Ventings from a guy with an unhealthy interest in budgets, policy, the dismal science, life in the Upper Midwest, and brilliant beverages.

Monday, October 17, 2022

High inventory, flat sales, and lower import prices should further slow inflation. Key word: SHOULD

In the later part of last week, we got several bits of information that indicated that INFLATION PANIC seems overblown.

The first item I want to notice is a follow-up from last week, where I expressed concern over a tightening of gasoline supplies and a higher amount of gasoline usage as September ended. I wanted to see what the reports from the Energy Information Administration said for the first week of October, to see if there was finally a supply-and-demand reason to raise gasoline prices.

Well that concern isn't as strong with me this week, as gasoline availability rose, and gas usage fell significantly, to the lowest post-Labor Day levels in years.

Likewise, prices at the pump have fallen back in many parts of America in the 10 days since that last week of usage was recorded - below $3.60 here in Madison, which makes the short-term spike that was passed out due to refinery outages a few weeks ago all the more BS to me.

We also saw multiple reports last Friday that indicated inflation at numerous types of shopping places should be leveling if not flat-out declining. The first of those reports showed the value of business inventories rising by 0.8%, and up by over 18% in the last 12 months.

And that report came a week after one that showed the value of inventories in retail businesses went up by 1.3% in August. Then last Friday, retail sales in America continued to show softening of demand in September after a strong first 6 months of 2022. That's not a great thing for the overall economy, but also gives little legitimate reason to jack up prices.

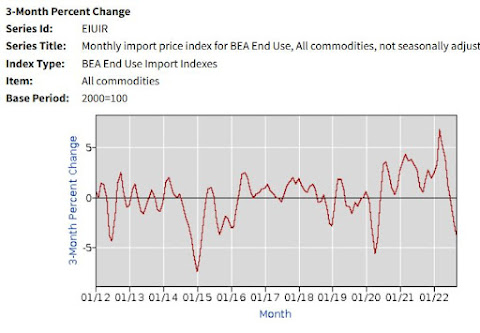

The other report that gave good news on the inflation front on Friday was from the Bureau of Labor Statisitics, which showed the prices of imported goods continued to fall in September. Part of this is a reflection of the absurdly strong dollar, but it also continued a 3-month trend of declines of more than 1 percent, and a marked reversal from the increase in import prices that we saw earlier this year.

If you look at the 3-month trend, we are seeing import prices fall in a way that we haven't seen since the COVID pandemic had much of the world in lockdown.

And while you frequently hear about the 12-month Consumer Price Index increase of more than 8%, it's worth noting that the price of non-fuel imports has only gone up by 3.4% in the last year, and has declined in each of the last 4 months.

The high inventories, strong dollar and softening demand for retail and gasoline all are items that should cause inflation to drop. Which reiterates to me that much of our "inflation" has been profiteering, and that Wall Street fear-mongering over inflation and profitability should be taken with a whole lot of salt. If prices stay high for Q4, it is more likely a cash-in than a pass-through.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment