Ventings from a guy with an unhealthy interest in budgets, policy, the dismal science, life in the Upper Midwest, and brilliant beverages.

Thursday, September 29, 2022

GDP down, inflation up, and profits up. A 2nd look at the first half of 2022

Q1 2022 +7.5% (+0.4% vs 7.1% original)

Q2 2022 +7.3% (+0.2% vs 7.1% original) Another effect of the lower incomes and wage growth? Profits were even higher than we knew. Unlike what was previous reported, pre-tax profits were higher in Q1 2022 than they were in Q4 2021. And then Q2 profits jumped by another 4.6% from that higher Q1 level, reaching $3 trillion on an annual basis. I got your f***ing inflation right there! Maybe that's what we should try deflating and dampening, instead of having Jerome Powell try to inflict some economic pain on working people. These figures also make me wonder if the Fed is spending too much time looking at what happened in the past instead of looking at the present situation, and figuring out what their rate hikes will do to the future economy. Which makes me seethe at the end of Q3 2022, as I wonder what's so bad about an economy that is still seeing unemployment claims at 50-year lows.

Wednesday, September 28, 2022

Property values way up in Wisconsin, but property taxes barely budge.

Total property values in Wisconsin grew by a record 13.8% in 2022, marking the largest increase in decades of data, according to a newly released interactive tool from the Wisconsin Policy Forum... In the seven-county southeast Wisconsin region, overall equalized property values increased by 12.9%, the most for the region in the available data going back to 1985. Every county in the region experienced a double-digit increase in total property values, led by Walworth County at 15.8%. Dane County overtook Milwaukee County to become the largest in the state in terms of property values. However, the city of Madison still trails the city of Milwaukee in this measure. Total values in the city of Milwaukee grew 11.6% as of Jan. 1, 2022, slightly less than the previous year's growth of 12.3%. Total values in the City of Madison grew by even more at 17.2%, the most since at least 1985. Residential property values statewide were up 14.9%, the largest increase since at least 1985. Residential values in southeast Wisconsin increased at a slightly lower rate of 13.5%, but also achieved the highest growth rate since at least 1985. In Dane County, residential property grew 14.5%, also slightly below the state average but still the most on record.But that doesn't mean that people's property taxes are going to blow up by double digits this Winter. That's because Wisconsin limits how much in additional taxes a community can get, and only allows for the rate of growth of NEW CONSTRUCTION, not the houses and office buildings that alreaady exist. The result of these levy limits was a property tax increase in 2021 of less than 2%, and 2022 probable will repeat that, regardless of the higher prices and home values.

Meanwhile, gross property tax levies approved in late 2021 (for 2022 local government budgets) increased by 1.6% statewide. That was far less than the rate of inflation and the smallest increase since 2014.The Policy Forum notes that property tax rates fell by nearly 5% last year, the largest drop in 16 years. But it's funny how we don't view that as a tax cut, even though we certainly would call it one if it dealt with income tax or sales tax rates. Among other things, the Policy Forum's tools allows you to look at your community's and your district's tax levies and how much property values went up in your town for 2022. The Policy Forum's figures are based on gross tax levies, but doesn't take into account the several ways that number is reduced further before people pay their property taxes. One of those answers came today, as we found how much this Winter's property taxes would be reduced due to ticket sales for the Wisconsin Lottery. The projected total of the lottery tax credit for this year is $320.7 million, which is down nearly $20 million from 2021's record reduction, but still double what it was 7 years ago. So while inflation may be blowing up the equity and home values for Wisconsin property owners, it doesn't look like their property tax bills will go up nearly as much. Which is a nice bit of relief for those people, but it also means that schools and communities aren't going to get to reap much of the benefits of their higher property values, and those local governments aren't allowed to add many more resources, even though their costs go up due to inflation and the need to raise wages to keep employees. That seems like a quandry that needs to be fixed in the next state budget, especially given the $5 billion that is sitting in the state's bank account.

Monday, September 26, 2022

How WisGOPs get the "independent" Audit Bureau to launder their garbage

Two Republican audit committee leaders launch an inquiry into security costs for Gov. Evers and Lt. Gov. Barnes https://t.co/u78YeEIuIN via @journalsentinel

— Daniel Bice (@DanielBice) September 26, 2022

Two Republican leaders of the Joint Legislative Audit Committee are calling on the State Patrol to provide answers about the security costs for Gov. Tony Evers and Lt. Gov. Mandela Barnes. Sen. Robert Cowles (R-Green Bay), co-chairman of the audit committee, and Rep. John Macco (R-Ledgeview), committee vice chair, wrote State Patrol Superintendent Tim Carnahan on Sept. 15 requesting security costs for state's top two officials from July 1, 2021, to Aug. 31. The GOP pair also asked for documentation on how the State Patrol determines the level of security that is needed and the roles Evers and Barnes' staff play in this process. In addition, Cowles and Macco asked how state security officials handle private and political events. The Dignitary Protection Unit, which is part of the State Patrol, provides security to the governor, his family and staff. It also provides security to other elected officials, including the lieutenant governor and those visiting Wisconsin on official business.Funny how the WisGOPs didn’t choose to (ab)use the power to ask for this information before now, but that’s how these lowlifes roll. Henry Redman of the Wisconsin Examiner gave a good illustration earlier this month how the Legislative Audit Bureau is being guided into doing the GOP’s dirty work, And then WisGOPs slant the findings of those audits to make the Evers Administration look bad.

A central part of Redman’s article goes into a recent audit of the state’s broadband grants that made it appear the Public Service Commission wasn’t giving adequate oversight to the tens of millions of dollars handed out to Wisconsin communities. But PSC Commissioner Rebecca Valcq says the GOP cherry-picked the audit, and misrepresented what was the PSC actually did.Executive agencies are worried the well respected Legislative Audit Bureau is being manipulated after reports on @PSCWisconsin and @WI_Elections included what staff say are faulty conclusions: https://t.co/HJc6XXOGUP

— Henry Redman (@HenryRedrobin) September 16, 2022

“I think when you are living in a situation, like we’re living in here in Wisconsin, and you have a Legislature that has been reluctant to work with a governor of the opposite party, you have an opportunity to use what has historically been an apolitical and nonpartisan body to go out and generate reports that you can then pick passages out of and use them as political fodder,” Valcq tells the Wisconsin Examiner. “So I don’t think it’s the bureau itself; I do think that the bureau is neutral, and I think that they’re state employees like the rest of us. But I think when you have divided government, I think that the ability to point to a nonpartisan body of government and take sentences that fit your narrative — I think that we will continue to see more of that.:…. Valcq says that the report’s section headlines paint a negative picture of the PSC as an agency that didn’t care how federal and state money meant for broadband expansion was spent once sent out the door — a contention she says couldn’t be further from the truth. Valcq adds that she doesn’t believe the LAB’s staff or the bureau itself are acting politically, but that it’s being used for partisan means. “They had a story written in their head that they wanted to tell, and in my mind, it does a disservice because it completely ignores all of the robust controls that we have in place and it makes it sound like we’re just out there willy nilly handing out bags of of money, and that couldn’t be further from the truth,” she says. “And it came as a shock to the broadband office itself. You know, these are people who literally comb through reimbursement requests and they fight providers to the penny because they take their job of being stewards of federal dollars and state dollars really, really seriously.” In recent years, the federal government has sent billions of dollars to Wisconsin to be used for, among other things, broadband expansion as part of packages in two COVID-19 relief bills and an infrastructure bill. Several times over the last legislative session, Republicans have attempted to wrest control of that money from Democratic Gov. Tony Evers and the state’s executive agencies. Valcq says she believes Republicans commissioned the audit to find an excuse for another attempt to take over control of those dollars.Redman notes Valcq’s criticism echoes what was said after GOPs told the LAB to look into policies and procedures related to the 2020 election. That LAB report was used as fodder for more GOP Big Lie BS, and members of the Wisconsin Elections Commission said that the report was misleading, and set up to give GOPs what they wanted.

