Shared revenues had already flatlined in the late 2000s, but Republicans took over state government in 2011, you can see that they cut shared revenues to local governments, and never did much to replace them. (And if you try to say "the tools of Act 10", that was a one-time shot more than 10 years ago, while the shared revenue cuts remain). With that in mind, I want to focus in on a few types of shared revenues that we can use our surplus on - roads, schools and other local government operations. Let's start with the roads, and let's go back to a recent paper from the Wisconsin Policy Forum that noted local governments were slated to collect $62.8 million in wheel taxes in 2021, and over $50 million higher than it was 6 years prior to that. And a big reason why is because wheel taxes are one of the few ways for local governments to add resources in Wisconsin, since state law prevents most cities, villages and towns from imposing a sales tax, and growth in property taxes have been near-zero due to Republican-imposed revenue limits. In order to get roads fixed and continue transportation services, many local governments in Wisconsin put in the wheel tax to try to keep up with these needs. But what if the state "bought off" those local wheel taxes? Using the $62.8 million figure from 2021, it would cost around $251.2 million for 4 years, and could be set up as an incentive program, where the community passes a resolution getting rid of the wheel tax and the state sends the same amount of money to that community. Those payments would be exempt from revenue limits and tied it to the same items that the current wheel taxes pay for. That seems to be a pretty good investment to me, especially when Wisconsinites in those communities see their registration fees go down. And for communities that haven’t had to put in a wheel tax yet, they shouldn’t be shut out of getting help, and should also get some additional local road aids to take pressure off of the property tax. We could do that through a “bonus pool” of road aids to local communities that can only go to places that don't have wheel taxes, and then distribute funds by the current road aid formula out of that. Using the 2023 amount as a base (which will be what these communities use when determining budgets), county and municipal aids total $526,137,000. If we made the “bonus pool” $62.8 million for each of the next 4 years, that would be a bump of at leat 12%, and likely more given that a lot of wheel tax communities are included in that total. You could even add in a provision where all bonus pool communities cannot put in a wheel tax for those 4 years. On the school aid side, I note this recent LFB memo to Dem lawmakers brings up that the state’s voucher and charter programs are taking away $202.6 million from K-12 public schools in this school year, and nearly $180 million outside of Milwaukee. Property taxes can be raised to make up the difference, but I'll ask a simple question - Why should those districts have to raise property taxes? Instead, why not use state funds to replace the property taxes used to backfill the losses for vouchers? If GOPs complain about Milwaukee being included in this (since MPS is receiving an outsized share of the state’s stimulus allocation), then you can leave them out and have the other $180 million go to districts for next year, and that and then some for the year after that. On top of the voucher backfill, we can use extra state funding to give further flexibility to schools and local governments, by giving an extra distribution of state aid, with 1/2 of that being added to a community’s/district’s revenue limit, and 1/2 being used to cut property taxes by using state funding instead. We can do this first as a rebate for property taxes paid this Winter (sent out by the local communities, after getting a payment from the state), then have another payment for 2022-23 (with the cut coming in the December property tax bills), and another for 2023-24. So how much money would that be? The Legislative Fiscal Bureau made estimates last year of how much Wisconsinites would pay in property taxes, and it looks like this. If we wanted a 4% drop in property taxes paid for schools, municipalities and counties, that’s a $433.1 million rebate for this year, and $435.2 million for 2022-23. However, you’d have to double it up to increase the revenue limits, so $866.2 million this year and $870.4 million in the next year. A 4% drop in property taxes would be around $135 (based on the LFB's chart, though your situation may vary), and for equity's sake, let's also include a $135 rebate for anyone taking a renter credit in 2021, and add $135 to the $300 limit for that credit for 2022's taxes (a 45% increase). I'll guess that renters make up 40% of the $430 million that was given out in the combined Property Tax/Rent Credit (PTRC) in 2019. So let’s use 45% of that $172 million, and add it up. Wheel tax refund $62.8 million x 2 =$125.6 millionState Shared Revenue payments have *decreased* under Republican control leaving local governments left to foot the rising costs of essential services.

— Evan Goyke (@RepGoyke) January 25, 2022

The solution is clear, we need to raise Shared Revenue. https://t.co/vvRBkhPfwJ pic.twitter.com/i2tjn8PtpX

“Bonus pool” for local transportation $62.8 million x 2 = $125.6 million

Fill “school voucher hole” of property taxes for 2022-23 $180 million

Cut prop taxes/increase local govt aids $866.2 million + $870.4 million = $1,736.6 million

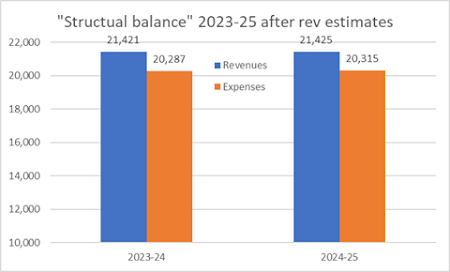

$135 renter's rebate $77.4 million x 2 = $154.8 million TOTAL $2,322.6 million That leaves us with a little less than $1.58 billion left at the end of the semester. I suppose you’d see GOP crocodile tears about “longer-term costs”, so let me take a look at what LFB estimated for the 2023-25 “structural budget” (based on laws when the budget became law in July), but I’ll use the updated figures from the revenue estimates. That’s a “structural surplus” of about $1.1 billion a year, before we talk about revenue growth or program/spending growth. So if we’re adding around $1.25 billion a year for these tax moves, that becomes a structural deficit of around $140 million, and we’d start eating into that $1.74 billion. Sure, this would reduce the cushion we'd have for an economic downturn goes down over time, but we've also got $1.73 billion in a Rainy Day Fund that's so high the state legally can't add any more to it! So we have the capacity to go big with this kind of structural reform, where we restore funding to our local governments and reduce our reliance on property taxes. We can if we choose to, and I certainly think Governor Evers and Capitol Dems should give it try with bills and a very vocal push.

No comments:

Post a Comment