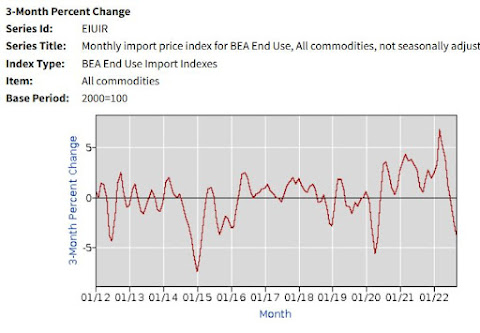

U.S. consumer spending rose more than expected in September while underlying inflation pressures continued to bubble, keeping the Federal Reserve on track to hike interest rates by another three-quarters of a percentage point next week. But there was some encouraging news in the fight against stubbornly high inflation, with other data from the Labor Department on Friday showing private industry wage growth slowed considerably in the third quarter. The moderation occurred in inflation-sensitive industries like retail, construction and finance. Sectors such as healthcare and education, which are still experiencing worker shortages, saw a pick-up.... Consumer spending, which accounts for more than two-thirds of U.S. economic activity, rose 0.6% last month, the Commerce Department said. Data for August was revised higher to show spending increasing 0.6% instead of 0.4% as previously reported.And while the Reuters report presents inflation as a mitigating effect, if you dig into the Commerce Department's report, the increase in spending rose past the rise in consumer prices for the second straight month.

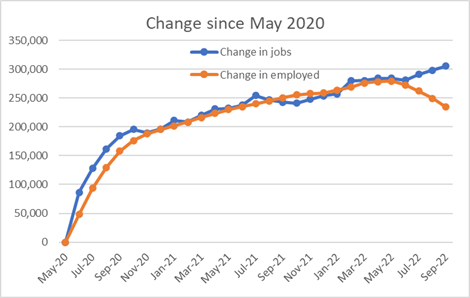

The PCE price index increased 0.3 percent. Excluding food and energy, the PCE price index increased 0.5 percent. Real DPI increased less than 0.1 percent in September and Real PCE increased 0.3 percent; goods increased 0.4 percent and services increased 0.3 percent.I'll add that the core PCE price index is actually 0.45%, which translates to just over 5% on an annual basis, and the last 3 months have had a total PCE core increase of 1.0%. Not that bad, really. After adjusting for inflation, consumer spending growth has certainly slowed down in 2022, but it's still higher than it was at the start of the year. When digging into the spending figures, you can see where the changes of 2022 have kicked in. Goods spending has been largely unchanged after the big increases of 2020-2021, and services have driven consumer spending growth for this year. And here is a trend in 2022 that has really intrigued me. As food inflation has continued throughout the year, Americans have downshifted and spent less at grocery stores, but have spent more on food outside of home and in travel. It also seems that Wall Street is finally waking up to the reality that the economy did well in Q3 2022, and is on track to have an October to remember.

Stocks rose on Friday despite a tumble in Amazon shares after economic data pointed to slowing inflation and a steady consumer. The Dow Jones Industrial Average closed 828.52 points, or about 2.6%, higher at 32,861.80. The S&P 500 added nearly 2.5%, to close at 3,901.06. The Nasdaq Composite ended up about 2.9%, to close at 11,102.45. On a weekly basis, the major indexes made notable gains. It was the fourth positive week in a row for the Dow, a first since a five-week streak ending in November 2021. The 30-stock index is up 5.7% this week in its best performance since May. It’s also on track for its best month since January 1976.You may be annoyed by paying more for products than you did a year ago, but things are pretty darn good in the Real Economy, no matter what corporate media and GOP politicians try to tell you. And I think the bigger danger with the Fed is them being more concerned with the annoyance of inflation than the real disruption of unemployment and economic insecurity. Besides, this is the inflation we all should be more concerned about controlling.

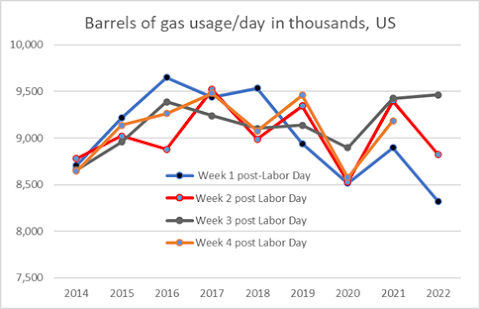

Do I have this right? Shell raked in $9.45 billion in profits last quarter and has announced $4 billion in stock buybacks, but American consumers are supposed to blame government spending for inflation?

— Robert Reich (@RBReich) October 29, 2022