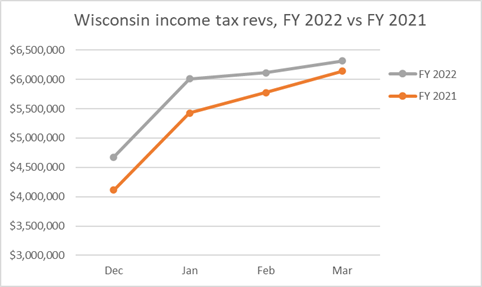

Speaking Monday on Wisconsin Public Radio’s "The Morning Show," DOR Secretary Peter Barca said the state is expected to end its current two-year budget with a $3.8 billion surplus. “We’re in the best shape we’ve been in fiscally in more than a half century. We’ve got a huge surplus," he said. "I think back to when I was elected back to the Legislature in 2008, we had structural deficits as far as the eye can see. Now we have structural surpluses.” Barca said the fiscal turnaround is the result of growing revenue and a bipartisan effort to control expenditures.That $3.8 billion means that Barca sees no reason to make any adjustment to the revenue estimates and budget outlook that the Legislative Fiscal Bureau released 3 months ago. And if anything, Barca is being conservative. The DOR recently released their revenue collections for March, and they reflect the impact of income tax cuts that were signed into law for 2021. However, those tax cuts didn’t get into the pockets of Wisconsinites until early 2022, in the forms of higher refunds, as well as this January’s adjustments to tax withholding tables. That means that income tax revenues for the first 3 months of Calendar Year 2022 are notably lower than they were for the same months in 2021, and you can see the reduction in year-over-year growth this chart. It’s worth remembering that January’s revenue estimates assumed that income taxes would fall by more than $1 billion in FY 2022 than FY 2021. To be fair, there was still 2 weeks left in tax filing season at the end of March, and filers had until May 2021 to send in their taxes vs April in this year, so we are still not in apples-to-apples mode on these numbers. But it feels safe to say that the state is in good shape, and seems likely to reach that level of estimated income tax revenues. As for the other revenues, sales and corporate taxes are running well ahead of estimates, but excise taxes have been running lower. But sales taxes and corporate taxes make up a lot more of the state’s revenue mix than excise taxes do, so it seems likely that we would see total revenues exceed the January projections. Combine that with a projected surplus of state Medicaid funds due to increase aids from DC, I would bet we end up with more than $2.84 billion in the bank when the fiscal year closes on June 30, which would also raise projections at the end of the biennium well past $3.8 billion. Also remember that we have a record amount of funds in the state’s Rainy Day fund (see this post for more details), to the point that it cannot be added to under current law. So there is absolutely no reason we could not make one-time payments and assistance available, such as the $150-per-person rebate checks that Gov Evers wanted to send out, or getting rid of local wheel taxes via increased road funding, or suspending the gas tax while prices remain high. Yes, all are gimmicks before an election year, but they’re short-term gimmicks that can benefit a wide variety of Wisconsinites, while maintaining the strong structural health of the state’s budget. And it's a whole lot more responsible than the permanent tax cuts to the rich that you know Republicans would do if they were in charge.

Ventings from a guy with an unhealthy interest in budgets, policy, the dismal science, life in the Upper Midwest, and brilliant beverages.

Tuesday, April 26, 2022

At the end of March, Wisconsin on track to have even more than $3.8 billion in the bank.

Tax filing season has just ended, and the head of Wisconsin’s Department of Revenue says that Wisconsin state government continues to have an unprecedented amount of money available.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment