Ventings from a guy with an unhealthy interest in budgets, policy, the dismal science, life in the Upper Midwest, and brilliant beverages.

Saturday, July 3, 2021

As COVID fades, the economy changes back. And jobs are moving as a result

One thing that's stood out in recent economic reports is that as COVID fades as a factor in Americans' spending decisions, we are seeing jobs and spending patterns shift accordingly.

On the positive side, more money and jobs continue to come back to bars, restuarants, hotels and entertainment. The jobs may not be catching up to the increased spending (particularly at sit-down bars/restaurants), which explains some of the alleged shortages that we are seeing in those sectors. But both parts have certainly been on the rise.

With Summer in full swing and any COVID restrictions going by the wayside, there's no reason to think this upward swing won't continue in these sectors. Now the problem is trying to get enough staff to catch up to the jump in demand.

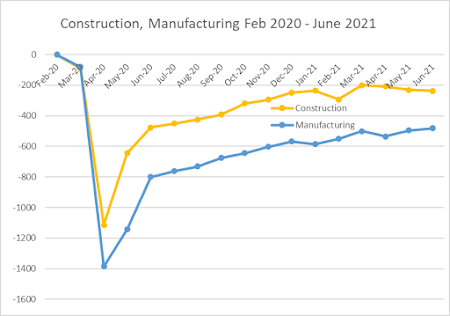

On the flip side, employment in manufacturing and construction has been flatlining, after getting a boost in the !st quarter of 2021 as more houses and goods were in demand, and weren't booming in price as much as they are today.

We also found out this week that overall spending on construction continues to be in a funk, even with the growth in home-building.

Construction spending during May 2021 was estimated at a seasonally adjusted annual rate of $1,545.3 billion, 0.3 percent (±1.0 percent)* below the revised April estimate of $1,549.5 billion. The May figure is 7.5 percent (±1.3 percent) above the May 2020 estimate of $1,437.7 billion. During the first five months of this year, construction spending amounted to $594.8 billion, 4.6 percent (±1.0 percent) above the $568.5 billion for the same period in 2020.In fact, the seasonally-adjusted amount of construction was lower in May than it was in January. And it's worthy to note the divergence in the different categories of construction. Change in construction, May 2021 vs Jan 2021 (annual basis)

Private Residential +$20.5 billion

Private Non-Residential -$11.8 billion

Public Construction -$13.2 billion

TOTAL -$4.5 billion Sure seems like there could be a need for an infrastructure package to re-start construction and the related manufacturing sectors, eh? In addition, now that the entertainment, dining and tourism sectors are opening up, there is less need for Americans to buy supplies at grocery stores and big box warehouses. As a result, the runup in jobs that we had in those sectors has now ended and is now reversing. This is likely in part due to the reduced demand, and likely in part due to other types of service jobs reopening, allowing people to change jobs. The question now is "how long does this readjustment continue"? When does this adjustment end, and what changes in employment and spending are permanent in the post-COVID America? I don't think those changes are done as of this time, and we need to be aware of the fallout and disruptions that are likely to continue in the 2nd half of 2021. The economy might grow enough so that the downsides aren't much, but I bet the growth will be uneven, depending on what type of sector we are talking about.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment