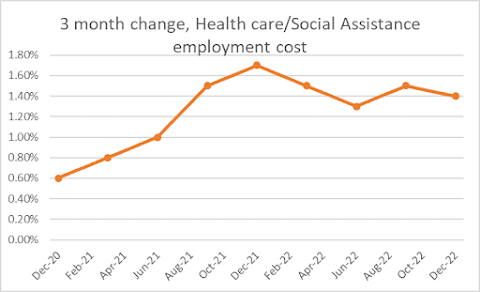

American employers spent just 1% more on the wages in the fourth quarter 2022, as compared to the third quarter. This marked a decline from the additional 1.3% they’d spent from the second to third quarter, and from the additional 1.4% they’d spent from the first to second quarter. Two quarters of consecutive decline shows that employer costs are falling, and that they will thus have fewer reasons to raise prices—a good sign for anyone worried about inflation. It also means, though, that workers currently have less leverage to negotiate higher wages for themselves. Absent further changes in the economy, employer spending on wages looks to be headed back to the prepandemic trend. In 2018 and 2019, the average increase in this kind of spending was 0.75% per quarter.A 1% increase for Q4 is still a 4% annual rate, which means workers are still able to get decent raises. But it’s cooling enough that there shouldn’t be a major cost burden for employers, or boost inflation for consumers. And digging further into the report itself, it looks like the rapid increases in wages and benefit costs that happened over the last two years in the lower-wage service sector faded at the end of 2022. That indicates the shortages in that sector may be fading, after losing a large number of employees at the start of the COVID pandemic, and then struggling to find people as business came back strongly in 2021 and 2022. However, one key sector had its compensation cost increases stay high in Q4, indicating that it’s still tough to hire and keep employees in these jobs. But even in health care, that's not a runaway increase. And what’s also intriguing is that even with overall inflation fading as 2022 ended, the year-over-year increases in employment costs in both 2021 and 2022 weren’t as high as overall inflation. So as

I agree with this thought, and the Employment Cost Index report should tell the Fed that we are in a different situation than we were a few months ago, and that it is time to ease off on rate hikes. We’ll see if they get the hint, or if the central bankers think workers need to suffer more in order to make cost increases and inflation go even lower than the already-calming situation they are in today.Most telling is the 3.7% annualized increase in wages for private workers x incentive pay. This is the best window into underlying wage growth. More evidence that inflation is headed in the right direction and the Fed should soon pause its rate hikes.

— Mark Zandi (@Markzandi) January 31, 2023

No comments:

Post a Comment