In a normal LAB report, the agency being audited gets a chance to see a draft version of the report, make corrections and offer a response that is included in the public version. This opportunity was not given to the WEC because auditors decided it couldn’t maintain the draft’s confidentiality. This lack of a review process, according to Wolfe and the commissioners, led to errors in the final report that have now gone more than a month without being corrected as Republican legislators have used its findings to hammer the commission and call for Wolfe’s resignation. In the meeting, commissioners largely echoed Wolfe’s previous statements — but with more force than the nonpartisan administrator was able to add publicly. Some of the strongest rebukes of the LAB report came from Dean Knudson, a former Republican legislator who was appointed to the commission by Assembly Speaker Robin Vos (R-Rochester)….. “This one was the most egregious example of sloppy work, inaccuracy and unprofessionalism on the part of the Audit Bureau,” Knudson said about the report’s errors pertaining to how the WEC receives data from a multi-state group called ERIC, which allows for state election administrators to track when its voters move to or die in another state. “It’s really uncharacteristic for them, but I think they fell into the trap of succumbing to political pressure that they would not allow a review. And a simple review, like they always do, helps prevent this kind of inaccuracy seeping into the final report,” Knudson continued. “What you’ve got here, if I were to use an analogy, it’s about like somebody came from France who was a soccer fan and wanted to see their first football game. They got to go to the Packers. And by halftime, they had decided that they knew better than Aaron Rodgers did about how to drop back and throw a pass.”I have no problem with oversight and identifying areas where processes could be improved or funds could be better accounted for. But Republicans are VERY picky over which areas get such scrutiny, and it is telling as to which areas they don’t choose to look into. For example, we know that Assembly Republicans have blown well over $1 million in taxpayer dollars in their absurd Big Lie investigation, and paid hundreds of thousands of dollars to

[In August], a group of Democrats sent a letter to the committee's co-chair State Sen. Robert Cowles (R-Green Bay) and asked him to support an audit. Democrats unsuccessfully pushed for an audit of Gableman's probe in February and again in March. “Using taxpayer dollars for political gain is really concerning,” State Sen. Melissa Agard, D-Madison, said. “Now, Speaker Vos finds himself on the receiving end of that political fodder with Gableman speaking ill about him, and I am hopeful that wakes the Speaker up to understanding that this was not the right thing to do from the beginning and it's past time to pull the plug.” Agard, who signed the letter, said she wants Cowles to at least let members of the committee debate whether to request an audit. “We could just look at Gableman and what went well and what didn't go well with the work he was doing, or we could expand it or shrink it, and certainly I believe that Chair Cowles has the ability to do that, to convene us and allow us to simply have that conversation,” Agard explained. “My hope is that the committee would agree and that we would move forward with an audit request to the audit bureau, but that's not even a given.”Don’t bet on that one, Sen. Agard. After all, Robbin’ Vos is saying that it’s too close to an election to be looking into things like the Big Lie, because it might

Always projection with Republicans. Every single time. I used to think LAB co-chair Cowles was one of the few GOPs left with an ounce of integrity, but he's more than happy to rig audits and waste taxpayer dollars on meaningless stuff instead of looking into real wastes of taxpayer dollars. I should have followed my own rule – ALL GOPS ARE BAD. ALL MUST GO DOWN AND GO DOWN HARD.From Vos' lawsuit: "... the Committee is demanding (Vos) appear for a deposition to answer questions irrelevant to the Committee’s investigation, with virtually no notice, in the closing days of his reelection campaign, merely because of the Committee’s public relations scheme."

— Molly Beck (@MollyBeck) September 26, 2022

Sunday, September 25, 2022

Markets fall as Fed jacks up rates. And it all feels very stupid.

The Dow notched a new low for the year and closed below 30,000 for the first time since June 17. The 30-stock index ended the day 19.9% below an intraday record, flirting with bear market territory. At one point, the Dow was down more than 826 points. The major averages capped their fifth negative week in six, with the Dow giving up 4%. The S&P and Nasdaq shed 4.65% and 5.07%, respectively. It marked the fourth negative session in a row for stocks, as the Fed on Wednesday enacted another super-sized rate hike of 75 basis points and indicated it would do another at its November meeting. “The market has been transitioning clearly and quickly from worries over inflation to concerns over the aggressive Federal Reserve campaign,” said Quincy Krosby of LPL Financial. “You see bond yields rising to levels we haven’t seen in years — it’s changing the mindset to how does the Fed get to price stability without something breaking.”As Rick Newman of Yahoo News mentions, that transition includes the belief that there won't be a a "soft landing" for the economy.

A soft landing would be a consistent drop in inflation that doesn’t disrupt the labor market or squeeze economic growth too much. The stock market rallied from July to August because falling oil and gasoline prices and some other factors suggested inflation would abate without drastic action by the Fed. Investors bet on a soft landing. But August inflation came in surprisingly hot, pushing the Fed into shock-and-awe mode. “Fed on a warpath,” Bank of America warned clients on Sept. 23. “Overshoot and hard landing likely. Central banks will hike till something breaks.” Like other forecasters, BofA downgraded its outlook for the economy on the inflation news and the Fed’s shift to even tighter monetary policy. The bank now expects a recession in the first half of 2023, with unemployment rising from 3.7% to 5.6% by the end of next year. “The Fed's actions suggest to us that it is committed to reducing inflation and it appears willing to accept some deterioration in labor market conditions,” BofA researchers wrote. “We think our forecast is consistent with the Fed taking ‘forceful actions’ to slow demand, erring on the side of doing more than less.”Are we really calling an increase of 0.1% in CPI in August "hot"? It was the 2nd lowest increase of the last 12 months, and oil has continued to fall, with futures now falling under $80 a barrel. This is all about Wall Street EXPECTATIONS, and now those

The only way things crash is if the Fed raises rates so high that Wall Streeters can't afford to borrow funds to pay their bills, and that job loss accelerates the decline in the housing market, which makes it go beyond people not being able to afford to move to another property. The job loss takes things to the next level because it causes people to not be able to make the payments they already are locked into. This is avoidable if the Fed simply backs off of its drastic measures. And is raising rates even going to do anything to give relief to Americans where it's needed - at the supermarket or in their electricity bills? US Sen. Elizabeth Warren is among those asking whether the Fed's moves affect the root causes of 2022's inflation.Full-on crash mode.

