Wanted to give an update on where the federal budget stands, as there were headlines this week that took the August budget update from the Congressional Budget Office, and noted that our budget deficit went past $3 trillion with a month left to go in Fiscal Year 2020.

The cumulative federal budget deficit for the first 11 months of fiscal year 2020 was $3.0 trillion, CBO estimates, $1.9 trillion more than the deficit recorded for the same period last year (see Figure 1).

Revenues were 1 percent lower and outlays were 46 percent higher through August 2020 than in the same 11-month period in fiscal year 2019. CBO projects that the 2020 deficit will total $3.3 trillion. At 16.0 percent of gross domestic product, that would be the largest shortfall relative to the size of the economy since 1945. </blockquote> Of course, 1945 was the final year of World War II, which led to a massive increase in expenses for the military and in services needed back at the homefront.

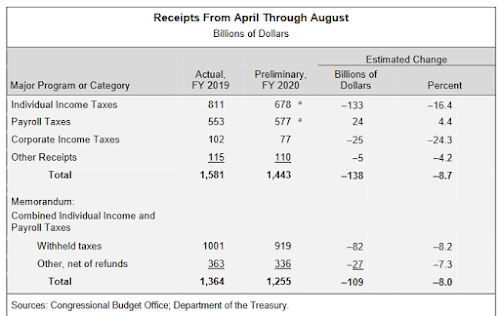

2020 is also having a large increase in spending and needs, although I’d argue it’s largely because we <em> didn’t </em> go on a wartime footing on COVID-19 until it was far too late, leading to large levels of shutdowns in March and April and a major hole in the economy that still is far from being filled. This chart gives you a good indication of when COVID-19 started hitting the budgets in DC.

The exploding deficit is largely driven by spending generated through the CARES Act and other legislation passed in the fallout of COVID-19 and the resulting recession, which makes for a major change in outlays for the 2nd half of this Federal Fiscal Year vs 2019.

But note the one area of expenditures that’s gone down – interest on the debt. That’s pretty amazing given the large increases in the deficit/debt in the last year, but it shows just how much interest rates have been lowered through Federal Reserve action. And given that inflation still remains muted (although it’s creeping up, as shown by the 0.4% increase in the Consumer Price Index for August), the deficit itself isn’t a major economic threat, for now.

What may be concerning for the future is that revenues are also showing signs of significant slowing, mostly due to the lack of jobs. They were holding up for a while, partly due to the fact that the $600-per-week add-on for unemployment benefits gets taxed. But that went away in August, and corporate taxes were already slipping before then.

Now add in the temporary

decline in payroll taxes that will

come from employers that choose to be part of

President Trump’s 3 month scam deferral,

and

revenues will likely be even less for the near future (well, until those

same people

getting a “tax cut” now have to double-pay those taxes in early 2021).

But as mentioned before, the size of the deficit isn’t that big of a deal if we

aren’t seeing other economic effects. And other than the increased inequality that

has resulted from asset Bubbles (a monetary policy effect more than fiscal, although

there is a lot of money floating around), there hasn’t been a lot to indicate

that our fiscal deficit is causing ripple effects in our economy for now.

What there has been is a noticeable increase in inequality that has hit due to

those asset Bubbles (helping the rich, who own most assets). Combine that with

the fact that job losses have been especially large for service occupations

like food service, travel, entertainment and lodging, and there is definitely a

need for more fiscal moves that reverse this damaging, unsustainable trend.

But given the meltdown of stimulus talks in DC this week, it looks like there isn’t going to be much done to redirect funds toward those in need, and that could well cause economic problems that ends the mini-recovery we’ve had in the last 4 months, and begins a “new normal” of lower activity compared to what we had at the start of 2020.

While the deficit might not be a reason for that stagnation and the related economic problems, you can bet some cynical corporatists will use it as a reason not to try to solve those problems. There are only 2 proper responses to that.

1. No the deficit is not causing our problems, and in fact, deficit spending kept them from becoming worse.

2. If you’re so concerned about the deficit, then tax the rich to have them pay for the programs that people need to stay afloat. After all, they’ve made a lot of money due to the Fed’s help, so they can afford to give some of that back to keep us from having a deeper and longer recession. It’s the least they can do.

No comments:

Post a Comment