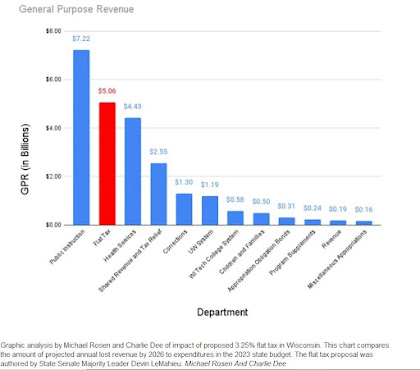

According to the nonpartisan Legislative Fiscal Bureau, when fully implemented the flat tax would reduce the state’s revenue by $5.06 billion annually. For perspective, the UW System's share of general purpose revenue in 2023 is $1.3 billion. The Department of Corrections also receives $1.3 billion. The total of $2.6 billion is slightly more than half (51%) the total tax cut. To put it another way, you could eliminate all state funding for corrections and the UW system, and still need to cut another $2.46 billion in state spending to pay for the tax cut. A group of national economists analyzed Michels’ flat tax proposal in October and wrote that a 3.54% flat tax, “…would mean draconian cuts to state services including public safety, K-12 education, environmental protection, the University of Wisconsin and Technical College systems.” Yet LeMahieu’s proposal would slash even more from state revenue.Rosen and Dee included this graphic that shows just how much of a hole the flat tax would blow in the budget every year by the time the flat tax is fully in place in 2026. You also can see just how much state spending would have to be cut to offset that. Worse, Rosen and Dee point out that the flat tax won't do anything to increase Wisconsin's attractiveness to workers and families, and could well make things worse for most of us, and increase our demographic challenges.

Now flat-tax advocates make up all kinds of justifications for this boondoggle. One is that we need to lower the tax rate to keep people from leaving the state. This ignores the fact that seniors relocate for a variety of reasons, including to escape Wisconsin winters and to be closer to their children and grandchildren. Think about how attractive Wisconsin will be to seniors or anybody else after our state has lacerated its spending on roads, education, public safety, clean water and air. Then raise your hand if you want to decimate our quality of life in an attempt to keep rich folks from relocating to Florida and Arizona. Instead of repeated attempts to carry water for Wisconsin’s richest 1.4%, Republican politicians should focus on boosting the quality of our lives by improving our education systems and infrastructure while developing targeted policies to encourage entrepreneurship, rural development, and a more diversified economic base.Marquette University economist Philip Rocco has also criticized the GOP's flat tax scheme, and says we should invest the billions of dollars into longer-lasting change that results in jobs and increases the state's economic competitiveness.

We have the resources to invest in a lot of things that Wisconsin has fallen behind on in the last 12 years, bring our human and physical infrastructure up to speed, and give our community schools and local governments a chance to preserve and expand their public safety and social services. The last thing we should do is to use those funds for nothing beyond a massive tax giveaway to the rich, which won't have nearly the economic impact, and will make a whole lot of Wisconsinites worse off.Second thing that deserves clarity: surplus is effectively a one-time opportunity. Use it to make investments that create multiplier effect for state. Examples of what this looks like can be found in many states, including MN, and in the deep history of WI.

— Philip Rocco (@PhilipRocco) January 24, 2023

No comments:

Post a Comment