Gross domestic product increased at a 2.9% annualized rate, the government said in its second estimate of third-quarter GDP. That was revised up from the 2.6% pace reported last month. The economy had contracted at a 0.6% rate in the second quarter. Economists polled by Reuters had forecast GDP growth would be raised to a 2.7% rate. The upward revision reflected upgrades to growth in consumer and business spending as well as fewer imports, which offset the drag from a slower pace of inventory accumulation.Not bad at all, but I'll note that there was some wide disparities in GDP changes for Q3, based on the type of industry. Changes in GDP, annual rate Q3 2022

Goods +8.2%

Services +3.2%

Motor vehicle output +2.5%

Structures -16.1% That reflects the big declines in housing starts, which seems to be directly related to the overheated housing market and the Fed-induced rise in interest rates. And speaking of the Fed, they were also in the news today.

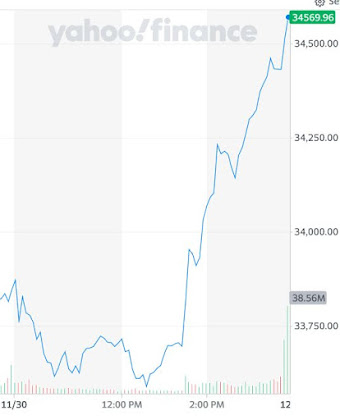

The Federal Reserve could pull back on the pace of its aggressive rate hikes as soon as December, Fed Chairman Jerome Powell said Wednesday at an economic forum. “The time for moderating the pace of rate increases may come as soon as the December meeting,” he said in remarks at the Hutchins Center on Fiscal and Monetary Policy, his last public appearance before the central bank enters a blackout period ahead of its December 13-14 policymaking meeting. Since rate hikes can take months, even years, to flow through the economy, the Fed now appears to be adopting a “lower and slower” model of smaller rate hikes over a longer period. Ideally, that approach will lead to the proverbial “soft landing,” reining in inflation while avoiding recession or significant layoffs. “I do continue to believe that there’s a path to a soft or softish landing,” Powell said Wednesday. “I think it’s still achievable.”About damn time you started to back off, Jerry. And Wall Street liked it as well. And we've seen quite a bit of evidence that inflation continues to flatten out. Now that election season is over, US gas prices have fallen 11 cents in the last week and 27 cents in the last month, and housing prices continue to deflate. And while this isn't great for workers, today's GDP report revised wage and salary growth for Q2 down from $182.9 billion to $132.5 billion. So why would we want to keep tightening when it looks like there is moderate growth and moderate inflation? But you know what the GDP report showed still was inflated? Corporate profits, which stayed near the record $3 trillion annual rate it hit in Q2, and profit margins, which also stayed at record levels in Q3. There's not too much the Fed can do about that inflation, but Congress and the Federal Trade Commission sure can. And as 2023 looms, it seems like that's the next step that needs to be taken (or at least threatened) in order to return gains to the workforce that helped to make it happen, while still allowing growth to continue.

No comments:

Post a Comment