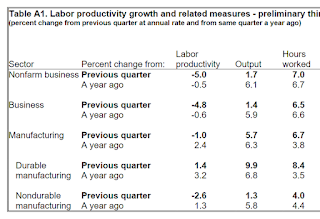

Nonfarm business sector labor productivity decreased 5.0 percent in the third quarter of 2021, the U.S. Bureau of Labor Statistics reported today, as output increased 1.7 percent and hours worked increased 7.0 percent. This is the lowest rate of quarterly productivity growth since the second quarter of 1981, when the measure decreased 5.1 percent. (All quarterly percent changes in this release are seasonally adjusted annual rates.) From the third quarter of 2020 to the third quarter of 2021, nonfarm business sector labor productivity decreased 0.5 percent. The four-quarter rate is the lowest rate since the third quarter of 2011, when the measure also declined 0.5 percent.But we certainly haven’t seen layoffs from the lack of productivity, as jobless claims in America continue to fall. In fact, we are now near our pre-pandemic lows of 203,000 (seasonally adjusted) new claims.

And the added work and lack of layoffs helps explain how the economy continued to grow in Summer despite the drop in productivity, because the amount of hours worked rose sharply. And while non-farm labor costs per unit was higher, overall labor compensation per hour wasn’t up that much at all - only up 2.9% for Q3 (BEFORE inflation), and all 3 quarters have had below 4% compensation growth for 2021. Manufacturing has had even lower increases in hourly compensation in 2021. And I think a reason behind Strike-tober becomes obvious when you look at how manufacturers have been able to get their workers to crank out a lot more product while those same workers aren’t seeing their raises keep up with inflation. It also looks like Q3 2021 was the last large adjustment back to what our “new normal” is in the manufacturing world. Last quarter was the first time total manufacturing output significantly exceeded the previous peak at the end of 2019 (aka pre-COVID). But you’ll notice that the number of hours worked is nowhere near back to 2019’s level. That means there have been significant increases in manufacturing productivity over the 21 months of the COVID World, well above what we saw before the pandemic.BREAKING: The number of Americans applying for unemployment benefits fell to a fresh pandemic low last week, another sign the job market is healing. Jobless claims dropped by 14,000 to 269,000 last week. https://t.co/DDz31jlGgt

— The Associated Press (@AP) November 4, 2021

Manufacturing sector output is now 1.1 percent above its level in the fourth quarter of 2019, the last quarter not affected by the COVID-19 pandemic. Hours worked in manufacturing remain 3.3 percent below the fourth-quarter 2019 level. The manufacturing labor productivity index is now 4.6 percent higher than in fourth-quarter 2019, reflecting growth at a 2.6-percent annual rate during the pandemic period of fourth quarter 2019 through third quarter 2021. This rate is much higher than the 0.2-percent average annual growth rate during the previous business cycle—from 2007 to 2019—and is just above the long-term rate of 2.3 percent per year from 1987 to 2020.No wonder people are demanding more money for the job – they’re not getting rewarded for the extra product they make, nor the extra profit that their bosses are receiving. Once again, what we’re seeing is how the American worker is having enough of getting stretched to the limit while not getting paid back nearly enough for doing so. Maybe that's starting to change, as today's blowout jobs report mentioned that average hourly wages in manufacturing have risen by a total of 0.9% in the last 2 months. And 60,000 more jobs were added in manufacturing, even with those higher wages. Employers need to understand the reality that the COVID World (and hopefully post-COVID World) entails. Better pay up, or you’ll continue to struggle to grow. And if that means we are seeing the end of the record corporate profits that marked the first half of 2021, OH WELL!

No comments:

Post a Comment