— Jason Goepfert (@jasongoepfert) September 24, 2022

Retail traders spent $18 billion buying put option protection last week, a record.

They're holding $46 billion worth of index futures net short, a record.

Leveraged traders are betting on very, very bad things happening very, very soon. pic.twitter.com/mFEsQC01ev

Then again, a recession would hurt workers' abilities to get better wages and "slow" demand, which indirectly would lower inflation. That might be nice for corporations, but sucks for most Americans. September's drop in the markets and damage being inflicted onto what was a growing, job-gaining feels so stupid and unnecessary. And if it causes election results that favor GOPs who would love nothing more than to wreck things in 2023 and 2024 - both in the economy and at the ballot box - it might lead me to buy some futures in this.The Fed’s interest rate hikes won’t straighten out supply chains or address corporate monopolies & price gouging. But they could throw millions of Americans out of work. I’m deeply concerned, and I’ll keep fighting for an economy that puts working people first.

— Elizabeth Warren (@ewarren) September 23, 2022

Saturday, September 24, 2022

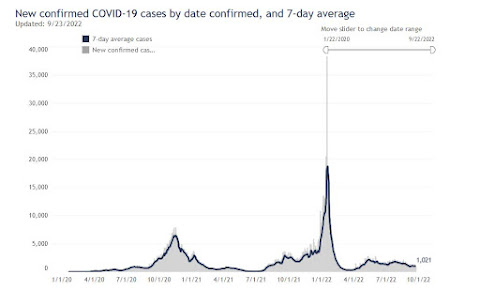

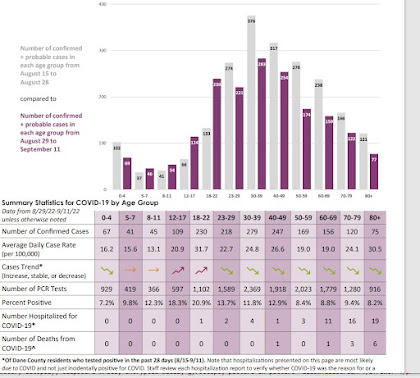

Late September and the new vaccine makes it a month to watch for COVID in Wisconsin

Friday, September 23, 2022

Wisconsin needs people! And voting for regressive GOPs won't bring them here

Of 626,000 millennials who lived in Wisconsin at age 16, 132,000 (21%) lived in another state at age 26. Those who left were partially replaced by 89,000 millennials who moved here from other states. On net, Wisconsin shed 43,000 people from this important age group. “Bright lights, big city” may best describe the reason many left. Only 37% of those who left moved to a state bordering Wisconsin. Of those [37%], nearly 70% migrated to either Minneapolis (42%), Chicago (26%), or Detroit (2%), the three largest metro areas in the Midwest.But the state was more successful in getting the next older generation of workers to come here, to the point that we started to gain in the last half of the decade.

During 2017-2020, the state had a net inflow of 1,128 families from [the 26-54] cohort, with 760 of those families coming here in 2020. The gains over these years do not make up for the losses in prior years. However, the trend shows the state heading in the right direction. Wisconsin needs to continue to attract this population as they will be critical to maintaining the state’s workforce over the next decade.Not surprisingly, most of those families that were coming and going didn't end up going very far away,.

Minnesota and Illinois were the most popular destinations for Wisconsin families. More than 65,000 (14%) families that left the state opted for Minnesota and more than 62,000 (13%) chose Illinois. Michigan (19,760) and Iowa (12,164) attracted smaller numbers of Wisconsin families. The geographic pattern of those moving to Wisconsin was a bit different. Compared to those leaving, a greater percentage came from neighboring states (43% vs. 33%). Minnesota and Illinois were the biggest source of families, but their order was reversed from the out-migration pattern. Responsible for more than one in five incoming families, Illinois (89,606) was the largest source of families moving here. Another 61,757 families came from Minnesota. Fewer families moved from Michigan (21,752) or Iowa (13,674).That’s not overly surprising to see more out-migration from Illinois than Minnesota - there are more people in Chicago than the Twin Cities, so why wouldn’t there be more families coming to Wis from Ill. than Minn? I also find it positive to see Wisconsin get a net gain from Michigan and Iowa, although those numbers are comparatively small. Another unsurprising finding by Forward Analytics is that many of the remaining movers from Wisconsin over the next decade headed south.

Like most Midwestern states, Wisconsin lost a large number of families to warmer locations in the Sunbelt. Of the 303,979 families that left Wisconsin and left the region (that is, out of Wisconsin but not to a border state) more than 171,000 (57%) moved to the Sunbelt. Four of those Sunbelt states —Florida, Texas, California, and Arizona—attracted 38% of the Wisconsin families that departed the Midwest. Florida accounted for 13% of those leaving the region, making it the favorite destination for these families. Texas attracted 10% of such families while California attracted 9% and Arizona 7%.The other top 5 destination for Wisconsinites moving to a non-bordering state was Colorado, or as I call it, “bizarro Wisconsin.” There’s another interesting stat that the Forward Analytics study includes, which indicates that many Sconnies move back home after making their way in bigger metros to start their careers.

The six states with the largest positive differential are states that attracted the largest numbers of young millennials based on findings from the Harvard/Census study discussed in the previous section. Half of this young cohort moved to these six states. Many, if not most, of these young movers would show up in the IRS data as single filers. This would help explain the relatively small average family size of those leaving Wisconsin for these states. If many of those moving to Wisconsin are married and possibly starting families, the average family size moving here would be much larger. Simply put, the data are consistent with young families moving from these states to Wisconsin. Some may be former Wisconsinites returning to raise their families.Kristin Brey of the As Goes Wisconsin show also saw the Forward Analytics report, and put the question to her Twitter followers as to how Wisconsin can get more people to come here (or come back here, as Brey herself did from California in her mid-30s).

These two responses sounded a common refrain among the 34 responses.First off... yes they are too sexy.

— AsGoesWisconsin (@AsGoesWisconsin) September 21, 2022

But second, an open question for Wisconsin Twitterverse: if you were in charge, what would you invest in or make a priority in order to attract people to move and stay here? https://t.co/OFhUNPsNy2

You know what’s NOT going to make people want to move themselves and their families back to Wisconsin? A reputation of being OK with garbage like this.What he said, plus try not to have your biggest metropolitan not be # 1 in every bad stat for POC, while being surrounded by the forbidden forest of suburbs.

— ClaudeMotley (@ClaudeMotley) September 21, 2022

.The filter on this GOP mailer of Mandela Barnes just happens to make him…significantly darker than he is.

— David Catanese (@davecatanese) September 22, 2022

Johnson’s camp calls any hint of racism “absurd.”https://t.co/OclqOYNzbZ#WISEN pic.twitter.com/4gUhk69BMl

Then again, maybe this garbage is part of the GOP's bigger plan for getting an edge in a battleground state like Wisconsin. And has been for several years. As a former leader of the Wisconsin Dems put it Friday, this November is really a test of the state’s decency."Different"

— Michael Bradley (@MikeBradleyMKE) September 13, 2022

I can't believe this is the messaging the GOP is going with in Wisconsin. pic.twitter.com/n8l6iCFDkn

This state is either going to vote for Barnes and Evers, and show that it wants to be a competitive place in the 21st Century, or we’ve given up, and are going to go along with regressives and oligarchs. We’d better not fail the test. The work force and future entrepreneurs are watching.Does anyone think this is ok? It says a lot about the pieces of shit behind these ads. But it will say something awful about our state and who we are if these ads work.

— Gordon Hintz (@GordonHintz) September 23, 2022

If you think these racist Johnson ads are wrong, then say something. Call them out. https://t.co/NM7HqHgTq5

Wednesday, September 21, 2022

FED WATCH - inflation must be put down, even if it kills the economy.

The Fed:

— Jeanna Smialek (@jeannasmialek) September 21, 2022

*Raises rates by three-quarters of a point to 3-3.25%

*Projects 4.4% rates at the end of 2022, suggesting a 75 and a 50

*Rates climb to 4.6% next year (up from 3.8%)

*Sees unemployment rising to 4.4% next year

This is a central bank in full inflation-fighting mode.

And after an hour of volatility, the traders on Wall Street came to a conclusion on what the Fed's actions and statements meant.This stood out to me — Chair Powell is being clear that the Fed is willing to trigger a recession in order to get inflation down.

— Heather Long (@byHeatherLong) September 21, 2022

The Fed does not want a recession, but the No. 1 goal is to lower inflation https://t.co/5MFKbJaTSz

This is dumb. US gas prices are down 26% in the last 3 months, and home prices are falling for the first time in a decade. Food prices are still an issue, but people generally don't borrow money to pay for food, and there is evidence American consumers have downshifted their spending to limit their expenses as grocery prices have risen in 2022. (Literally as I write this, US Sen. Elizabeth Warren is saying a similar thing on Chris Hayes' show. Sen. Warren points out that the Fed can't do a thing about disrupted supply chains or that the lack of competition in several sectors leads to price gouging. All the Fed deals with is the money supply, so while they hurt part of the economy, they may not do do much to curb many of the reasons any inflation exists today). A lot of this "inflation concern" by the Masters of the Universe does seem to come down to what was mentioned in this online exchange I had with a Wisconsin candidate for Congress, which came after last week's release of the Consumer Price Index.Stocks took a sharp turn lower to end a choppy session Wednesday, sinking after the Federal Reserve delivered a widely expected 75 basis point rate hike.

— MarketWatch (@MarketWatch) September 21, 2022

The Dow Jones Industrial Average dropped around 522 points, or 1.7%, to end near 30,184: https://t.co/Jjv0mDpi4w pic.twitter.com/Jmv3EEP3gk

Apparently in Wall Street World, corporations have to continue to have a better chance at maintaining their record profits instead of having everyday Americans continue to benefit from a strong labor market. Even if prices are rising more than we've been used to, I bet most of us would rather pay a little more than make a little less - with millions more Americans not making anything at all, because they're OUT OF WORK. And Central Bankers will never have to deal with the financial stresses of unemployment and a lower standard of living like millions of unemployed Americans would.Because workers are starting to get ahead.

— Mike Van Someren (@mvsforwi) September 14, 2022

Tuesday, September 20, 2022

When WisGOPs defund and handcuff Milwaukee, the city has to defund other things

Milwaukee Mayor Cavalier Johnson's first proposed city budget is the equivalent of a big wince, calling for cuts that he acknowledged he doesn't want to make in police, fire and library services. The 2023 proposed budget, released Monday, calls for a 1% reduction in sworn police officers, the elimination of two fire engines, and substantial cuts in the hours and programming at five of the city's 12 neighborhood libraries. "It's not that we don't want to fund them. It's that we don't have the resources to fund them or the resources to generate the revenue ourselves to fund them," Johnson told the Journal Sentinel.If you read the city’s proposed budget summary, Mayor Johnson, Budget Director Nik Kovac, and other city staff lay out the crunch in painstaking detail. One of the reasons the city lacks resources is that they get less money from the state now than it did in 2022. And that's before you include 22 years of inflation. Combined with the limits on property tax that are imposed by state lawmakers, and city officials could not hide their resentment at their fiscal relationship with the state.

This Shared Revenue could be more accurately described as “Redistributed Revenue” because it is generated by the sales, income, and excise taxes paid by Milwaukee residents, workers, and visitors. The total amount of money that Milwaukee taxpayers contribute to Shared Revenue exceeds the amount of money that the state “shares” back. Shared Revenue was once the city’s largest source of revenue but has been outpaced since 2009 by the property tax levy – a source of funding which has roughly kept up with the real value of money, i.e., inflation, over the past two decades. The cost of our largest department, the Police Department, now exceeds our Shared Revenue by $78 million, nearly the reverse position of these two accounts in 2000.The second constraint on Milwaukee's budget is the increased amount of money that has to be put into the pension fund for city employees. This is a cost that the city didn't have to pay for up until The Great Recession, but the combination of more retirees and the 2008 stock market crash means that the free ride is over, with the costs going up every year.

Another expense – the employer pension contribution – emerged in 2010 to soon become the second biggest driver of our structural budget gap. This obligation was entirely absorbed by fund investment returns in the prior decades, but became an extremely volatile line item in our general city budget for several years until we implemented a stable five-year contribution formula in 2013. The stabilized annual cost was $62 million until 2017, and then $71 million from 2018-2022. Our current expectation is that this cost will be at least $100 million in 2023, and could even exceed $120 million. The exact amount will not be known until the Pension Board finalizes its actuarial and investment assumptions early next year, and this contribution will not be due until January 2024. This higher pension contribution amount is required to be made each year until the 2027 payment is due in January 2028.The city is still able to utilize funds from the American Rescue Plan Act (ARPA), signed by President Biden in 2021. And this year's ARPA budget allocation of $75 million to make up for "revenue loss" goes entirely to the city’s fire department, or else the reductions to fire fighter jobs and engines could be even higher. ARPA will pay for the majority of the Milwaukee FD’s expenses in 2023, and funds nearly 60% of the city’s fire fighting positions. Of course, you have to find a place to pay for those funds in 2024, and that puts a squeeze on those jobs and/or other services going forward. Along those lines, ARPA is paying for 97.5 positions in the police department, and those jobs now have top be put back onto city funding, meaning that the Milwaukee PD’s city-funded budget is slated to go up by $20 million next year. While there are 17 fewer cops, there actually will be more people working for the Milwaukee PD due to 43 dispatchers being added to bring that part of law enforcement up to standard, and additional forensic investigators and crime analysts. This is where I remind you that the city cannot use the "tools" of Act 10 to change the pension agreement with police and fire fighters, as payback for their unions supporting Governor Walker and other WisGOPs in 2010. Now there is one type of payment to Milwaukee that hasn't been cut by the GOP Legislature in recent years, and that's voucher payments to allow K-12 students in the city to attend private schools. Total payments to voucher schools under the Milwaukee voucher program have risen more than 50% since 2013 - $244.4 million this year vs $161.1 million in 2013. Funny how those funds get adjusted for inflation and costs among WisGOPs, and how the voucher schools aren't subject to limits on other fees and funding. Those WisGOPs sure don't allow the city of Milwaukee's public schools or its government to have that kind of help and fiscal freedom. And without changes in state law to allow the city to have a sales tax, increased shared revenues, or more flexibility in dealing with police and fire fighters to reduce the pension costs that continue to grow, it will get worse when ARPA funds dry up after next year. If WisGOPs gave a damn about improving conditions in the state's largest city, tourist destination and economic engine, they'd GET OUT OF THE WAY and allow the city the optiuons and resources to do what needs to be done. But then they wouldn't be able to beat up on majority-minority Milwaukee to outstate and suburban rubes, and misdirect these scared fools from asking real questions about why the WisGOPs aren't doing a thing to improve the rest of the state either.

