As an example, "left-leaning" Rick Newman examined Elizabeth Warren’s wide-ranging plans in Yahoo! Finance, and expressed alarm at “the staggering cost” of the major changes that Warren wants to put into place to unrig our economic system.

Altogether, the Massachusetts senator’s agenda would require $4.2 trillion per year in new federal spending, and a like amount in new taxes, if she paid for everything without issuing new debt. The federal government currently spends about $4.4 trillion per year, so Warren’s plans would nearly double federal spending.Newman is using the “$3.4 trillion in tax revenue” and “$4.4 trillion in spending” that the US got in the 2019 Fiscal Year. However, this is a bad comparison.

The Treasury takes in about $3.4 trillion in tax revenue each year, so if Warren levied new taxes to pay for everything, federal taxation would rise by 124%. She could pay for some of her plans by issuing new debt instead of raising taxes, but with annual deficits close to $1 trillion already, that might be unwise.

1. Newman uses 2019 figures for tax revenues while using the 10-year (inflation-increased) average for Medicare for All. That’s not a fair figure, because as you’ll see below, the net cost the Urban Institute got for Medicare for All in 2020 was $2.7 trillion.

2. If you look at the Congressional Budget Office’s projections for the next 10 years, the correct numbers are $4.6 trillion in average tax revenue and $5.8 trillion per year in spending. So while implementing all of Warren’s plans would likely lead to a significant increase in government spending and taxes, it will not require doubling spending or taxes to do so.

3. Also worth noting – the added spending assumes other areas won’t have spending cuts, which seems unlikely in Warren presidency (particularly the military and Border Patrol, both of which have been massively beefed up under Trump).

Newman does note that Warren’s plans-to-date do account for the $800 billion a year in initiaitives that are outside of Medicare for All.

But that still leaves the largest blue circle on the right.

The biggest chunk of new spending in Warren’s agenda, by far, would be Medicare for all, the single-payer health plan she would impose to replace all private insurance. Warren explains how she would pay for all of her plans—except this one. With fellow Democratic candidates pressing her for details, Warren says she’ll provide financing options for Medicare for all soon.I immediately questioned that figure to Newman on Twitter, claiming that this figure wasn’t accounting for the fact that Medicaid and Medicare would be absorbed into the new program. But I was mostly wrong about that, as the $3.4 billion is the EXTRA cost of Medicare for All on top of what we do today in those programs and other federal aid.

A single-payer plan covering every American would cost about $3.4 trillion per year, according to the Urban Institute and other analysts. Again: that’s equal to all federal tax revenue in 2019. Warren says “costs” would go down for middle-class families under Medicare for all, because all care would be free and families would end up paying less in new taxes than they now pay for health care. But that doesn’t mean Americans would be comfortable with the tradeoffs.

Fair enough, but let’s dig further into the Urban Institute report that Newman cites and see where this figure comes from. First off, the Urban Institute’s estimate comes from the widest-ranging type of single-payer you could have (reform 8 in a list of ways to expand medical coverage). All American residents (not just citizens) are covered, and a large range of services are covered.

Single-payer enhanced program covering all medically necessary health benefits (dental, vision, hearing, and nationally uniform home- and community-based LTSS), eliminating cost sharing, enrolling all US residents (including the undocumented population), maintaining Medicaid for institutionally based LTSS, and eliminating private health insurance coverage.OK, so what would it cost and how much would it cover, using 2020 estimates?

Coverage. Reform 8 is the only one in this report that eliminates uninsurance among both the legally present and undocumented immigrant populations. This intent, clearly indicated as components in the most-discussed single-payer proposals,30 introduces some additional uncertainty into the estimates. For example, we do not attempt to estimate any potential effect of additional residency (legal or otherwise) or medical tourism that could result from the reforms.31 Nor do we estimate less than universal coverage among the undocumented population, some of whom might decline providing information to a government entity for fear of deportation. Thus, we estimate this single-payer program covers 331.5 million people (table 13), increasing minimum essential coverage by 34.6 million people compared with current law. The program eliminates all other forms of insurance coverage.The $157.6 billion income tax offset results from employers not getting a tax break due for providing health insurance, because that becomes superfluous when the “providing insurance” part is taken care of under Medicare for All.

Health care spending. Net federal government health spending, accounting for savings from eliminating Medicare, Marketplace subsidies, the acute-care portion of Medicaid, and uncompensated care, as well as savings on other federal insurance programs, increases by $2.8 trillion in 2020. Offsetting increases in income tax revenue mean $2.7 trillion in additional federal revenue is needed to finance the new program.

