One of the biggest economic reports dropped on Friday, and it indicated that

growth for US spending slowed in February after a major uptick to start off 2023.

Consumer spending, which accounts for more than two-thirds of U.S. economic activity, increased 0.2% last month. Data for January was revised higher to show spending vaulting 2.0% instead of the previously reported 1.8%. January's increase was the biggest since March 2021. Economists polled by Reuters had forecast consumer spending would gain 0.3%.

Consumers increased spending on housing and utilities as well as on healthcare, but cut back on spending at restaurants, bars and hotel accommodation. Overall, services spending rose 0.2% after advancing 1.2% in January.

Still a pretty good start to 2023 overall on the spending side, and even after adjusting for inflation, it is noticeably above where we ended 2022 at.

Speaking of inflation, that report showed that prices continued to moderate in February.

The personal consumption expenditures (PCE) price index increased 0.3% last month after accelerating 0.6% in January. Energy prices decreased 0.4%, while food rose 0.2%.

In the 12 months through February, the PCE price index advanced 5.0%. That was the smallest year-on-year gain since September 2021 and followed a 5.3% increase in January.

Excluding the volatile food and energy components, the PCE price index climbed 0.3% after increasing 0.5% in January. The so-called core PCE price index rose 4.6% on a year-on-year basis in February after gaining 4.7% in January. The Fed tracks the PCE price indexes for its 2% inflation target.

I would hope that the Fed doesn't ignore that overall PCE inflation is only up 2.2% since peaking in June 2022, with core PCE is up 2.9% in that same time. Stretch that out to a 12-month rate, and core and especially overall inflation is well below those year-over-year totals, and the 5% Fed Funds rate is well above both PCE and CPI inflation since mid-2022.

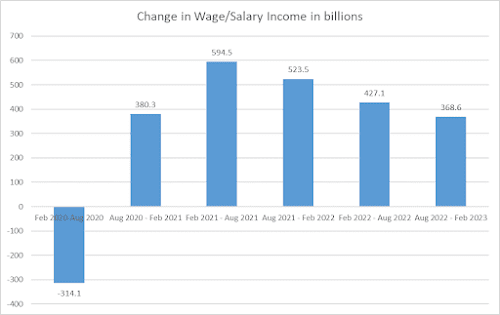

And if the Fed needs even more evidence of inflation slowing, wages and salaries have seen 2 of its 3 slowest months of growth over the last year in December 2022 and February 2023. But those are still going up (0.3% in February), and is also moderating into a Goldlilocks-type scenario of decent wage growth that won't re-ignite the higher inflation of late 2021 and early 2022.

Wall Street took in the data,

and continued its late-March rally on Friday. The S&P 500 added 1.44% to close at 4,109.31, while the Nasdaq Composite advanced 1.74% to end at 12,221.91. The Dow Jones Industrial Average gained 415.12 points, or 1.26%, closing at 33,274.15.

The S&P 500 and Nasdaq were up 7.03% and 16.77%, respectively, for the first quarter. It was the best quarter since 2020 for the tech-heavy Nasdaq. The Dow ended the period with a 0.38% increase.

For the month, the S&P 500 and Nasdaq have gained 3.51% and 6.69%, respectively. The Dow, meanwhile, advanced 1.89% to end March.

The Street definitely thinks that the Fed is going to recognize that rates don't need to go higher in 2023. Combine that with a reduction of instability in the banking sector, and they're ready to come back in.

And I agree with that thinking, as I think the Fed should shove that 2% goal up their backside, and deal with the real world in 2023, at least until we get further data as to how a full-employment, moderate-inflation economy handles interest rates that are at their highest levels in 16 years. February's numbers show that things are still pretty good in the US economy, but without the high inflation that we were seeing this time last year.

No comments:

Post a Comment