller than Evers had), and allowed for a more-level income tax cut that would offset what people would pay now that more online retailers have to pay sales tax. JFC also removed a gas tax increase that Evers also wanted to pay for roads, and offset much of that with a $10 increase for automobile registrations and a significant jump in title fees.

The Budget Project notes that these moves in Joint Finance hiked the amount of taxes and fees that the poorest Wisconsinites will pay by $80, to the point that they are now paying more than they did before.

The governor’s plan would have helped even out a tax system under which residents with the lowest incomes pay a higher share of their income in state and local taxes than taxpayers with the very highest incomes. Taxpayers with incomes in the lowest 20% by income – a group with an average income of $14,000 – would have received a tax cut under the governor’s plan, but will pay more in taxes and fees under the budget passed by the Legislature.For middle income Wisconsinites, they would also have been better off under Gov Evers plan, but unlike poorer people, they still will get a tax cut under the signed budget.

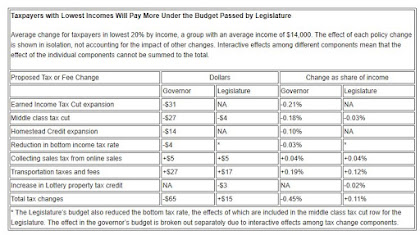

Taxpayers with the lowest incomes would have paid an average of $65 less in taxes and fees annually under the governor’s budget, representing a decrease of 0.45% as a share of income. Under the budget passed by the Legislature, taxpayers in this group will pay more, with an increase of $15 in taxes and fees on average, representing an increase of 0.11% increase as a share of income.

But look at how the richest 1% of Wisconsin were protected under the GOP’s moves in Joint Finance and the State Legislature.

Governor Evers’ budget included changes that would have reshaped Wisconsin’s tax code to give less of an advantage to wealthy taxpayers, by reining in tax breaks for the rich and redirecting the benefits to the middle class and people with low incomes. In contrast, the Legislature’s budget will have almost no effect on the wealthiest taxpayers.And these re the same 1%ers that already got a massive tax cut in 2018 out of the GOP Tax Scam from DC. God forbid they give some of that back at the state level!

The governor’s plan would have raised taxes and fees by an average of $11,681 on average for taxpayers in the top 1% of income, a group with an average income of $1.4 million. That increase represents 0.82% of their income on average. The budget passed by the Legislature increases taxes and fees paid by the top 1% by $71, an amount that rounds to zero as a share of their income.

The Budget Project’s chart of the tax and fee effects on the richest Wisconsinites is telling, as the only increases those people have to pay seem to come from the fact that this tax bracket is likely to own and title fleets of vehicles for their businesses. In addition, they’re the biggest beneficiaries of a move by the GOP Legislature to give nearly $65 million in tax dollars to the state lottery to make property taxes be $4 less than Evers’ original budget would have.

Also remember that the GOP-run Joint Finance Committee not only cut out much of Evers’ proposed increase to K-12 education, but also moved that funding from the state’s General Aid formula (which gives more money to poorer districts), and put it into the School Levy Tax Credit (which gives a bigger boost to richer property owners and districts).

When you lay it out this way, it’s really obvious how the GOP chose to support the needs of richer Wisconsinites over Evers’ plans that were geared more toward poorer and middle-class Wisconsinites. No wonder why there have been a few events around Wisconsin this week demanding a payback of the many gains that the 1% have been able to pull off in recenty years through their friends in Capitols, be they in DC or in Madison.

It’s time we say no. Enough. We are going to stand up for a fair economy that’s not rigged for those at the top. The wealthy elite have to pay their fair share! #TaxTheRich #GOPTaxScam @taxmarch pic.twitter.com/hWYhQeACxS

— Chris Taylor (@ChrisTaylorWI) July 24, 2019

No comments:

Post a Comment