I admit that I'm starting to worry some about the US budget situation. And it's not because of the amount of spending, and I'm not too concerned about the size of the deficit (other than its effects on the debt ceiling and interest on the debt). But I am concerned with the fact that tax revenues aren't just failing to keep up with inflation, they're

going down.

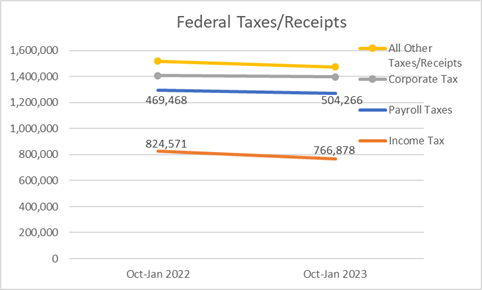

We saw this in the recently released

Treasury Statement for January, which shows that income tax revenues have declined by 7% over the first 4 months of Fiscal Year 2023 vs the same time period a year before, and overall revenues are down 2.9% so far.

But what's also odd is that payroll taxes (mostly the taxes that pay for Social Security and Medicare) are up. You'd expect that in a time of growing employment and wages, but overall income taxes should also go up with that.

Doesn't add up, so let's look at

the Congressional Budget Office's summary of the budget numbers and see what they chalk it up to.

Unemployment insurance receipts (one type of payroll tax) were $6 billion (or 33 percent) smaller this year. Those receipts were larger in 2022 because states were replenishing their unemployment insurance trust funds, at least in part by collecting more in unemployment taxes from employers. (The trust funds had been depleted by unusually high unemployment beginning in March 2020.) Those collections count as federal revenues, reflecting the nature of the unemployment insurance system, which is a federal program administered by the states.

• Individual income tax refunds increased by $24 billion (or 81 percent), reducing net receipts. Most refunds typically are made from February through April.

That's still not enough to explain this type of drop, especially given the strong labor market. In January, the income tax brackets were adjusted to account for the higher inflation of 2022, which means more income is taxed at a lower rate. But this trend of lower income tax revenues and overall revenues predates January, so this is a worrysome trend.

I looked at the

CBO's budget and economic forecasts for the next 10 years, which also came out last week, to see if it gave more insight. And it seems that 2022 had historic increases in tax revenues as the economy bounced back and people cashed in their stock gains, which now is coming back to earth in 2023.

Given that

2022 was the worst year for stocks since the financial crisis of 2008, it would make sense that the big capital gains of the last 2 years would be going away. And it's plausible that many took tax losses at the end of 2022 (or offset gains that had previously come in earlier in the year), and so there would be less being paid in now. It also makes me wonder what effect this might have on tax refunds as Americans file over the next 2 months.

I'm also intrigued by what the effect may be in Wisconsin, as the state is also seeing declines in income tax revenues in Fiscal Year 2023. The latest revenue update for the Wisconsin Department of Revenue dropped on Friday, and it shows declines in most revenue sources outside of sales taxes.

Some of this is understandable, given that state withholding tables are now updating with every year, much like the Fed tables are. But an (adjusted) 10.9% decline in income taxes is still a lot, as is a 9.5% decline for the 7 months of state Fiscal Year 2023. This seems like it'll be a shortfall compared to

the Legislative Fiscal Bureau's revenue estimates from last month, which thought that revenues would go UP by 4.3%.

But the LFB didn't seem too concerned about this trend through December, and thinks that lower tax refunds in the coming months will offset these declines.

Based on preliminary collections information through December, 2022, individual income tax revenues for the current fiscal year are 12.9% lower than such revenues through the same period in 2021. This is primarily due to decreased withholding collections following the withholding table update that took effect January 1, 2022. However, individual income tax revenues are expected to increase at a rate of 21.1% over the next six months relative to the same period a year prior.

The primary factor for this estimated revenue increase is an expected decline in refunds paid to taxpayers in 2022-23 relative to 2021-22. The income tax rate reduction included in 2021 Act 58, which took effect beginning in tax year 2021, caused refunds to spike when taxpayers filed their corresponding income tax returns in 2021-22. However, because the income tax withholding tables were later updated beginning January 1, 2022, to reflect the rates, brackets, and standard deduction in effect for current law, the amounts withheld from taxpayers during tax year 2022 incorporated the Act 58 rate reduction for the first time. As a result, when taxpayers file the corresponding returns in Spring of 2023, their refund amounts will be lower (all else equal) than the refunds they would have received had the withholding tables not been updated.

It's a good thing on the surface - Wisconsinites took home more money in their paychecks because of that adjustment in withholding tables in Jan 2022. But be prepared not to get as much back from the state when you file this year, and we better start seeing that 21% increase show up in the numbers with February's revenue report, or else red flags should be flying.

Tax season is always the big variable when you talk about tax revenues at both the state and federal levels, and given the shortfalls that we are seeing at both the state and federal levels, it may demand even more attention over the next 3 months. That's the largest fiscal concern that I am feeling these days, and the reasons why income tax revenues make me wonder if this is merely due to 2022's drop in the stock market, or if it portends some weakness in the labor market and income growth that isn't showing up in other data.

No comments:

Post a Comment