In order to discredit the Build Back Better bill in the Senate,

Republican Lindsey Graham sent a request down to the Congressional Budget Office to ask what might happen to the US budget deficit if the act became permanent, instead of with much of it expiring after a few years. And CBO gave Graham the answer he wanted.

The Congressional Budget Office and the staff of the Joint Committee on Taxation project that a version of the bill modified as you have specified would increase the deficit by $3.0 trillion over the 2022–2031 period (see Table 2). That amount includes three components: effects usually counted in CBO’s cost estimates (which are labeled conventional effects in the table), the effects of increased resources for tax enforcement, and effects on interest on the public debt. Under long-standing guidelines agreed to by the legislative and executive branches, estimates to be used for budget enforcement purposes include the first component but not the second and third.

In comparison, including the same three components, the version of H.R. 5376 that was passed by the House of Representatives would increase the deficit by $0.2 trillion over the 2022–2031 period, CBO projects. The largest difference between the two estimates stems from an increase in the child tax credit that ends after 2022 in the House-passed version of the bill.

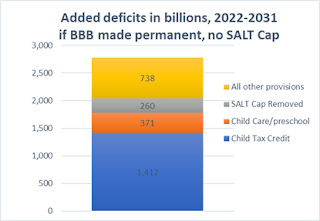

In fact, the Child Tax Credit part is $1.4 trillion of that $3.0 trillion, and the child care and preschool parts of Build Back Better would be another $371 billion.

There’s a lot of dishonesty in Sen.Graham’s request (some of these items are intended to be temporary reactions to our current situation), but there’s also BS that isn’t part of Build Back Better at all. CBO counts the higher cap on the State and Local Tax (SALT) deduction as both a negative (before 2026) and a positive (after 2026) due to the change in the tax code, but

Lady G’s Sen. Graham’s CBO request gets rid of the SALT Cap entirely after 2025, which adds another $260 billion to BBB’s “deficit”.

Those 3 items alone are more than $2 trillion of the $2.8 trillion of the added deficits that CBO says making BBB permanent would lead to.

In addition, this analysis assumes that the added IRS agents that are part of Build Back Better wouldn’t account for any more revenues after 2026 (after recovering at least $207 billion from tax cheats the first 5 years), which is an absurd assertion. So knock that off of the figure as well. Then remember that this is over 10 years, so even if you assume all of the non-SALT items happen, making Build Back Better permanent would cost around $200 billion a year, about 5% of total spending today…..or around ¼ of what we are projected to spend on the military in those years.

Not surprisingly,

Wisconsin’s Senior Senator piled onto this dishonest analysis with some spin of his own.

On Monday, U.S. Sen. Ron Johnson (R-Wis.) issued the following statement on the real cost of President Biden’s and Congressional Democrat’s Build Back Better plan:

“President Ronald Reagan once quipped, ‘Government programs, once launched, never disappear. Actually, a government bureau is the nearest thing to eternal life we’ll ever see on this earth!’ I appreciate the Congressional Budget Office (CBO) recognizing that wisdom when it provided a more honest score of President Biden’s and Congressional Democrat’s Build Back Better (BBB) budget busting plan. Dispelling the lie that BBB is fully paid for and will not ‘add a dime’ to our debt, CBO projects it will add $3 trillion. Oops, guess the Democrats forgot to tell the American people that. This latest example of Democrat governance reveals how dishonest Congressional Democrats are in trying to sell their radical far left socialist agenda to the public.

Democrat Party! SOZHIALIZM!

Actually RoJo, these programs would only remain if

voters and their Reps wanted them to remain. But Build Back Better would be likely to stick around because does things that people want, such as Medicare coverage for vision and hearing, expanding availability of Medicaid services in the home, more access to child care and preschool, an expanded Child Tax Credit, more clean energy and cheaper drug prices.

This is what Johnson and other Republicans are REALLY scared about – that Build Back Better will improve people’s lives, give them more choices and make them less reliant on corporate providers. Which is not what the GOPs (and their oligarch puppetmasters) want in any way.

And by the way, (mo)Ron, if you are so concerned about long-term costs and debts, why don’t we also look at how much our deficit grows if we assume the GOP Tax Scam continues through 2031? Most of those items are slated to expire in 2026 or earlier, because that was the only way it could be passed under the 50-vote reconciliation rules.

I do see an analysis from the Citizens for a Responsible Federal Budget mention that

an extension of the Tax Scam to 2028 would add another $1.2 trillion in deficits, and an earlier estimate from the Tax Policy Center

estimated the cost at $480 billion by 2027 plus “a growing amount thereafter.”

But “deficit hawk” Ron Johnson sure doesn’t say much about that, now does he? In fact, I’d bet Republican hacks would screech about “TAX INCREASES!!!” if the Scam is allowed to go away at that time. Because RoJo and other GOPs want to use the lower revenues from the Tax Scam as an excuse to decimate Social Security and Medicare…..after he and many of his fellow Boomers are dead, of course.

To flip it around, why doesn’t CBO include the expiration of the GOP Tax Scam as an additional pay-for on Build Back Better? After all, under current law there would be revenue boosts as the Tax Scam ends, and those dollars could be used to pay for whatever might get extended in Build Back Better.

The fact that GOPs like Ron Johnson never ask about the long-term costs and economic effects of the Tax Scam and other giveaways to the rich means we should completely ignore their crocodile tears about “future costs” of new spending programs. Particularly the ones that are in Build Back Better which can level our economy back toward something that gives our most vulnerable a better chance at stability and improvement.

No comments:

Post a Comment