Monday, September 19, 2022

Budget deficit still in good shape, and not a drag on our growth

The federal government incurred a deficit of $217 billion in August 2022, CBO estimates— $47 billion more than the deficit recorded last August. Revenues and outlays were higher this August than they were a year ago. Outlays in August 2021 were affected by a shift in the timing of certain federal payments that otherwise would have been due on August, 1, 2021, which fell on a weekend (those payments were made in July 2021). If not for those shifts, the August 2022 deficit would have been $13 billion less than the deficit in August 2021.Ah, so that explains it. When you combine July and August to remove those distortions, the US budget deficit has shrunk by a little more than $42 billion, or 8.9% ($472.7 billion in 2021, $430.6 billion in 2022). And August’s picture seems especially OK when you break down the individual numbers, which show a sizable increase in tax receipts, with an increase in expenses that is smaller than the rate of inflation.

CBO estimates that receipts in August totaled $304 billion—$36 billion (or 13 percent) more than in the same month last year—primarily because receipts of individual income and payroll taxes grew by $34 billion (or 15 percent). The largest source of that increase was amounts withheld from workers’ paychecks, which rose by $22 billion (or 10 percent). The net collections of those taxes also were boosted by a decline in refunds of individual income taxes, which were $8 billion (or 44 percent) lower than they were in August last year. Unemployment insurance receipts increased by $3 billion (or 42 percent). Revenues from all other sources rose by $2 billion, on net. Outlays in August 2022 totaled $521 billion, CBO estimates. If not for timing shifts that decreased spending in August 2021, outlays in August 2022 would have been $22 billion more than in August 2021, an increase of 4 percent.With one month to go, the CBO says the budget deficit is at $944 billion for FY 2022, which is the lowest deficit since 2019 - the last fiscal year before COVID-era assistance programs were put in place. The CBO said there is one final wild card in figuring out what the final deficit figure might be.

Ordinarily, with just one month left in the fiscal year, projecting the annual deficit would be relatively straightforward. This year, however, the announced changes to the student loan program add significant uncertainty because they may lead to the recording of substantial outlays in September. Under the Federal Credit Reform Act, the estimated long-term effects of such changes to the terms of outstanding loans are recorded as an increase in outlays in the month when those terms are changed. This year, both the timing and the amounts of the changes to the student loan program are uncertain. Without the changes to student loans, CBO’s projection of the 2022 budget deficit would be about $1.0 trillion, compared with a $2.8 trillion shortfall last year. If significant numbers of student loans are modified in September, the 2022 deficit could be considerably larger than CBO has estimated. Some of the announced changes (such as the changes to income-driven repayment plans) will increase deficits in future years.Given that student loan recipients aren’t likely able to even apply for relief until next month, it is possible (if not outright likely) that the full-year deficit for 2022 will be below $1 trillion. That would be the first time in 4 years we’ve had a deficit under 13 figures, and reiterates that 2022’s inflation has little to do with “government spending” or our budget deficit. What's especially noteworthy is the 15% drop in outlays compared to 2021, and it is largely due to the end of many COVID-related boosts in assistance.

Outlays for certain refundable tax credits totaled $281 billion—a decrease of $469 billion, or 63 percent. That reduction occurred largely because most of the second and third rounds of recovery rebates were paid in January and March 2021. Partially offsetting that decrease was higher spending on the child tax credit and the premium tax credit. Outlays for unemployment compensation decreased by $346 billion because enhanced benefits that had been enacted earlier in the pandemic expired in September 2021 and because the number of people receiving unemployment benefits declined.Which is how it’s supposed to work, right? The depressed economy recovers, and the stabilization/stimulus measures go away. That demand has kept up to the point that we are now dealing with shortages in labor and supplies instead of slack illustrates how strong the underlying economy as th3ese supports have ended. But there is one expense that has grown in FY 2022 - and it would be the only reason that you should really care about the deficit these days.

Net outlays for interest on the public debt increased by $121 billion (or 32 percent), primarily because higher inflation this year has resulted in large adjustments to the principal of inflation-protected securities.And because the Federal Reserve seems bent on jacking up interest rates to reduce inflation to a low number, no matter how much it damages asset markets or the real economy, that interest cost is likely to stay high and/or grow with new debt that gets issued. Still, that higher expense won't be a level that should limit other parts of the US budget, and the US dollar remains at multi-decade highs. But if GOPs like Ron Johnson starts crying crocodile tears over the deficit, then we can unwind the GOP Tax Scam that blew up the deficit in the first place, especially the giveaways to the rich, and that number will fall real fast.

Sunday, September 18, 2022

In Wisconsin, the MU Law Poll is not God. Especially with young voters

Johnson vs Barnes

Johnson 55%, Barnes 33% Evers vs Michels

Michels 37%, Evers 33% For Senator, do we really believe that the election denier who believe climate change isn't real (Johnson) is leading the 35-year-old Black man (Barnes) among the youngest and most diverse set of voters in the state? For Governor, do we really believe the out-of-state CEO that wants to outlaw abortion and is endorsed by Donald Trump leads the former school teacher that wants to keep abortion safe and legal and supports the legalization of marijuana? I don't, especially when we know that Wisconsin voters 18-29 supported Joe Biden over Donald Trump by more than 20 points in 2020. And the former press secretary for US Sen Russ Feingold has a good theory as to why that 18-29 result is so out of step with all other data points that we've seen. Note: he is referecing the "likely voter" results, but it's the same story.)

I'm coming up on 50, and I rarely answer phone calls from weird numbers (although sometimes I do in the hopes I'm getting polled). And it gets less common as you get younger, which makes you wonder what kind of person under 30 would answer a phone calls from a number they don't know. I'm not blaming Charles Franklin and company on this - it's just a problem with polling in general. So let's throw out that 18-29 figure from the MU Law Poll, assume the Dems win that demographic by 20 points (which is likely a better result for the GOP vs what they're going to get in November), and here's what we get. MU Law Poll if Dems win 18-29 by 20 pointsWhat's going on here? Too much sample stretching. Because 52% of the poll respondents were 60+ & only 16% were in the 18-39 group. So, the youngsters' sample was stretched to proper weight. However, when sample is too small (and bad ) and it's then stretched, it skews poll. pic.twitter.com/PtWJBjkFum

— Jud Lounsbury (@JudLounsbury) September 15, 2022

Evers 47.2, Michels 41.4

Barnes 48.0, Johnson 43.5 That doesn't mean I'm not concerned. Barnes and the Wisconsin Dems in aren't hammering Johnson nearly hard enough - and God knows Johnson has enough to attack that makes him unelectable to more than 50% of Wisconsinites. And they need to be more forceful in calling our Republicans as election deniers, racist trash, and a party that HAS NOTHING when it comes to dealing with the issues that matter in 2022 Wisconsin and 2022 America. But what would our media be saying if Evers was up 6, and Mandela was up 4-5? They sure wouldn't be spinning the race as a toss-up and it would make GOP attacks look much more desperate. And if Dems were attacking, it would push our media into having to ask real questions about Republicans and what they truly believe in, which is something that GOPs do not want voters to know.

Wednesday, September 14, 2022

INFLATION WATCH and WALL STREET PANIC returns! And it's really stupid

OK, not much different than what we saw in July (where inflation was flat). But Wall Street saw this and LOST THEIR FUCKING MINDS!JUST IN: US inflation was 8.3% in August. That’s still way too high, but it is down slightly from 8.5% in July and 9.1% in June.

— Heather Long (@byHeatherLong) September 13, 2022

In a surprise, inflation ROSE 0.1% in August. (many expected a drop). Shelter, food and medical care went up, offsetting a 10%+ decline in gas prices

Stocks fell sharply on Tuesday after a key August inflation report came in hotter than expected, hurting investor optimism for cooling prices and a less aggressive Federal Reserve. The Dow Jones Industrial Average slid 1,276.37 points, or 3.94%, to close at 31,104.97. The S&P 500 dropped 4.32% to 3,932.69, and the Nasdaq Composite sank 5.16% to end the day at 11,633.57…. The August consumer price index report showed a higher-than-expected reading for inflation. Headline inflation rose 0.1% month over month, even with falling gas prices. Core inflation rose 0.6% month over month. On a year-over-year basis, inflation was 8.3% . Economists surveyed by Dow Jones had been expecting a decline of 0.1% for overall inflation, with a rise of 0.3% for core inflation. The report is one of the last the Fed will see ahead of their Sept. 20-21 meeting, where the central bank is expected to deliver its third consecutive 0.75 percentage point interest rate hike to tamp down inflation. The unexpectedly high August report could lead the Fed to continue its aggressive hikes longer than some investors anticipated.So this drop in the stock was entirely due to Wall Street expectations and then speculation of what might happen in the future. Sure seems like a system you want to trust your retirement in, right RoJo? I’m looking at the data, and I’m confused over what the big deal is. The ”core” inflation figure that triggered the traders was 0.6%, higher than the 0.3% that registered in July. But it’s no different than the increases we saw in the 3 months before then (all between 0.6% and 0.7%), and in the Bureau of Labor Statistics’ summary, you can see a key driver of August’s core increase is due to one factor in particular.

…The shelter index continued to rise, increasing 0.7 percent in August compared to 0.5 percent in July. The rent index rose 0.7 percent in August as did the owners’ equivalent rent index. The index for lodging away from home rose 0.1 percent over the month after declining in June and July.This “equivalent rent index” seems to have lagged the increases that we saw in home and property values in much of 2021 and early 2022. But now it’s catching up to those higher levels, while home prices are plateauing and declining as the Federal Reserve has rapidly and severely hiked interest rates.

After two years of runaway price growth, the U.S. housing market has hit a tipping point. Home price growth has been decelerating for months now as the U.S. market cools from the pandemic frenzy. But in July, that shifted to an actual decline as the median home price fell 0.77% from June — the largest single-month decline in over 11 years. That’s according to Black Knight’s July Mortgage Monitor report released Wednesday, which also showed home prices have declined from their peaks in more than 85% of the 50 largest U.S. housing markets. Home prices are down by more than 1% in a third of those markets, and more than one in 10 are seeing prices fall by 4% or more.Given that the Fed is projected to raise the costs of mortgages by doubling the Fed Funds between now and early 2023, there’s little reason to think home prices will start going back up any time soon. I just hope it’s a steady leveling/decline that pares back the big jump in wealth many have seen in recent years, instead of a crash that cascades onto itself, and causes significant job loss. The better news on the inflation front came today, with the release of the Producer Price index. This number declined for the second straight month, and the “core” increase was much less than what we saw with the CPI.

The Producer Price Index for final demand fell 0.1 percent in August, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices decreased 0.4 percent in July and advanced 1.0 percent in June. (See table A.) On an unadjusted basis, the index for final demand moved up 8.7 percent for the 12 months ended in August. In August, the decrease in the index for final demand is attributable to a 1.2-percent decline in prices for final demand goods. In contrast, the index for final demand services advanced 0.4 percent. Prices for final demand less foods, energy, and trade services moved up 0.2 percent in August following a 0.1-percent rise in July. For the 12 months ended in August, the index for final demand less foods, energy, and trade services increased 5.6 percent.That 8.7% 12-month increase is a big decline from the 11.3% that number was at in June. And even better is that producer prices for foods didn’t change at all in August, and have only increased a total of 1.6% in the last 4 months measured – an annual rate of less than 5%, compared to the 11.4% increase we have seen for food over the last 12 months at the consumer level. Logically, CPI should be calming in several areas in the next couple of months. Which makes me wonder why Wall Street media keeps talking about inflation “continuing to roar” and doesn’t see that things are moderating (albeit at an elevated level of prices vs what we had 18 months ago). Is it because they WANT the market to fall and fear to rise, which would hurt Democrats in November’s elections? And why does the Fed seem hell-bent on imposing pain and crushing the economy along with inflation, instead of allowing for the soft landing that will likely happen if it does smaller rate hikes and gives time to let things sort out? I know the Masters of the Universe don’t like it when people with real jobs start making money and having more options, and they don’t care what happens to most of us (both politically and economically) as long as it maintains and/or increases their chances of being the controllers of things. I'm frustrated at the situation, because our "inflation" feels like BS greed with record corporate profits, followed by Wall Streeters and other rich BubbleWorlders using a 1970s playbook to deal with a very different post-COVID reality in 2022.

Monday, September 12, 2022

After delay, GOPs on Finance finally OK opiod funds. Will they hold up JUUL settlement?

Revisions approved by the panel include: *approving $10 million to expand prevention, treatment and recovery facilities, $1 million less than what the Evers administration had proposed. *approving $250,000 for K-12 substance abuse prevention curriculum, rather than the $2 million the Evers administration had proposed. *eliminating the Evers administration proposal to put $1 million into community-level prevention programs and the $2 million for family support centers. Along with putting $3 million into law enforcement grants, the GOP motion added $1 million to the Evers proposal for using medication such as methadone to help those with withdrawal symptoms. That pushed the funding to $2 million.So Republicans are fine with using settlement funds for opiod-related grants to pay for services. But won’t give money to local governments to make it easier to hire cops or provide other law enforcement services, or even allow most communities to raise their own money via sales tax.