But that $157.6 billion that business won’t get in tax breaks is small compared to savings that will come to them, consumers, and states under single-payer.

States’ health care spending decreases by $259.6 billion, accounting for continuing Medicaid spending on institutionally based LTSS and savings from eliminating Medicaid/CHIP acute care, other state-specific programs, and uncompensated care. Employer spending on health care decreases by $954.7 billion, and household spending falls by $886.5 billion. The only remaining household spending required is in the continuing Medicaid program for those using LTSS. Providers no longer face any uncompensated care because all care is financed through the federal government, reducing their aggregate spending by $24.1 billionSo that knocks off more than $2.1 billion of that $2.7 billion in 2020. Most of that $2.1 billion isn’t currently collected as “taxes”, but it sure takes money out of the pockets of people and businesses, which has a significant effect on our economy.

Even the Urban Institute followed up their single-payer analysis by noting that Newman’s alarmism about “$34 trillion in new taxes” is misleading. Because while the total amount of spending is higher, it’s nowhere close to that level.

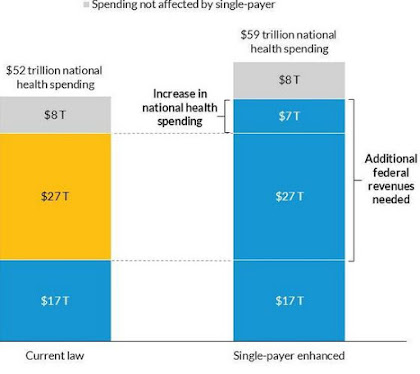

For this approach to reform, federal spending would increase by $34 trillion over 10 years, but health spending by individuals, employers, and state governments would decrease by $27 trillion, so national health spending would increase by $7 trillion over the same 10-year period, from $52 to $59 trillion.True, but there aren't "$3.4 trillion a year in extra costs" either, like Newman claimed.

The $8 trillion includes costs associated with an array of expenses, such as medical care for members of the military and their families while military members are deployed, services provided to foreign visitors, acute care provided to people living in institutions (e.g., prisons and nursing homes), and the value of new construction and equipment put in place by the medical sector. This spending also includes long-term services and supports by states and individuals that would continue under reform. For our purposes here, we refer to this $8 trillion in spending as “spending not affected by single-payer.”

The taller second bar shows that the total national spending under a single-payer program would be higher than under current law. The $17 trillion in federal spending under current law would be shifted to help fund the new program, and the federal government would take over the $27 trillion in current health care spending by employers, households, and state and local governments.

Fully funding a new single-payer program would require an additional $7 trillion in federal spending beyond that repurposed $44 trillion. The $8 trillion in spending not affected by the single-payer program would continue to be funded by a mix of government and private sources.

Thus, it is not appropriate to compare an estimated increase in federal spending of $34 trillion over 10 years with a current-law level of national health spending of $52 trillion over the same period and conclude these are savings in national health spending.

Theoretically that middle $27 trillion (the $2.1 trillion + inflation over 10 years) the feds take on can be made up for with higher federal taxes or lower aids to states/corporations (to offset some of the savings they get) or other methods.

Does it mean Warren owes an explanation for the $700 billion a year that still needs to be account for? Maybe, but I’d also argue that the benefits of more security and a lack of “job lock” due to having health care be a right is well worth $40 a week to the typical American. In addition, the extra usage of medical services would likely raise GDP, which would have its own positive effect of raising tax revenue through economic activity.

I’ll also add that it’s funny how Republicans can throw $1.5 trillion down the tubes to a Tax Scam that has done nothing for most Americans, and "serious people" in our media never asked them in 2017 what program would have to be cut if/when a budget hole opened up. So if deficits are going to be huge as 2020 looms (not saying it doesn't matter, just saying if they're a given), isn't it better to have those deficits be a result of letting everyday Americans have more money in their pockets due to $0 in premiums and out-of-pocket expenses?

A little slamming of how insurers and drug companies screw over the average Joe/Jane wouldn’t be a bad move either. We used to not care so much about cost and what might happen to the corporate and comfortable when it came to making the country into a better place. Returning to that mentality would be the real way to MAGA.

A former Senator from Massachusetts understood that in 1961, and what better way to “assure the survival and success of liberty” than to stop having us be beholden to employers and/or a soulless insurance industry to have the basic security of health?

Maybe corporate media should talk about Medicare for All from that perspective on Sundays. After this message from Pfizer/Humana, of course.

No comments:

Post a Comment