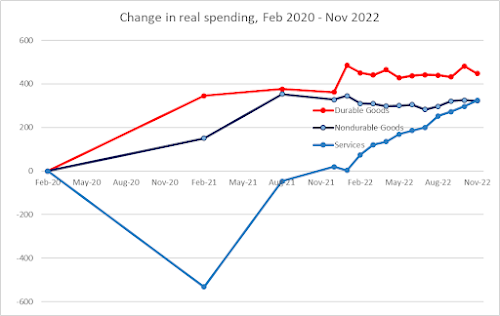

Personal income increased $80.1 billion (0.4 percent) in November, according to estimates released [Friday] by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $68.6 billion (0.4 percent) and personal consumption expenditures (PCE) increased $19.8 billion (0.1 percent). The PCE price index increased 0.1 percent. Excluding food and energy, the PCE price index increased 0.2 percent. Real DPI increased 0.3 percent in November and real PCE increased less than 0.1 percent; goods decreased 0.6 percent and services increased 0.3 percent.Other than the decline in real spending on goods, this is what a slow-to-moderate growth, stable price economy looks like. And even the decline in durable goods (and particularly vehicles) seems to be a seasonally-adjusted thing, as October had a strong increase, and this reverted to the norm in November. It's also noteworthy that COVID-era increases in services spending have now exceeded the increases in COVID-era non-durable goods spending. We also saw the continuance of a trend that has happened throughout 2022, where Americans have spent more on going out to eat and drink, but have downshifted their (inflation-adjusted) spending on groceries as those prices have continued to rise. So despite the bad numbers in the retail sales report from November, it looks like overall consumer spending was OK as 2022 wound down. On the income side, it was another steady (but not huge) increase in job earnings and overall income, which led to the first increase in savings since July. The personal savings rate is still alarmingly low (2.4% of disposable income), and it's one of the few reasons to justify higher interest rates at this point. But we also are already seeing the moderation in both prices and economic activity, which in a lofical world would make the Fed back off and stop raising rates. It makes December's holiday spending numbers seem very important when it comes to getting a read on whether this growth can continue in early 2023. And whether our full-employment situation starts to come to an end.

Ventings from a guy with an unhealthy interest in budgets, policy, the dismal science, life in the Upper Midwest, and brilliant beverages.

Monday, December 26, 2022

Income, spending, inflation, all muted in November

At the end of last week, we got more evidence that the US economy's growth was downshifting, with the always-important income and spending report for November. Not only did money coming and money coming out see a slowdown, but so did price growth.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment