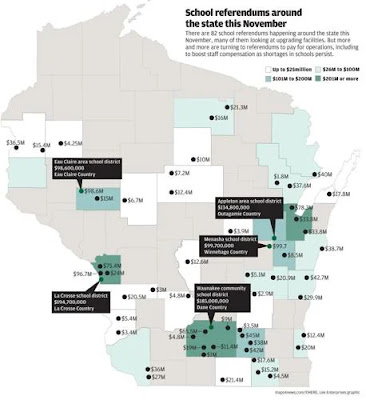

Over the past week, Governor Evers has been rolling out major parts of the 2023-25 budget that (he will introduce tonight). That’s typical for a Wisconsin governor to do, and most of the items released were your typical meat-and-potatoes stuff (veterans initiatives, tax plans, K-12 schooling, shared revenue, etc).

But I was not expecting

this to be a part of it. Gov. Tony Evers today announced a new plan to keep Major League Baseball and the Milwaukee Brewers in Milwaukee for the next 20 years. The plan, released as part of the governor’s 2023-25 biennial budget proposal, will invest a small portion of the state’s historic approximately $7 billion surplus to ensure the Milwaukee Brewers remain in Milwaukee through 2043. Without this investment, the Milwaukee Brewers and Major League Baseball could leave Milwaukee as soon as the conclusion of the 2030 season when the current lease with American Family Field expires….

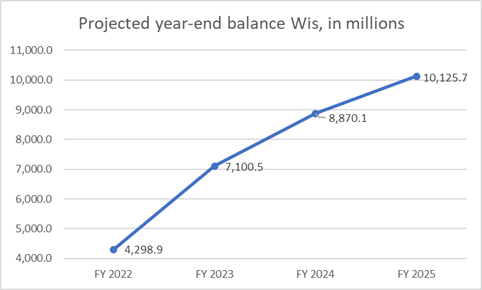

Gov. Evers’ budget proposal, which makes a one-time investment from the state’s historic surplus rather than using long-term bonding, will save taxpayers over $200 million over the Brewers’ lease term while generating more than $400 million in revenue over the next two decades.

I had mentioned previously that the Brewers’ stadium issue was one that was going to become more prominent in the coming years, as the Miller Park tax ended in 2020 and

team officials started discussing ways to pay for future fixups to what is now known as American Family Field.

I wasn't counting on Evers or the Legislature to do anything about the Brewers stadium question in 2023, and especially not as part of the state budget. I was not the only one taken by surprise by this.

First of all, let’s remember that Robbin’ Vos and almost all GOPs backed a Governor who “dropped the bomb” on public workers 12 years ago this month, and tried to jam that bill through in a week, instead of through the state budget process. I don’t need to hear it from that twerp.

And let's not forget what the previous Governor cooked up when confronted with another Milwaukee stadium issue 8 years ago.

My response to tax dollars paying for pro sports stadiums is generally “NO”, as that industry tends to make a lot of money on its own, and communities usually have other needs worthy of tax dollars beyond entertainment districts (yes, entertainment outlets matter, but roads and public safety and parks and a lot of baseline items matter more).

However, I am willing to give the plan a look. So what is it, and

what did they base the need on?

The first step was figuring out how much it would cost to keep up AmFam Field to an adequate level over the next 20 years.

The Evers administration and the Brewers agreed to the $428 million estimate, with another $20 million to cover inflation's effects on those costs.

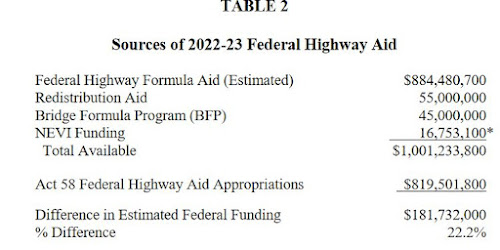

That $448 million would be covered by the proposed $290 million payment; interest earned on that payment, which would be deposited in an escrow account operated by the stadium district, and $70 million from the stadium district's current reserve fund.

So this is a one-time payment out of the surplus of $290 million, which goes to the Ballpark District board that oversees stadium operations, and then sits in an account along with the $70 million left over from the Miller Park tax, earning interest over time.

It's a positive that this would be done without having to borrow money and take on extra costs over time, unlike the Bucks arena.

The final package for the Bucks ended up costing a little over $100 million at the state level (after accounting for the extra funds needed to take care of the Bradley Center in the meantime), and we will be paying off that debt for another 13 years.

I’d argue the Brewers are a bigger draw than the Bucks for out-of-town dollars and attendance, But three times larger? Not so sure about that, and I’m not overly keen on subsidizing the Brewers’ ballpark when those guys don’t even pay property taxes on the acres of property that they have been given

(as Bruce Murphy of Urban Milwaukee pointed out last year).

Let's also bring up the sports standpoint. At least Bucks have already gotten one title since moving to their new arena, are in great shape for another this year, and

have signed Giannis Antetokounmpo to a league-maximum contract that will likely keep the Bucks as a title contender for at least the next 2 years.

To be sure, no one knew Giannis would become a Hall-of-Fame player when the Bucks arena bill became law in 2015. But it's still going to be hard for the Brewers to justify a subsidy at a time when the Crew’s billionaire owner is

shelling out millions for an English soccer team, which happened in the same month when the Brewers tanked the 2022 season by

selling off one of the top relievers in baseball with the team in first place.

And this recent headline sure makes you wonder how badly the Brewers want to invest in a winning product going forward.

When the team won’t spend $740,000 to avoid an arbitration hearing with one of the elite starting pitchers in the game, with his free agency looming in 2 years, it becomes pretty hard for them to justify giving them $290 million in tax dollars without any promise of using freed-up funds to improve the team.

Remember that the team is getting all of the operating profits from food and drink and admissions and media rights as it is, and with this package, they wouldn't have to spend as much to fix up the ballpark they use. So at the very least, if we’re going to subsidize the Crew,

can they at least not charge fans $12 for a Spotted Cow? I'm just saying.

Given how the Crew has disappointed in the last 6 months on and off the field, this may not be the best time or forum to talk about ponying up hundreds of millions of dollars to “save the team” when it can’t leave Milwaukee for at least 7 years as it is. And bringing the Brewers issue into the state budget is going to make that one of the big focuses of this Spring and Summer’s debate, when this is a once-in-a-generation chance to change a lot of things in this state for the better.

Most of the budget's issues generally favor Evers and the Dems, but now I have a sinking suspicion quite a bit of that will be drowned out by the talk among casual voters about the Brewers stadium. Feels like an unforced error to be talking about this now, especially when this picture could commemorate the last time we see an on-field Brewers celebration for a while.