Wisconsinites are no different than other Americans on this aspect, as the Legislative Fiscal Bureau noted in its recent update of the state’s tax revenues.

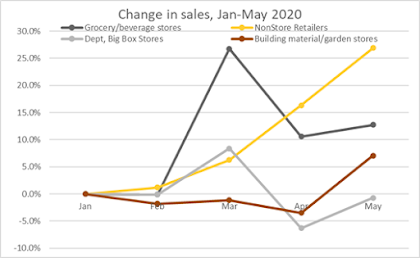

Based on preliminary sales tax data provided by DOR, the economic impact of the coronavirus pandemic and the Safer-at-Home order has impacted retail industries differently. Taxable retail sales were lower in April of 2020, compared to April in the prior year, by 74% for clothing and clothing accessories stores, 53% for food services and drinking establishments, and 28% for motor vehicle and parts dealers. Conversely, April taxable sales in 2020 were higher at nonstore retailers (including remote sellers and marketplace providers) by 83%, building material and garden equipment and supplies stores by 23%, and food and beverage stores by 18%. Growth in total taxable retail sales at these three retail sectors were $403 million, or 38% higher, in April, 2020, than in April of the previous year.But that boom in online sales also comes with a budget twist in Wisconsin, because of a GOP-passed law from a few years ago that followed the Supreme Court’s Wayfair decision that formally allowed states to collect sales taxes from out-of-state businesses that sold items to Sconnies.

What set Wisconsin apart is that even before the decision, it had a law on the books requiring that any increases in sales tax revenue to out-of-state businesses with no presence in Wisconsin be used to lower income taxes. It expanded on that requirement last year.It comes from Act 10 of 2019 (summarized here by the LFB), which estimated this income tax cut to be $120.5 million, and would be seen as larger state tax refunds next year. It also creates an odd circumstance in the state budget where Fiscal Year 2020 is helped by the fact that this higher income tax cut hasn't fully kicked in, but the state is able to collect the higher sales taxes from online sales.

[Wisconsin Policy Forum research director] Jason Stein said Wisconsin's law may be the only one like it in the country.

"From what we could see, Wisconsin was unusual or even unique in how it ties income tax cuts explicitly to these particular sales tax revenues," Stein said.

The Wisconsin Policy Forum report estimated increased online sales could lead to a $200 million income tax cut if trends continue.

This chart shows the effect thru the end of Tax Year 2020, and while the higher sales taxes will keep rolling in beyond FY 2021, you can see where the income tax cut effect is delayed.

This could result in the state having a good chance of not having to repair the budget over the next 3 weeks, and having more money carried over into Fiscal Year 2021. However, it also means that there is less money slated to come in for that fiscal year, and the higher income tax cut and related refunds makes a revenue shortfall and budget deficit even more likely over the next 12 months.

This is all the more reason that Evers should call a special session to have the budget repaired once we know what the final revenue numbers are in late August. The new income tax cuts combined with the state adjusting its withholding tables to take out less money from paychecks means that funds are likely to run low quickly in FY 2021. Especially if unemployment and the need for social services like Medicaid stay high (hint: they will).

As part of that Special Session, it might not be a bad move by Evers to delay the Wayfair-induced income tax cut for 2020, with the promise that it gets “doubled up” for 2021. Yes, this would reduce the amount of income tax refunds that would be coming back in early 2021, but tax refunds are already likely to be higher for many Wisconsinites for a bad reason – job losses and reductions in hours worked after COVID-19 broke out in March means that they had money taken out at a higher rate (of income) early in the year anyway.

Also, delaying the Act 10 income tax cut would make any kind of budget repair bill less severe while allowing 2 years to adjust any budget cuts required to pay for the larger income tax cut that would appear in the 2021-23 state budget. Plus, it leads to larger tax refunds in early 2022, right before Evers would run for re-election.

So this is where the change in buying habits as a result of COVID-19 could have significant ripple effects on the income tax side of things for Wisconsinites over the next year or two. And it seems like a good opportunity for the Evers Administration and the State Legislature to take a second look at what is set to happen, and possibly adjust what happens before the typical Sconnie would know that anything changed.

No comments:

Post a Comment