Yes, COVID and omnicron is an overhang of the national mood, but at least for the first part of the Holiday shopping season, it wasn't keeping Americans from going out and spending. We saw more proof of that

in Thursday's income and spending report, which continued to show steady increases at or near the rate of inflation.

Personal income increased $90.4 billion (0.4 percent) in November according to estimates released today by the Bureau of Economic Analysis (tables 3 and 5). Disposable personal income (DPI) increased $70.4 billion (0.4 percent) and personal consumption expenditures (PCE) increased $104.7 billion (0.6 percent).

Real DPI decreased 0.2 percent in November and Real PCE increased less than 0.1 percent; spending on services increased 0.5 percent and spending on goods decreased 0.8 percent (tables 5 and 7). The PCE price index increased 0.6 percent. Excluding food and energy, the PCE price index increased 0.5 percent (table 9).

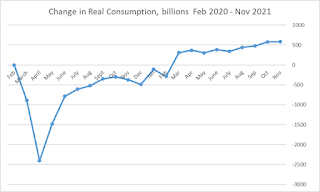

On the spending side, levels jumped up with the first round of vaccinations for most Americans this Spring, and has remained elevated since then, even after accounting for inflation.

It's also intriguing that services spending continued to grow even as COVID cases grew in the North and weather cooled, a much different pattern compared to what we saw when COVID cases rose in 2020 and early 2021.

The $104.7 billion increase in current-dollar PCE in November reflected an increase of $97.4 billion in spending for services and a $7.4 billion increase in spending for goods (table 3). The increase in services was widespread, led by housing and utilities. Within goods, an increase in nondurable goods (mainly gasoline and other energy goods) was partly offset by a decrease in durable goods (led by recreational goods and vehicles as well as motor vehicles and parts).

To me, this indicates that we have now adjusted to the COVID World, and now are spending and existing in similar patterns to what we did pre-COVID, with modifications in behaviors such as masking and perhaps in the method in which we consume the same items we did before.

But despite the gains in the last 9 months of 2021, some parts of the services side of the economy still have yet to benefit from the overall gains in spending that have happened in the country over the last 21 months. Food and accomodation services have barely nudged ahead of the inflation-adjusted pre-COVID totals, and transportation and recreational services are still in the hole.

With omnicron hitting bigger cities and complicating Holiday travel plans for many Americans, the December numbers in this sector will tell an interesting story, one way or the other.

On the income side, it's worth noting that CARES and ARPA-related stimulus measures are largely faded out, with stimulus checks being already paid to those who were eligible, and total unemployment benefits actually falling below the amount that they were at before COVID hit. Meanwhile, wages and salaries continued to grow form the 9th straight month.

You'll also notice that the direct payment of Child Tax Credits are the second-largest source of growth on this list, at an annual rate of more than $222 billion. That would be quite a bit of income to suck out of the economy if those checks were to go away in January, which seems like something to keep our eyes on in the next 3 weeks, and 3 months if we are foolish enough not to renew

this poverty-reducing measure.

The other income item of note that grabbed my attention was on how business owners are doing. For the first time since the pandemic started, business owners were getting more money from their everyday operations than they were from PPP loans and other subsidies, which is a strong indicator that things have finally returned to a near-normal situation during this Biden Boom.

So business owners are doing fine,

corporate profits are at record levels, wages continue to rise (particularly at the low end),

the stock market is at record highs, and spending continued at a solid pace in November despite all of the media-induced fears about inflation.

Other than the record profiteering (which can be controlled with the better anti-trust enforcement and higher corporate taxes that are in Build Back Better, this seems like a good situation to be in, although that nagging virus is certainly the wild card as 2021 winds down.

No comments:

Post a Comment