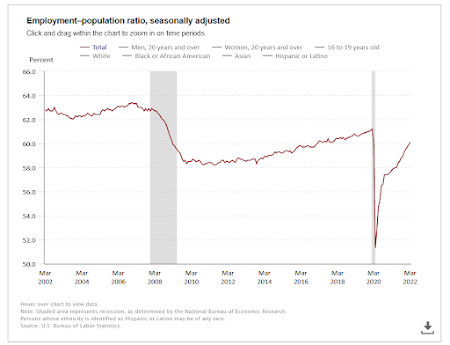

I keep thinking the jobs market is near maxed-out, but more jobs keep coming and the unemployment rate continues to fall – nearly cut in half from the 6.7% we were at when Joe Biden took office 15 months ago. We even had the Employment Population Ratio (of working age Americans) get over 60% 2 years after COVID first broke out. Go back to the Great Recession, and you’ll see it took 8 years to recover back to that 60% mark, with the limited stimulus of 2009 and the austerity of the 2010s being a big reason why. Especially note that the EPR starts gaining faster in the last year, as the Biden stimulus was passed and COVID vaccinations became more widespread. Oh, but that means the economy is “overheating”, and we can't have too many people working and making money, ya know. A lot of the inflation concerns voiced in corporate media deal not only with rising prices, but the added implication that the typical American isn’t keeping up with those higher costs. And given that the 12-month inflation rate is 7.9%, the topline numbers would bear this out.BREAKING: The US economy added a solid 431,000 jobs in March, a bit below expectations. The US has averaged ~541,000 job gains a month in the past year.

— Heather Long (@byHeatherLong) April 1, 2022

Unemployment rate fell to 3.6%

Wage gains: +5.6% in past year

**93% of jobs lost in the pandemic are now back**

Average hourly earnings for all employees on private nonfarm payrolls rose by 13 cents to $31.73 in March. Over the past 12 months, average hourly earnings have increased by 5.6 percent. In March, average hourly earnings of private sector production and nonsupervisory employees rose by 11 cents to $27.06.Obviously, 5.6% in wage gains isn’t 7.9% in prices. But dig a little more into the jobs report, and you’ll find that many lower-wage workers are seeing their wages go up well past the rate of inflation.

This is especially true among everyday line workers. Wage increases, non-supervisory employeesThe rate of wage growth among the lowest-wage workers right now is really remarkable. No sign of a slowdown here whatsoever. pic.twitter.com/jRzo8pT5Em

— Ben Casselman (@bencasselman) April 1, 2022

Leisure and Hospitality +14.9%

Transportation and Warehousing +11.1%

Education and Health Services +7.6%

Retail trade +7.3%

All private sector jobs +6.7% That doesn’t mean inflation’s not a problem for workers in those industries, especially given some of the crazy housing prices in many communities where they have those lower wage jobs in many communities. But it does help explain why real consumer spending can remain strong as prices keep rising – because people have the money to pay for things. (The real economic concern comes when they either run out of money or stop wanting to spend…). The lower increases in wages in non-supervisory jobs seem to be coming from the middle and upper ranges of the wage scale. This includes the Information/IT/Communications (+0.6%) and Utilities sectors (+2.5%), where the average wage is between $77K and $85K a year. It also includes goods-related jobs in manufacturing (+5.6%) and construction (+6.2%), which have seen sizable job gains in recent months, which would indicate that those workers and in demand and can/should be asking for more in the coming months. Given the tight labor market, don't be surprised if you see a lot more headlines like this in the coming months.

Might not be a bad time for Dems in Congress to revive the PRO Act to remove barriers that companies may put up to try to keep labor from organizing, eh? Given record profits and more needs from companies, workers have an ability to demand more of the proceeds of what they've helped to produce. Pretty good jobs report in all, and it should translate into a strong 1st Quarter for economic growth in the Real America, despite what all the Wall Streeters and Faux News types may be telling you. The bigger question is how to bring in this red-hot jobs market into a soft landing for the rest of 2022.Chris Smalls, fired from Amazon almost two years ago to the day, just popped champagne outside the NLRB offices where he and his peers won one of the greatest labor victories in a generation. “To the first Amazon union in history,” he said. pic.twitter.com/ZHNcjFC5N1

— Jodi Kantor (@jodikantor) April 1, 2022

No comments:

Post a Comment