RESPECT OUR AUTHORITY! Side note – the state is only getting these funds because Attorney General Josh Kaul joined the multi-state lawsuit against the opiod manufacturers in March 2019. That came after GOP predecessor Brad Schimel refused to join that suit, and likely for the corrupt reason you think. And it appears that the Joint Finance Committee is going to be presented with information on another multi-million dollar settlement, based on this news from last week.

Wisconsin will receive part of at $438.5 million settlement between the U.S. and JUUL labs, following a two-year investigation into the vape manufacturer. JUUL, a popular e-cigarette brand, has been under scrutiny for both its advertising and its cartridge flavors, such as fruit and candy, which draw in the child and teen market. Wisconsin, one of 34 states and territories to receive a portion of the settlement, will receive $14.4 million…. States will begin receiving their portion of the settlement in the coming weeks, with funds to be paid over a period of six to 10 years. The amounts will increase if JUUL stretches out the payments until the full 10 years. The total owed could reach $476.6 million.This is another lawsuit that AG Kaul joined in on, which makes me suspicious that the Republicans will pull another delaying tactic in the coming months when the plan to spend that $14.4 million comes out. Especially if the plan is released before the November 2022 elections. The delay for the opiod funds was eye-rolling, as was the excuse that the GOP co-chairs on JFC gave for not going along with the original plan (the GOPs complained they weren’t asked for input, despite DHS holding 12 public hearings on what to do with the opiod funds and the related epidemic). But the funds are finally getting out there, and while it’s a small benefit compared to the great costs that the drug pushers have put upon people and the state, it’s at least something that can help people in the future. Which makes it all the more pathetic when GOPs in the gerrymandered Legislature hold up that money to have input settlement that they never wanted to make in the first place.

Saturday, September 10, 2022

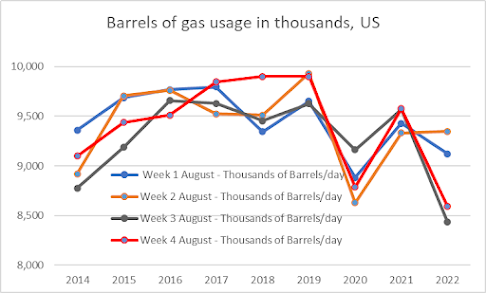

Gas prices fell back to earth in August, as Americans adjusted to oil company greed

Tuesday, September 6, 2022

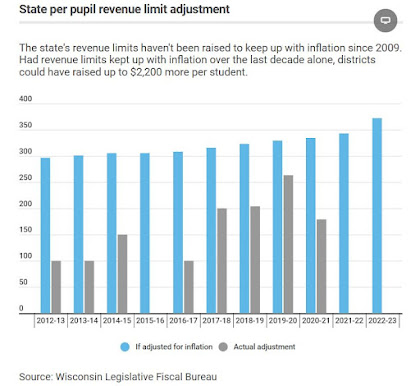

Evers goes big on K-12 again, looking to increase resources, but not property taxes

Gov. Tony Evers on Tuesday called for spending nearly $2 billion more on public K-12 schools — a plan derided by Republicans that was released nine weeks before the election and designed to allow school spending to increase without resulting in higher property taxes.> Well of course Republicans wouldn't like anything that funds public schools without raising property taxes. They don't want Wisconsinites to realize we can do both. But with $5 billion in the bank, we certainly are capable of doing this, if we choose to. However, I've maintained that what is possibly more important than the amount of state spending on K-12 public schools is the revenue limit that guides how many funds can actually go into the classroom. There may have been a sizable increase in state spending in the 2021-23 budget, but it won't do much because the GOP Legislature made that increase go to property tax relief instead of actual resources for the district, by keeping base revenue limits at the same levels that they were 2 years ago. That's especially bad in a time of rising costs. The GOP Legislature argued that COVID relief funds could make up the difference for K-12 districfts 2021-22 and 2022-23. But that is out of the picture in the next budget, and there is going to be a need to make up the difference for the lack of increased revenue. And that's not just happened in the last 2 years, but for the decade before. So what do we have on this front? Let's go to Evers' own press release.

Revenue limit increases of $350 per pupil in 2023-24 and an additional $650 per pupil in 2024-25, along with a roughly $800 million state investment to hold the line on property taxes.Evers' $350/$650 per pupil increase in the revenue makes up for some (but not all) of that. What I'm trying to figure out is where the "$800 million to hold the line on property taxes" is derived from. Is it $800 million in extra general aids to offset some/all of the added revenue limit? Or is it enough to increase revenue limits by $350/$650, and also cut property taxes by $800 million. My guess is that it's just keeping property taxes flat while allowing for schools to spend more with the higher revenue limits - still a good thing, by the way. I say that because of the other additional funds that Evers' education budget is asking for.

Per pupil aid increases of $24 per pupil in 2023-24 and an additional $45 in 2024-25 (matching percentages of increase to the revenue limit growth), resulting in a more than $60 million in estimated investment..... Gov. Evers and Superintendent Underly’s plan will ensure our schools have the resources they need to ensure every kid can succeed by investing $750 million over the biennium to increase special education aid.Then add increases for several other categorical aids (which do not count toward revenue limits), and that gets us toward $2 billion in additional funding pretty quick. No, I don't count on a lot of Evers' K-12 plans to become law, barring a Dem landslide that causes the GOP's gerrymander to fall through the floor. But it does serve to show who believes in investing in education, and in making this state more economically competitive. It also brings into sharp focus the fact that the Tim Michels and all other WisGOPs have nothing to offer on K-12 besides the regressive, community-destroying idiocy of "vouchers for all".

It's like listening to Trump promise his "extra special health care plan that's better than ever." Sure, Timmy. That ridiculous response from East Coast millionaire failson Michels underscores why it was a very good move for Evers to come out with this. And to remind Wisconsinites that we have the resources to strongly invest in first-class public schools and improve our communities if we choose to. So choose wisely.ten bucks says this guy can’t explain the difference between equalization aid and categorical aids and he’s talking about schools like he didn’t send his own kids to private schools in connecticut https://t.co/1y0hbgihGb

— Jay Bullock, Election Rigger (@folkbum) September 7, 2022

US and Wisconsin still benefitting from better jobs/wages as Labor Day passes

Krugman's first point is that before Biden took office, econimic “experts” were saying that unemployment would still be above 5% in 2022, instead of the 3.7% we are at today. And having all those additional jobs means more income overall for Americans, which is a good thing.”A strong labor market seems to have helped reduce inequality,” @paulkrugman writes. “And the Biden boom may also have indirect effects that will raise wages and reduce inequality further in the future.” https://t.co/tbjG92cX27

