Ventings from a guy with an unhealthy interest in budgets, policy, the dismal science, life in the Upper Midwest, and brilliant beverages.

Monday, October 10, 2022

Despite OPEC moves and refinery outages, oil keeps pumping in US.But big reports later this week

With gas prices at or above $4 a gallon in Wisconsin these days, I wanted to take another look at this country's supply-and-demand situation for the product, and oil in general.

First off, while there has been (conveniently timed) disruptions with refinery outages in both the Midwest and the West Coast in recent weeks, the amount of oil being produced in America still remains at or above 12 million barrels a day. That's basically what we were doing in early 2019 when prices weren't nearly this high, and well above the 11 million that was being pumped out when President Biden took office in January 2021.

And let's add that the Biden Administration is still releasing oil from the Strategic Petroleum Reserve and delivering it to refiners through the end of next week, so put that 600,000 or so a day on top of what you see in that graph.

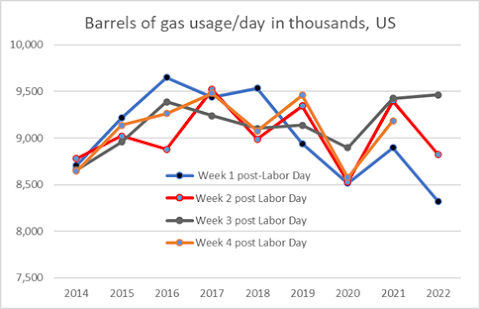

On the demand side, I wanted to look at the full weeks after Labor Day in recent years, as that removes the distortions of the holiday and gives us a good reference for what consumption looks like in a normal school/work period. Consumption had trended down for the first two weeks after Labor Day this year, but there was a sizable amount of usage in Week 3, the last week reported so far.

This meant that availability of gasoline dropped to their lowest post-Labor Day levels in 5 years, after being quite a bit more plentiful earlier in September.

It makes Thursday's report on gasoline consumption and availability an important one, because let's see if the increased demand and restrained supply is a one-week blip, or a sign that things have actually gotten tighter, which would give prices a legitimate reason to be higher vs the speculation/greed BS we've had to deal with in a lot of this year.

That being said, it'll also be intriguing to see the reaction when the Consumer Price Index shows another drop in gas prices for September, which likely will lead to another lower overall number. Because it's been interesting to me how the Federal Reserve and speculators have pointed to CPI increases in earlier 2022 as an example of "high inflation" for Q3 (not true), but that they're now avoiding the recent history and looking ahead to OPEC supply cuts and higher future prices as a reason to keep tightening money.

But what's not mentioned is that the gasoline supply picture should loosen up in the next couple of weeks as the refineries come back online now that Q3 profits have been locked in, and that along with the traditional lower driving levels of October should counteract any limits on oil supply that start hitting the system in the coming weeks.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment