Sorry, guys.Here’s @ABC NEWS …accidentally releasing a pre written jobs report story with “XYZ” filling in for the coming numbers.. read the text… it is Amazingly wrong. pic.twitter.com/mROXiGB9if

— Hal Sparks (@HalSparks) August 5, 2022

BREAKING: Payrolls increased 528,000 in July, much better than expected in a sign of strength for jobs market https://t.co/MAhKmg6hrz

— CNBC Now (@CNBCnow) August 5, 2022

Oh no! Pivot, pivot!!We have now fully recovered *all* the jobs that were lost early in the pandemic pic.twitter.com/IPz9gyWZIZ

— Catherine Rampell (@crampell) August 5, 2022

Yeah, it amazes me too. Job growth is still picking up, even as unemployment falls to 50-year lows of 3.5%. So let's look at the full jobs report and see what is driving the growth.Holy shit. Fox News is now attacking President Biden for BEATING jobs expectations, saying that it “misses [their] forecast.” https://t.co/8ez1AuZVr3

— No Lie with Brian Tyler Cohen (@NoLieWithBTC) August 5, 2022

In July, leisure and hospitality added 96,000 jobs, as growth continued in food services and drinking places (+74,000). However, employment in leisure and hospitality is below its February 2020 level by 1.2 million, or 7.1 percent.But I'll add that this gap was 4.1 million when Joe Biden took office in January 2021, so that sector is still building back from the COVID-related bomb dropped on it in 2020. And perhaps given how some of us have changed our leisure spending (along with increased use of methods of service such as carry-out/order ahead), some jobs in the sector may not come back. Although I still see plenty of "help wanted" signs around in this sector, so there's still demand to be met. The jobs report also notes a positive and possibly permanent shift in employment in another sector.

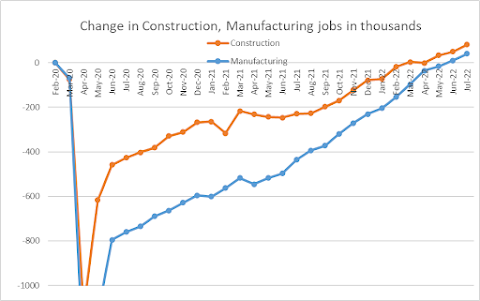

Employment in professional and business services continued to grow, with an increase of 89,000 in July. Job growth was widespread within the industry, including gains in management of companies and enterprises (+13,000), architectural and engineering services (+13,000), management and technical consulting services (+12,000), and scientific research and development services (+10,000). Employment in professional and business services is 986,000 higher than in February 2020.Blue-collar industries have also come back strong in 2022. Mining added another 7,000 jobs, and has added 45,000 in the last 6 months. The construction (+32,000) and manufacturing (+30,000) sectors also continued to hire, and are now above their pre-COVID levels. This is why the worries over "slowdown in housing" doesn't concern me much. There's still hiring going on, and a slowdown on the demand side is allowing the labor supply side to catch up, to the point that there shouldn't be much difference in overall activity....except perhaps with prices that aren't so ridiculous. However, the inflation picture is part of the reason that this jobs report was initially seen as "good news being bad news" on Wall Street. Because the household survey indicated an economy that may still be pumping at or beyond potential.

In July, the unemployment rate edged down to 3.5 percent, and the number of unemployed persons edged down to 5.7 million. These measures have returned to their levels in February 2020, prior to the coronavirus (COVID-19) pandemic..... The labor force participation rate, at 62.1 percent, and the employment-population ratio, at 60.0 percent, were little changed over the month. Both measures remain below their February 2020 values (63.4 percent and 61.2 percent, respectively).But shouldn't we expect a lower participation rate simply due to pandemic and demographic effects? Take a look at this.

Well, they're gone unless scum like Ron Johnson are successful in putting Social Security Medicare on the chopping block. Now add on a whole lot of COVID death and permanent disabilities among the living, and this isn't that surprising. A lot of people resigned their jobs, moved on to better ones, and now have to be replaced by a smaller cohort of people. I don't see a large group of working-age people laying around, choosing not to work, especially as prices have risen and COVID-era relief has diminished over the last year. The other reason "INFLATION" fears may come back up after the employment report is this part.Okay so 2/3 of lost labor is 55+. I don’t think there’s an environment where they come back to the workforce. https://t.co/ucj7skJ2XU

— Brian Truman (@trumanium) August 6, 2022

That's both increased demand and increased cost for employers. While I view that as the "good type" of inflation, I have fears the Fed will now raise rates more than necessary in September and beyond, because how DARE we have everyday workers in control of things and limit profits like that! Even if there's evidence that Americans are adjusting their spending habits to limit their own distress from higher prices. But there's a whole month of data and a another jobs report ahead of that next Fed meeting. And for the rest of Summer, things seem pretty bright to me on the jobs front, and the economy in general. If we get a month of strong back-to-school and related spending, Q3 growth could look pretty good. That fact makes Republicans VERY unhappy, since they really have nothing to offer voters beyond whining about things. If too many people recognize that GOPs are selling empty BS, then the GOPs are set up to get slapped down in 3 months.Average hourly earnings growth, three month change, annual rate:

— Jason Furman (@jasonfurman) August 5, 2022

Last month's data: 4.1% and stable/falling

This month's data: 5.2% and rising

This is due to a combo of an additional month of data and revisions to previous months. pic.twitter.com/YXIZZhOSVS

No comments:

Post a Comment