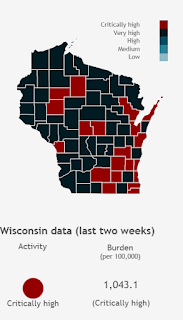

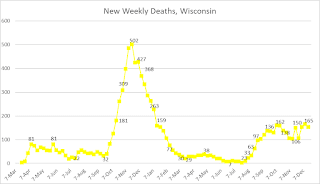

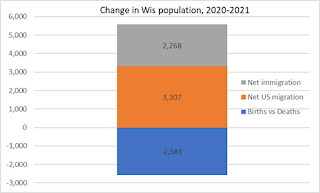

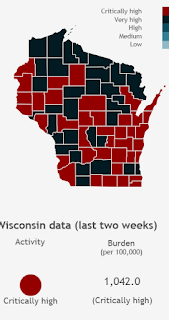

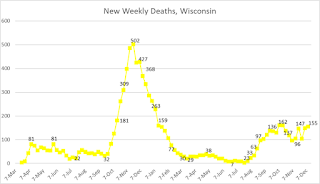

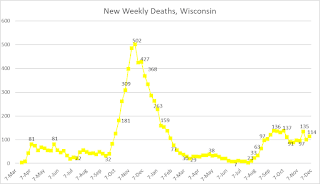

And you can't "trust the System" when our legal and political systems seem incapable of doing what it takes to hold the most flagrant lawbreakers accountable. Trump trash laugh as they break the law and threaten Democratic leaders with violence without being locked up or losing their jobs. An immense catharsis would come from seeing the January 6th plotters, Trump White House officials and members of Congress perp walked AND LOCKED UP for what these bastards tried to do and got others to do. It would go a long way toward lifting the feeling of cynicism and hopelessness that many of us feel right now. Democratic voters and activists did their job in 2020 to put Dems in power to reverse the damage from the Trump years and get this country in a new direction, and it is dispiriting to be told "trust us" and see excuses from DC Dems in not using that power to the full extent possible. Instead, we are asked by these same people to "vote harder again so we have wider margins in Congress" instead of taking the steps that are needed. I can do math and I get what they're saying, but dammit, CAN DC DEM "LEADERS" USE THE POWER AND THE PLATFORM THAT THE PEOPLE GAVE THEM? And if you can't, find some leaders who will. These people make 6 figures a year with government benefits, yet far too often are passing the buck to everyday people who don't have that amount of money, and have real jobs and lives to deal with. Then COVID continued to drag on, first in the Summer in the Confederacy, then into other parts of America in the Fall (mostly in unvaccinated MAGAt areas), and now it's back in vaccinated, urbanized areas with omnicron, and new cases are at their highest levels ever. Leading things to feel not much different than they did at the start of 2021, even though deaths are down significantly because of the vaccine and advances in treatment. Especially when so much work time and other time is spent glaring at a computer/phone screen. Many like me did all the right things in the first half of 2021 to avoid this very situation. We stayed in through the COVID Winter of 2020-21, got ourselves the shot when we were able to (after waiting behind the more vulnerable members), continued to mask up at work and crowded indoor situations, and got ourselves boosted near the end of the year. We did these things so we'd be able to return to normal and come and go without having to worry about COVID. Yet 30%er COVIDIOTS have kept that from happening, and have been rooted on by a Republican propaganda machine that believes undermining public health is a political winner. And now we are in December, where a friend of mine had to endure pain in his elbow and arm that so severe he couldn't stand up, but couldn't be admitted to the hospital in Madison for 2 weeks because of MAGAts from other parts of the state were taking up beds. Now that he has been admitted, they don't want him to be home for New Year's, because if they release him, they fear it will be difficult to re-admit him if things flare back up. These are the real damages happening from COVIDiocy today. And because we have a broken system that doesn't hold this type of scumbaggery accountable, either in everyday life or in politics, it makes it hard to function on an everyday basis because I'm infuriated by what I see, but the current Systems are either controlled by the bad guys (Wisconsin Legislature, courts) who block any action, or see justice delayed because of stodgy methods that advantage the rich and connected, and those in power aren't tough enough to stamp on those toes and force the confrontation and crushing that has to happen. Which mean there isn't much I can do in my everyday life that won't get me fired and/or in prison. And I bet I'm not alone. It's even limited me on thios page, because I have a job and a life and it becomes downright depressing to be smashing my head against the wall against all of the bad things that continue to overhang. So I've largely kept myself to the econ side and other numerical things on this blog more than the politics, although I certainly could riff a long time on that if I wanted to mess up my mental health. (I often use the quick, reactionary slams on Twitter vs here). What's also distressing is that the stakes of the bad guys winning in 2022 (both in Congress and in Wisconsin) are so high. It's the key to their plans to rig the Presidential election in 2024, and want to wreck the resemblance of fair elections at the state level. The WisGOPs are already showing some of the ways they would do this."The situation we're in now is that 24% of the American people have an effective veto over anything that 76% of the American people think is important public policy. I don't think that squares with democratic theory." -Sen. King on the broken Senate filibuster @SenAngusKing pic.twitter.com/6QsH6OcEQ6

— Maddow Blog (@MaddowBlog) October 21, 2021

Wisconsin GOP lawmakers want DPI chief, state treasurer and secretary of state appointed, not elected; voters rejected amendment to eliminate treasurer’s job in 2018, but Rep. Sortwell and Sen. Roth say this time would be different: @MollyBeck. https://t.co/kwYrY4FoFs

— Larry Sandler (@larrysandler) September 30, 2021

Add in the horrendous gerrymandering that makes it very hard to remove Republicans from controlling the lawmaking process in this state, and it can take a person to a dark place when they try to figure a way out to restore the Wisconsin that we loved prior to 2011. But I also know giving up is the ultimate goal of the bad guys, and letting the Bad Guys win and permanently screw over this state is an outcome I won't accept. This blog and my social media feed is a great outlet for venting my seething rage and maybe gets read by someone who actually is in a position to take steps to stop this madness. And I hope I can at least give some salve to others that are like "This is messed up, right?", but don't see much pushback to it in their everyday life. I'm going to still be here in 2022, and maybe we see progress where people that believe in decency, self-respect and fairness actually start getting a payoff for belieivng in such things. We're definitely not enough of it today, as grifting, arrogance and selfishness run rampant, without any accountability or comeuppance. I have to believe that 2022 will be a lot less of the "bleh" slog that we have today. Which leads me to this song that was the focus of the latest episode of the excellent "60 Songs that Explain the '90s" podcast from Rob Harvilla. He talks about Counting Crows and particularly focuses on the melancholy song "A Long December", which seems to sum up a lot of the cloudiness that we live under, despite the reality that things really are in a better spot compared to the start of the year.GOP lawmaker Amy Loudenbeck launches secretary of state campaign, calls for office to take control of elections https://t.co/CXAvQCZvoP

— Laurel White (@lkwhite) December 1, 2021

Drove up to Hillside Manor sometime after two a.m.

And talked a little while about the year

I guess the winter makes you laugh a little slower,

Makes you talk a little lower about the things you could not show her And it's been a long December and there's reason to believe

Maybe this year will be better than the last

I can't remember all the times I tried to tell my myself

To hold on to these moments as they pass And it's one more day up in the canyon

And it's one more night in Hollywood

It's been so long since I've seen the ocean

I guess I should. Thanks for those of you still reading, and let's make 2022 what we hoped 2021 would be, and then some.