“While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses,” Powell said during a speech in Jackson Hole, Wyoming. "These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain."The DOW Jones dropped over 1,000 points after those comments, as Wall Streeters (correctly) recognized that Powell and the Fed would not stop tightening in 2022. And the Fed Funds rate has gone up another 2% since those comments, and are now at the highest levels in 15 years. This led to my first (and far from the last) use of this clip. I wasn't keen on this strategy, as even by August, it was becoming apparent that gas prices and inflation had peaked, and were coming down.

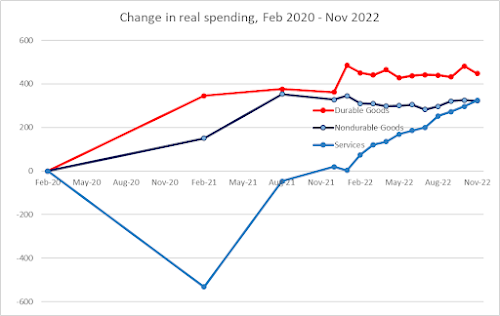

I understand the idea of trying to crush out the chances of a wage-price spiral, but this seems to be overdoing it. We don’t need to be trip-wired into a recession by the Fed jacking rates to high levels when it looks like a lot of these issues are sorting themselves out. We have a labor imbalance because of high demand and because we have had over 1 million people DEAD and many others that have left the work force in the last couple of years. But that has already been reflected in higher wages and prices, and price pressures are less extreme as consumers adjust and supply disruptions clear. ....Unike the Fed, I believe that 5% inflation is MUCH better than 5% unemployment. And if we see unemployment go from our current 3.5% to 5% because the Fed is still operating in a 1970s mentality instead of dealing with the reality of the 2020s, and it screws up our politics in 2022 or (more likely) 2024, I will be quite angry.Since August, CPI has gone up a total of 1% in the four months measured since then (a 3% annual rate), and core CPI is up 1.7% in that time (and only 0.5% in the last 2 months). Which means the real Fed Funds rate is well above 0%, and there is little need to keep hiking in 2023 when we've probably gone too far as it is. There is little doubt that our economy slows from the 2.5%-3% GDP growth we saw in the 2nd half of this year. But with inflation ending (supply shortages are mostly cleared up, stimulus is faded out and there's no election to try to influence), and job growth inevitably slowing and unemployment likely to rise above its current rock-bottom levels at some point, when does the Fed start to deal with the real problem of economic slowdown in 2023 instead of chasing the inflation ghosts of the past? I repeated that theme in another widely-read story in October 2. Again, don't believe the hype. JOBS >>>> Inflation. And "inflation" = profiteering.

That post ended this way, with midterm elections looming in 2 weeks.

Bigger corporate profits account for *over half* of the higher prices people are paying. pic.twitter.com/RZr5O0X4oJ

— Rep. Katie Porter (@RepKatiePorter) October 18, 2022

...why is Katie Porter one of the few Dems talking about this FACT in a time when corporate profits reached an annual rate of $3 TRILLION in the last quarter measured? And why is this not being connected back to the other obscene inflation in 2022 - spending during a midterm election? Seems like something a whole lot of Americans would agree with, and demand real answers for. And Republicans absolutely do not have any answers for it. Frankly, they don't want this to change at all. It helps them and their oligarch buddies maintain the advantaqge when they can't win on the issues, especially the economy.Since then, we've seen Q2 corporate profits stay at those record levels, with Q3 revised up to be right near that record level. I think they can get by with keeping and paying their employees in 2023. But my bigger concern in the job market is in the tech industry, which seems to be repeating the dot-com bust of the 2000s, where it can't keep up its pandemic-related expansion, and higher interest rates pop the Bubbly companies that were invested in little more than BS (hi there, FTX!). Here's the other highly-read post that I want to look back at. And I put it up all the way back in February. 3. Here it comes - how to pay for the the next 20 years of Miller Park.

I intentionally used the former name of the Brewers' stadium, because that's what it was named when the park was built and the Miller Park sales tax was in place to help pay for debt and ongoing maintenance at the ballyard. Now that the Miller Park tax has finally been paid up and done away with, it inevitably means that the Brewers are looking for ways to keep up what is now known as AmFam Field, and possibly develop the many acres of land that they have control over around the ballpark. I tied in my thoughts to another issue that is likely to become a big discussion in 2023 and future years - how to stop fiscally handcuffing Milwaukee, and allowing a better chance for public safety and/or other needs to be met.

Not that I'm in favor of any [taxpayer] subsidy given how things lay out right now, but if they [Legislature and/or local governments] want to do it, then maybe it should be a way to allow Milwaukee to get some long-deserved fiscal help. For example, why not have a 1% tax that is levied on all revenues generated from events at AmFam Field? This could then be split in some way (call it 50-50?) between the team (who uses the money for capital needs) and the City (who provides services that benefit both the Brewers and their fans). In all seriousness, how can it be justified for the state and county get a cut of the Brewers' revenue (via sales tax), but the City basically gets no boost in tax revenue outside of the contract with Milwaukee Poloice and possibly a few more room taxes from tourists. Aside from a sales tax, another option could be to follow the example of the Bucks arena, which has a $2 ticket tax, of which $1.50 goes to downtown Milwaukee's Wisconsin Center District for future development. Also, what happens if the City and the State tells the Brewers to pound sand and pay for their own upgrades if/when the Stadium District runs out of money? I suppose the team could go as far as claiming that the terms of their lease is being broken in not allowing the ballpark to be "kept up with the Joneses", and could use that as an excuse to try to leave town in 10 years or so. But do we really see that happening? That type of brinksmanship is well down the road. But watch out for the talk to begin about how to "keep the Brewers competitive" by finding some kind of new subsidy or some other kind of assistance to keep the Crew from having to pay more into the ballpark that they and so many Brewer fans benefit from. You know it's coming.This was written before the 2022 season, which the Brewers spent in first place for much of the year before making the idiotic Josh Hader trade in early August, a move General Manager David Stearns would later admit hurt the team on the field and in the locker room, before Stearns stepped down from that role. And since the season ended, with the Brewers ending up 1 game out of the playoffs behind a Phillies team that made the World Series, what has the Crew done in advance of the 2023 season?

Gonna be pretty hard to justify paying more tax dollars for the ballpark when the team doesn't seem to be upgrading itself and trying to contend for a title (or even the expanded postseason). And if the year starts bad, I won't be surprised to see fans choosing other options for their entertainment dollar, which will make it even harder to justify state help for the Crew. Then add in the fact that Brewers owner Mark Attanasio seems more interested in his English soccer team than in the MLB team he owns in the US, and let's just say that the Brewers stadium and ownership situation is one we should be aware of in 2023 and the near-future. I may put together a few more personal thoughts on 2022 and 2023 later on, but it always is intriguing to go back and see what I said earlier in the year, and what was responded to by you. I often found it easier to slam a few posts on Twitter or some other area to quickly react vs diving deep on this site during the year, but with Elmo messing that spot up, it may prove a bit harder to speak up that way. Either way, I'm not fading away from this space. I like the long-form, both as a venting outlet and as a way to explain and reference things that go beyond a snarky reply. And with the possibility of a landmark state budget (or a failed opportunity to make the big changes that are needed), and an economy that might be on the verge of recession and further disruption, 2023 could make for a lot of things worth diving into and explaining about.Like this tweet if you’ve spent more then the Brewers this off-season 😵💫 pic.twitter.com/LkH95Y1BYX

— ʙᴏʙʙʏ’ꜱ ʙᴏɴɢ™️ (@yelichfans) December 31, 2022