Now that I finally have a chance to catch up to the recent release of the GOP’s flat tax plan, let’s

dig into the Legislative Fiscal Bureau’s analysis, and see who will get the biggest benefits. Let’s start with the rates and the time frame:

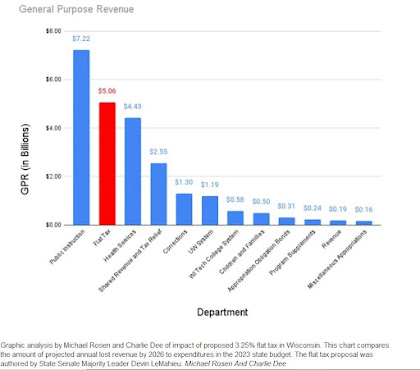

As you’d expect, the LFB tells us that this would result in a sizable tax cut to start, and then will balloon higher as the top rates decline more to reach the flat tax rate of 3.25%.

In total, the bill is estimated to reduce state general fund tax revenues by: (a) $2,113.5 million in 2023-24; (b) $2,845.1 million in 2024-25; (c) $4,314.7 million in 2025-26; and (d) $5,059.0 million in 2026-27 and annually thereafter. These fiscal estimates are expressed in corresponding tax year dollars (for example, the fiscal estimate under (d) is shown in tax year 2026 dollars).

Even if you figure that the state might have as much as $10 billion to play with over the next 2-year budget (based on

the Evers’ Administration’s estimates and a higher-than-budgeted Medicaid surplus), the LFB says this tax cut would blow nearly $5 billion of that total in those two years.

Then throw in the reality that more state spending would be needed merely to keep up with the loss of federal COVID assistance (especially in Medicaid) and to account for combined total inflation of 14% over calendar years 2021 and 2022 (which was not figured when the 2021-23 budget was passed). Then throw in the wild card of the crazies in the GOP House trying to take away more Federal spending and shove off the responsibilities to the states, and what is left gets taken up quickly.

Then add in another $9.4 billion that is given away in the following budget, and it removes any opportunity to invest in public schools, fix our broken system of shared revenues and local government financing, or any way to cut property taxes and target relief to low-income Wisconsinites. Doesn’t seem like a good use of this once-in-a-generation chance to change the way things are done and paid for in our state.

And that’s before we get into the regressive nature of the tax cuts that would result in a 3.25% flat tax.

Among all taxpayers with a tax decrease under the proposal, the estimated cumulative average tax decrease relative to current law would equal $4,415 over the four-year period from tax year 2023 through tax year 2026, and would equal $1,799 annually relative to current law beginning in tax year 2026. For filers receiving a tax decrease with Wisconsin AGI between $40,000 and $50,000, the estimated cumulative average tax decrease relative to current law would equal $752 over the same period, and would equal $290 annually relative to current law beginning in tax year 2026. For filers receiving a tax decrease with Wisconsin AGI between $125,000 and $150,000, the estimated cumulative average tax decrease relative to current law would equal $5,617 over the same period, and would equal $2,231 annually relative to current law beginning in tax year 2026. These examples assume that the tax filer remains in the same Wisconsin AGI category from tax year 2023 through tax year 2026 and annually thereafter.

Or to put it graphically…..

See how Wisconsin millionaires go from around $28,000 in tax cuts in year 1 to more than $112,000 in tax cuts by the time this flat tax is fully phased in 3 years later? By comparison, Wisconsinites making $50,000 would be getting a tax cut of less than $25 a month in 2026 (and likely paying more in property taxes or fees on the other end).

And if we assume the $70,000 to $80,000 range in 2023 (which will likely be the median household income in Wisconsin due to inflation/growth), the tax cut starts at $233 this year, and ends up near $900 by 2026. Not a bad total, and about 1/3 of total state tax a median income earner pays today, but nowhere near as much of a break as the 61% cut in taxes that millionaires would get.

I also want to throw in this nugget of analysis, which indicates that the flat tax would reduce a main source of the higher corporate tax collections since the GOP Tax Scam from DC became law in 2017 – because it won’t be as worthwhile for Wisconsin business owners to get the Feds’ corporate giveaways under a lower flat tax.

Provisions of 2017 Act 368 allow tax-option (S) corporations and partnerships to elect to be taxed at the entity level at a rate of 7.9% as opposed to filing under the state individual income tax. Based upon available data on final payments made by partnerships and estimated payments collected from S corporations, it is estimated that pass-through entity filers will remit over $800 million in 2023-24. By filing at the entity level, taxpayers are able to deduct state and local taxes on their federal income tax return (the "SALT" deduction) on pass-through income without the limitation that applies to individual filers that itemize deductions under federal law (which limits individuals from deducting more than $10,000 of state and local taxes). If the value of the SALT deduction exceeds the increased cost of the higher state corporate tax rate, it makes economic sense for certain tax filers to consider paying at the entity level.

Wait, before going further, why, does that pass-through provision sound familiar? Oh yeah, now I remember.

(SCUMBAGS! And it’s extra cool that RoJo, Hendircks, Uline and the rest of those oligarchs get to write off the SALT deductions and mortgage interest and “charitable” donations that people like me don’t).

Anyway, I digress. What would this flat tax scheme do for these pass-through loopholers from Wisconsin?

However, an individual with a marginal tax rate of less than 5% would receive a larger tax benefit by paying the lower state tax by filing as an individual, rather than paying the higher 7.9% entity-level tax rate and taking the federal deduction. Because the bill would create a top rate lower than 5% beginning in tax year 2025, it is assumed that all current entity-level filers would lack an economic incentive to file at the entity level and would file under the individual income tax beginning in tax year 2025 under the proposal. The estimated state revenue reduction associated with this filing shift from corporate to individual is $172.0 million in 2024-25, $442.6 million in 2025-26, and $516.3 million in 2026-27 and annually thereafter. These amounts are not included in [the analysis of tax years 2025 and 2026]. It is possible under the proposal that some current entity-level filers would revert to remitting under the individual income tax prior to tax year 2025, and that other taxpayers may continue to remit tax at the entity level in tax years 2025 and thereafter, but these assumptions are not included in this analysis.

So there’s another $1.1 billion that would mostly go to rich business owners.

And you also get a nice payoff if you’re, say, the Uihleins and own a Wisconsin company, but live out-of-state.

Under current law, pass-through entities with Wisconsin income that is allocable to a nonresident member are generally required to withhold Wisconsin income taxes from that member at the highest tax rate applicable to individuals (currently 7.65%). If the top individual income tax rate is reduced, this will reduce the income tax amounts withheld from nonresident members of pass-through entities as a result of the lower rate. This effect on pass-through withholding under the bill is an estimated revenue reduction of: (a) $53.5 million in 2023-24; (b) $71.4 million in 2024-25; (c) $103.6 million in 2025-26; and (d) $121.8 million in 2026-27. These amounts do not appear in [the analysis of tax years 2023 through 2026].

Oh, so another boost to

WisGOP megadonors rich folks who own business here, but live elsewhere? Why are we helping them, again?

The pass-through loophole shows that this flat tax scheme is even more of a regressive giveaway than you may have thought. And

as Dan Shafer of the Recombobulation Area pointed out earlier this month, the quotes from WisGOPs about who they’re trying to help with this plan is a great example of why the GOP’s “solutions” so frequently suck, and fail.

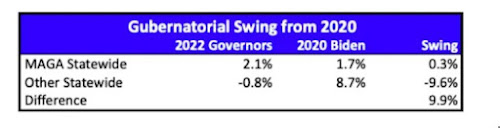

Robin Vos, in his inauguration day speech, mentioned wanting to enact this flat tax – campaign’s over, huh? – and went out of his way to say there’s “absolutely nothing wrong with” rewarding the wealthy through such a tax structure.

He also went on a tangent about retired couples with second homes who are making their primary residence somewhere other than Wisconsin. This is not the first time he’s mentioned this in recent months. Does he think this is a major problem for everyday Wisconsinites? Is he going to call an extraordinary session on snowbirds and second homes? Truly bizarre.

And the context in which he brought this up was about what he characterized to be Wisconsin’s “demographic” challenges — no net population growth over the last decade, combined with an aging population. (Gee, who could have been in charge during that period of flat population? Whose fault could this be? It’s a real mystery!).

But this continues to be a frequent refrain for Republicans, that cutting taxes for the wealthy or enacting a flat tax would help grow the state’s population. Republicans wanting to cut taxes is far from a new policy position, but with this as a stated end-goal? It just doesn’t add up.

The de-investment in communities that would certainly go with this flat tax scheme won’t help Wisconsin’s already-bad demographics. The lack of health care, strong community schools and local services would make it even harder for many to justify living in a place that has 4-5 months of Winter, let alone want to raise their families here.

We can use the massive amount of funds available in 2023 to give income tax relief to those who most need it, improve quality of life, and add incentives to deal with actual drawbacks to Wisconsin’s economic competitiveness. In addition to a modest drop in rates for all/most Wisconsinites (but still keeping it progressive), this can include giving a tax credit to caregivers, expanding the Homestead Credit, and reforming the model of funding our community schools and local governments so that we don’t need to use property taxes so much.

We’ve got plenty of money to play with in Wisconsin, and a cut in income taxes certainly can and should be done. But we shouldn’t be taking our cues from Indiana or Iowa or Illinois on how to do tax policy, and God knows that the rich and corporate don’t need much more help after the last 12 years of Fitzwalkerstani giveaways.