Profits from current production (corporate profits with inventory valuation and capital consumption adjustments) increased $20.4 billion in the fourth quarter, compared with an increase of $96.9 billion in the third quarter (table 10).That doesn’t seem like much for the 4th quarter itself. But then combine it with major increases in profits earlier in 2021, and you have a big jump for last year.

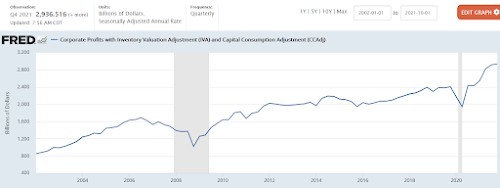

In 2021, profits from current production increased $562.0 billion, in contrast to a decrease of $124.0 billion in 2020. Profits of domestic financial corporations increased $64.3 billion, in contrast to a decrease of $39.9 billion (table 10). Profits of domestic nonfinancial corporations increased $461.0 billion, in contrast to a decrease of $25.5 billion. Rest-of-the-world profits increased $36.7 billion, in contrast to a decrease of $58.7 billion.That $562 billion (annual average) is an increase of more than 25%. And profits were already high to begin with, as this graph from the Federal Reserve Bank of St. Louis (FRED) shows, with pre-tax profits up nearly 34% since the GOP Tax Scam became law at the end of 2017. You might also notice that as vaccinations against COVID became widespread after 2020, profits took off even more than they were doing before the pandemic. It shows corporations have been able to use the disruptions of the pandemic to jack up prices and pocket the difference.

A growing number of U.S. firms are able to pass along their higher costs to consumers, and it remains to be seen how high the Federal Reserve will need to raise its benchmark policy interest rate to get inflation under control, said Richmond Fed President Tom Barkin on Wednesday. “I am increasingly hearing” that companies have so-called “pricing power,” Barkin said, in an interview with Bloomberg. Businesses, still frustrated by supply chain woes resulting from the pandemic, are seeing costs increases from suppliers and are “determined” to pass those higher costs on to consumers, Barkin said. Firms are not yet getting a reaction in the marketplace that indicates they will lose market share because of their higher prices, he added.Heck, they didn’t wait till those (alleged) higher costs came from suppliers. That's how year-over-year consumer inflation can go from 1.3% at the end of 2020 to 7.1% at the end of 2021, while profits boom at the same time. So what do we do about this

Unfortunately, I don’t see a lot of those tax measures happening in the next 6 months, as Congress will likely bail on any budget action until after the November elections, if any changes happen at all (profiles in courage!). Which means that it’ll take public pressure and the Biden Administration stepping up enforcement of anti-trust and other non-competitive measures to stop the spiraling profits. We're still in a lot better of a situation than we were in at the start of 2021. But now it’s time for this economy to readjust to a place where we really do grow in a better and healthier way than we’ve seen in the unequal and often-stagnant last 20 years. The only austerity we should have is one that hits those that have done well in the COVID World and can afford to pay, not the ones that needed support, and might need more in the future.Profit Increase Last Year from Pre-Pandemic Levels:

— Bernie Sanders (@BernieSanders) March 26, 2022

ConocoPhillips:⬆️1,400% to $12.7 billion

Chevron:⬆️184% to $21.6 billion

Exxon Mobil:⬆️57% to $31.2 billion

Gas Price Increase from 2019:⬆️63% to $4.24

Please don't tell me that a windfall profits tax is radical.

No comments:

Post a Comment