— New York Times Opinion (@nytopinion) September 6, 2022

If we include wage gains due to the rising share of Americans with jobs and the rising number of hours for those employed, the Biden boom has, unambiguously, been good for workers’ incomes. Thomas Blanchet, Emmanuel Saez and Gabriel Zucman of the University of California at Berkeley have a new website, Real Time Inequality, that tracks American incomes by source on a monthly basis. They found that overall labor income per working-age adult, adjusted for inflation, rose 3.5 percent from January 2021 to July 2022. Furthermore, the biggest gains went to the lowest-paid workers. So the Biden boom didn’t just increase overall incomes; it reduced inequality.This is backed up by the latest US jobs report, which continues to show big annual increases in average hourly wages for 2 of those lower-wage sectors. Change in average hourly wage, Aug 2021 - Aug 2022

Transportation and Warehousing +8.9%

Leisure and Hospitality +8.7% That being said, Krugman admits that overall wages for many who have kept jobs since Biden took office in January 2021 haven’t had their wage increases keep up with rising prices (lagging by about 3% among all jobs). But Krugman adds that most of those rising prices are due to significant increases in food and energy prices, which has little to do with anything Biden has or has not done, and a lot more to do with worldwide factors that all nations are dealing with. Sure, we still pay for those high food and gas prices and it hurts if wages don’t keep up. But Krugman adds that these Bubbles have been popping in recent months while wages have continued to rise (by 0.5% in July and 0.3% in August). Put it together, and Krugman says that US workers are in a better spot than they were at the end of 2020, and are well-positioned to get even better for the future.

So, yes, the Biden boom has been good for workers. More Americans — a lot more Americans — got jobs, and while those who were already employed suffered a decline in real wages, that decline reflected events in global food and energy markets, not U.S. policy. Beyond that, a strong labor market seems to have helped reduce inequality. And the Biden boom may also have indirect effects that will raise wages and reduce inequality further in the future. For the sellers’ market for labor may have helped revive America’s long-moribund labor movement. There has definitely been a surge in attempts to organize workplaces, although there haven’t yet been enough successes to show up in overall unionization statistics. Still, attitudes have clearly changed, and not just among workers. Gallup recently reported that public approval of unions has reached 71 percent — its highest level since 1965.Paul Krugman of the New York Times, who noted that this economy has come a long way since Joe Biden took office in January 2021. Kruman's first point is that “experts” were claiming that unemployment would still be above 5% for 2022, instead of the 3.7% we are at today. And having all those additional jobs means more income overall for Americans, and that’s a good thing.

If we include wage gains due to the rising share of Americans with jobs and the rising number of hours for those employed, the Biden boom has, unambiguously, been good for workers’ incomes. Thomas Blanchet, Emmanuel Saez and Gabriel Zucman of the University of California at Berkeley have a new website, Real Time Inequality, that tracks American incomes by source on a monthly basis. They found that overall labor income per working-age adult, adjusted for inflation, rose 3.5 percent from January 2021 to July 2022. Furthermore, the biggest gains went to the lowest-paid workers. So the Biden boom didn’t just increase overall incomes; it reduced inequality.Krugman admits that overall wages for those who have kept jobs since Biden took office in January 2021 haven’t kept up with rising prices in that same time (lagging by about 3%). But Krugman adds that most of those rising prices are due to significant increases in food and energy prices, which has little to do with anything Biden has or has not done, and a lot more to do with worldwide factors that all nations are dealing with. Sure, we still pay for those high food and gas prices and it hurts if wages don’t keep up. But Krugman adds that these Bubbles have been popping in recent months while wages have continued to rise (0.5% in July and 0.3% in August). Put it together, and Krugman says that US workers are in a better spot than they were at the end of 2020, and are well-positioned to get even better for the future.

So, yes, the Biden boom has been good for workers. More Americans — a lot more Americans — got jobs, and while those who were already employed suffered a decline in real wages, that decline reflected events in global food and energy markets, not U.S. policy. Beyond that, a strong labor market seems to have helped reduce inequality. And the Biden boom may also have indirect effects that will raise wages and reduce inequality further in the future. For the sellers’ market for labor may have helped revive America’s long-moribund labor movement. There has definitely been a surge in attempts to organize workplaces, although there haven’t yet been enough successes to show up in overall unionization statistics. Still, attitudes have clearly changed, and not just among workers. Gallup recently reported that public approval of unions has reached 71 percent — its highest level since 1965.The COVID era likely made a lot of people reasses their working situation, and what is or not an acceptable situation. And we're still the results shake out in 2022. Closer to home, the Center on Wisconsin Strategy (COWS) released their annual State of Working Wisconsin last week. And COWS says that Wisconsin reflects a lot of the national trends, including a disparate jobs impact among sectors.

From the very beginning of the pandemic, the Leisure and Hospitality sector has faced the most intense changes. Shedding nearly half its jobs in March 2020, the sector has had a dramatic recovery but still holds 6 percent fewer jobs than before the pandemic. Workers in this sector faced the most intense unemployment at the beginning of the pandemic, suffering that piled on top of the low wages, insufficient and volatile hours, and few benefits that these jobs tend to offer. While the underlying structure of these jobs is still a challenge, national evidence suggests that workers are securing some increases in wages and hours of work. Three other sectors have posted similar losses since February 2020: Other Services (which includes a mix of services including repair and cleaning services) is down 6.8 percent; Government is down 5.4 percent; and Education and Health Services has declined by 3.7 percent. Wisconsin’s declines in Government and Education and Health Services are especially notable because the state’s sectors substantially underperform the national trend. Wisconsin has four sectors that have grown since 2020: Construction (up 4.5 percent); Trade, Transportation and Utilities (up 0.7 percent); Information (up 1.7 percent); and Professional and Business Services (up 1.5 percent). The growth of Construction is especially strong and far outpaces national trends for the sector.On the wage side, working Wisconmsinites have also seen a strong increase in pay during the 2020s. COWS says a combination of a tight, strong labor market and the effects of the pandemic are both playing a role here.

There are two explanations for strong wage growth over the last two years. First, sustained economic growth that preceded the pandemic finally showed up in workers’ paychecks. This is unambiguously good news for workers. A more ominous factor was also at play in increasing wages in 2020. COVID shutdowns disproportionately displaced low-wage workers — particularly restaurant, bar, and hotel workers who lost jobs during the shutdowns. Median wages rose during the shutdowns because lower wage workers lost their jobs. This likely also explains part of the dynamic in wage growth in 2020. As lower wage workers returned to their jobs in 2021, this compositional impact has faded.Wisconsin's median (inflation-adjusted) wages had stagnated for nearly 15 years, until they finally started rising in the mid-2010s. But things took off in 2019 and 2021, to the point that COWS says our median wages finally passed the US median for the first time in several years. And COWS also gives evidence of wage inequality being reduced in Wisconsin between 2019-2021, at least if you break it down by race and gender. COWS doesn't have this breakdown for 2022, so it'll be intriguing to see what we find as our jobs market seems to have maxed out this year. But at both the US and state levels, we see a very strong jobs market that continues to roll as we end the 3rd quarter of 2022. Which is probably why US central bankers want to stop that growth in the name of "taming inflation". Can't have the plebes get too many choices and feel like they have control, after all.