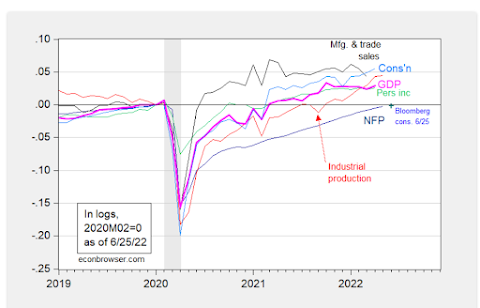

New orders for U.S.-made capital goods and shipments increased solidly in May, pointing to sustained strength in business spending on equipment in the second quarter, but rising interest rates and tighter financial conditions could slow momentum. Orders for non-defense capital goods excluding aircraft, a closely watched proxy for business spending plans, rose 0.5% last month. These so-called core capital goods orders gained 0.3% in April. Economists polled by Reuters had forecast core capital goods orders would climb 0.3%. Those orders were up 10.2% on a year-on-year basis in May. Last month's increase reflected a 1.1% rise in machinery orders. There was also strong demand for primary metals as well as computers and electronic products. But orders for electrical equipment, appliances and components fell 0.9%, while demand for fabricated metal products was unchanged. The better-than-expected increase in core capital goods orders underscored underlying strength in manufacturing, which accounts for 12% of the economy, despite weak factory surveys. A survey from S&P Global last week showed business confidence dove in June to the lowest level since September 2020.That 10.2% increase over the last year is still above the rate of inflation in the same time period, and it is similar to a divide that we've been seeing with US consumers, where sentiment is at the lowest levels in more than a decade, but actual spending and activity continues at high levels. This survey adds more evidence to my belief that all of this recession talk is overblown, at least as of now. Jobless claims are still very low, with job gains still expected in this Friday’s report for June. And AAA is predicting that this weekend’s 4th of July travel will get back near 2019’s record levels, with more Americans choosing to drive for that travel than ever. UW's Menzie Chinn put up this recently-updated list of economic indicators, and while it's not the torrid growth we were seeing this time last year, it is still growing in many key areas. And now we’re starting to see gas prices level off and start declining in the last week (I saw rates as low as $4.24 this weekend). Yes, they are still quite high, but it’s something that will level off inflation numbers, and let’s see if that changes some of the gloomy mentality that has overhung Wall Street in much of Q2 2022. Sure, inflation is still a concern and it is still disrupting businesses and consumers. It's no fun. But let's not pretend that it's 1980 with double-digit price hikes and 8% inflation. We are nowhere close to that, and the economic data continues to show that much of the economy is chugging along.

Ventings from a guy with an unhealthy interest in budgets, policy, the dismal science, life in the Upper Midwest, and brilliant beverages.

Monday, June 27, 2022

Recession? Not in manufacturing, not in the job market

Even with all of the blaring of INFLATION and RECESSION fears, we saw on Monday that there’s strong demand for durable goods continues in America.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment